Ether has fallen below $2,000, confirming a marked retracement phase. Indeed, the movement is accompanied by a visible disengagement of holders, an influx toward exchanges, and degraded technical signals. This threshold break tests the market structure and investor resilience.

Home » Archives for Luc Jose Adjinacou

Luc Jose A.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The crypto market has sharply declined. In a few hours, major assets lost several months of gains, bringing bitcoin, Ethereum and Solana back to forgotten levels. After the 2025 momentum, investors hoped for consolidation. Instead, a wave of panic took over. More than 2 billion dollars were liquidated, revealing an atmosphere of extreme fear. The entire ecosystem is affected, from tokens to listed stocks, indiscriminately.

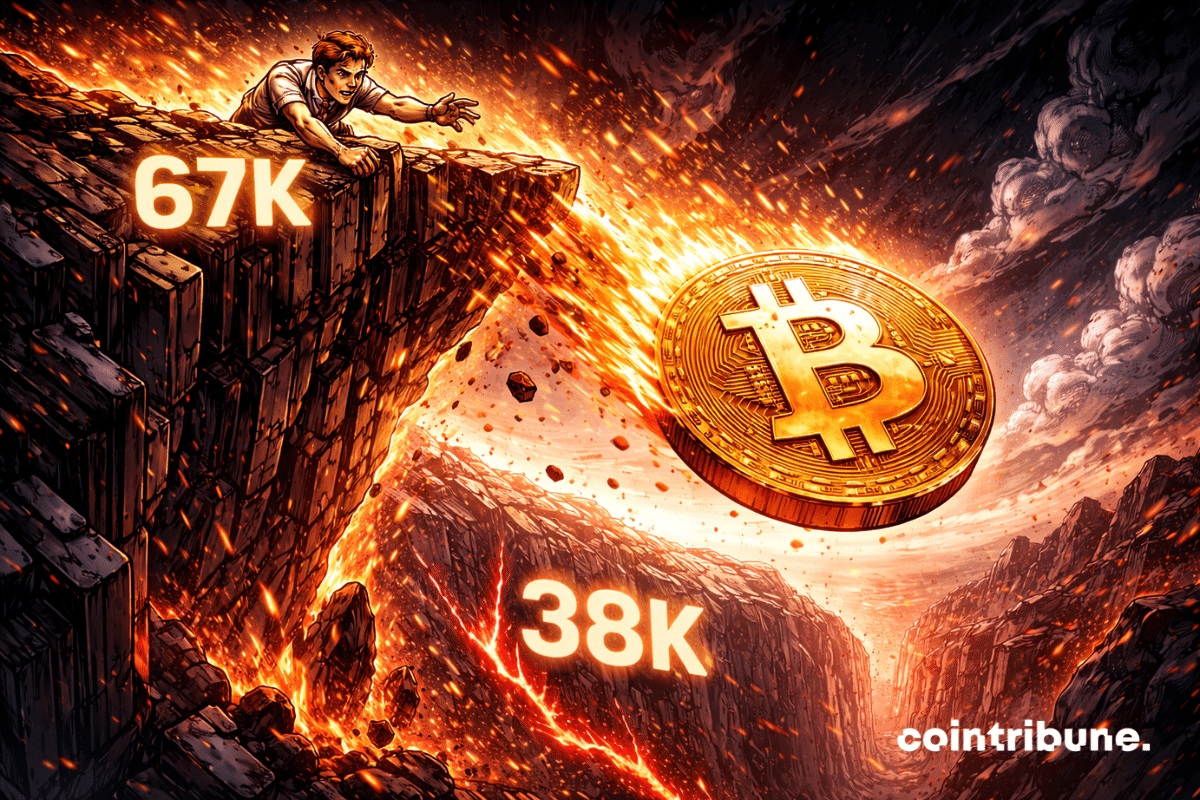

Bitcoin wavers below 67,000 dollars and concern is rising. In an already fragile context, Stifel bank issues a severe warning: a return to 38,000 dollars is now possible. Such a retreat, over 40% decline, would far exceed usual corrections. This scenario, supported by technical and macroeconomic signals, brings crypto market volatility back to the forefront. And this time, it is no longer a mere warning.

