EU Firms Urge Faster Rule Changes as U.S. Advances in Tokenized Markets

European companies developing tokenized securities are urging EU lawmakers to act quickly, warning that existing rules are stalling growth in regulated on-chain markets. Industry participants argue that prolonged delays could divert capital and trading activity to the United States, where tokenization is advancing under established market frameworks. These calls come ahead of a parliamentary debate on the future of Europe’s digital market infrastructure.

In brief

- European firms warn EU DLT Pilot limits are blocking scale in regulated tokenized securities markets.

- Industry says slow reforms risk pushing capital, liquidity, and trading activity toward the United States.

- Firms propose targeted DLT Pilot updates without deregulation or changes to investor protections.

- U.S. regulatory clarity and exchange plans highlight growing contrast with Europe’s slower progress.

EU Risks Falling Behind U.S. in Tokenized Markets, Firms Say

In a joint letter, several tokenization and market infrastructure firms call on policymakers to amend the EU’s DLT Pilot Regime, a regulatory sandbox designed to test blockchain-based securities trading. Signatories include Securitize, 21X, Boerse Stuttgart Group, Lise, OpenBrick, STX, and Axiology. The group says current asset thresholds, transaction caps, and time-limited licenses prevent regulated platforms from reaching meaningful scale.

While companies broadly support the EU’s Market Integration and Supervision Package, which aims to modernize capital markets, they argue that its benefits will materialize too slowly. Structural delays could push full implementation into the next decade. By then, firms warn, tokenized markets elsewhere may already be mature, leaving Europe struggling to remain competitive.

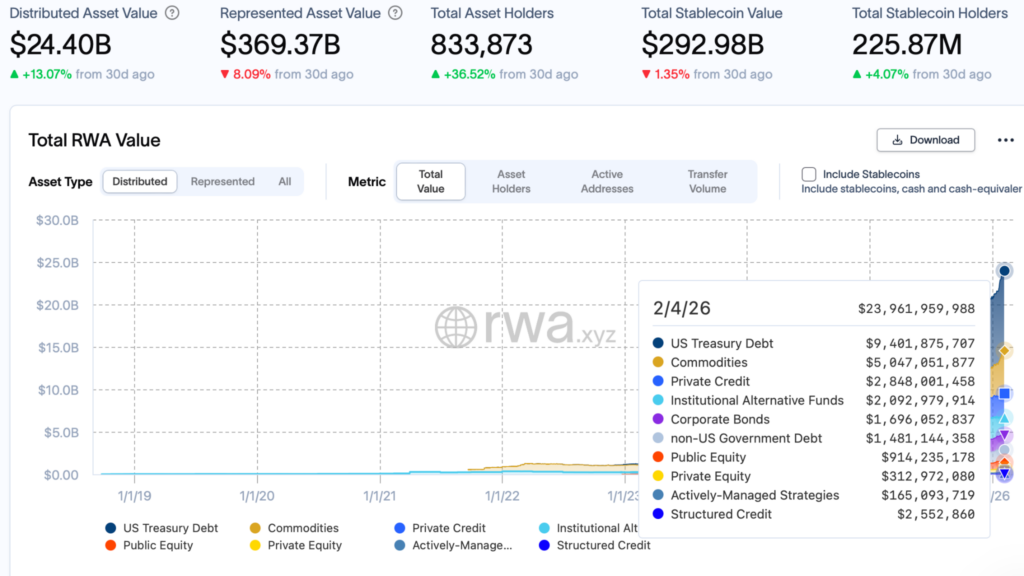

The letter highlights growing pressure from the United States. According to industry participants, global liquidity naturally flows to jurisdictions that offer faster settlement and fewer structural barriers. Once that liquidity migrates, regaining it may prove difficult. The concern extends beyond market share to the euro’s role in global capital markets, as issuance and settlement increasingly move to digital infrastructure.

Industry Pushes for Narrow DLT Pilot Reforms to Unlock On-Chain Market Growth

Rather than calling for deregulation, the companies propose a narrowly scoped technical update to the DLT Pilot Regime. Investor protections would remain intact, but outdated limits would be adjusted. The group argues that such changes could be implemented quickly without reopening broader, more complex market reforms.

The proposed updates include:

- Expanding eligibility for tokenized financial assets.

- Raising issuance and transaction volume caps.

- Removing the six-year limit on pilot licenses.

- Maintaining existing investor protection rules.

- Enabling faster adoption through a standalone technical amendment.

According to the firms, these steps would enable regulated platforms to scale across Europe rather than relocate activity abroad. Continued delays, they warn, risk weakening Europe’s position as on-chain settlement becomes a standard feature of global finance.

SEC and Exchanges Signal Green Light for Tokenized Markets Under Existing Rules

Developments in the United States underscore the contrast. Last December, the SEC’s Trading and Markets Division clarified how broker-dealers may custody tokenized stocks and bonds under existing customer protection rules, signaling that blockchain-based securities fall under traditional regulatory oversight.

That same day, a no-action letter issued to a subsidiary of the Depository Trust & Clearing Corporation cleared the way for a new tokenization service. DTCC confirmed that its Depository Trust Company unit received approval to tokenize real-world assets already held in custody.

Additional guidance followed on Jan. 28, when regulators defined two categories of tokenized securities: those issued directly by companies and those created by unaffiliated third parties. The clarification aimed to provide firms with greater regulatory certainty as activity expands.

Traditional exchanges are also moving forward. In November 2025, Nasdaq said securing approval for tokenized stock listings was among its top priorities. The New York Stock Exchange followed on Jan. 17, announcing plans for a blockchain-based platform to trade tokenized stocks and ETFs, pending regulatory approval. The proposed platform would offer near-instant settlement and round-the-clock trading.

European firms argue that similar progress remains achievable at home—but only if near-term regulatory constraints are addressed before global momentum shifts permanently elsewhere.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.