Binance creates a staggering gap. CoinMarketCap's Proof of Reserves report reveals overwhelming domination: $155.6 billion in assets, far beyond any other platform. As transparency becomes a vital requirement in a market under regulatory pressure, this ranking raises a crucial question: who can be trusted today? Binance establishes itself decisively.

While the crypto market remains without a clear direction, XRP attracts attention. According to analyst XForceGlobal, the token has entered a "washout zone," an intense correction phase potentially preceding a major reversal. Relying on Elliott wave theory, he suggests a scenario where the current drop precedes a surge up to 30 dollars. As selling pressure intensifies and technical signals blur, this interpretation divides opinion.

The crypto market has just received a strong signal from traditional finance. By sharply revising its forecasts for Solana, the Standard Chartered bank caused a shock in the ecosystem. While SOL remains one of the most watched assets by institutional investors, the lowering of the target for 2026 contrasts with a spectacular long-term projection. This decision reveals a much more nuanced reading of the future of blockchain than simple price movements suggest.

Vitalik Buterin turns a page in Ethereum's history. In a published post, the protocol's cofounder calls into question the strategic vision of Layer 2, long considered the key to the network's scalability. For him, the rollup-centric model no longer delivers on its promises. As Ethereum continues its transformation, Buterin calls for a profound rethinking of the role of second-layer solutions. This stance could well redefine the future of the ecosystem.

It fell back below $74,000 on February 2, Bitcoin suddenly erases gains recorded since Trump’s 2024 election. This sharp decline occurs in a climate of widespread distrust towards risky assets, as selling pressure intensifies. After a peak close to $126,000 reached at the end of 2025, the market now questions the strength of the bullish cycle and leaves doubt over the continuation of the movement.

Solana (SOL) flirts again with the critical threshold of 100 dollars, its lowest in 10 months. For some analysts, this level marks a possible floor, signaling a rebound of +150%. For others, it is just a stage in a still fragile trend. Between hopes for a recovery and technical doubts, the market hesitates. Are the current signals really enough to reverse the momentum?

While volatility establishes itself as a new norm, the recent drop in bitcoin goes beyond a simple technical correction. It reflects a brutal disengagement of institutional capital and a questioning of crypto market dynamics. Between ETF panic and rarely observed undervaluation signals, the crypto leader finds itself at a critical crossroads.

While the market digests a wave of massive liquidations, bitcoin and Ethereum register an unexpected rebound. In a still tense climate, this recovery intrigues as much as it divides. The contrast between extreme volatility and price increase reignites debates about the market's real solidity. After a week marked by instability, signals are blurred and positions are opposed.

While bitcoin briefly fell below $75,000, Michael Saylor did not hesitate to strengthen his positions. The Executive Chairman of Strategy invested $75.3 million to acquire an additional 855 BTC. A strategic choice, made official via the SEC, that fits into an uninterrupted accumulation policy since 2020. In a tense market, this move confirms the long-term vision of a key player on the crypto scene.

The official figures of American inflation are directly opposed to those of alternative indicators. While the Fed is cautious about a possible monetary pivot, independent data suggest that real inflation would already be well below the 2% mark. This discrepancy raises doubts about the relevance of the tools used by the authorities and could disrupt market expectations, especially in the crypto ecosystem, where every macroeconomic signal is closely scrutinized.

The Bitcoin network is faltering in the face of the American winter. In January, an extreme cold wave paralyzed part of the territory of the United States, causing a sharp slowdown in mining activity. As the United States now concentrates a large share of the global hashrate, this episode highlights the sector's dependence on local energy infrastructures. The sudden drop in production raises questions about the network's real ability to withstand climate shocks and the limits of a model nonetheless considered resilient.

Bitcoin is faltering, and warning signals are multiplying. As hopes for a recovery fade, the market seems to be returning to the bearish patterns of previous cycles. Key technical thresholds have broken, reviving projections of a return below $50,000. This scenario, long considered extreme, is gaining ground among analysts and seasoned traders. The prospect of a prolonged bearish phase is no longer a mere hypothesis but is becoming a concrete risk for investors still exposed.