By continually reaching new heights, Bitcoin has finally surpassed them. This week, the pioneer of cryptocurrencies not only broke its own record: it has also pulled a host of stock values along with it, from exchange giants like Coinbase to the most aggressive miners. A spectacular surge that speaks volumes about the market's mindset: crypto is no longer on the sidelines; it is taking center stage. And when it ignites, an entire parallel economy, now institutional as well, is set ablaze. A breakdown of a week that will be remembered in the annals of digital finance.

Theme Bitcoin (BTC)

While Bitcoin continues to dominate headlines and attract capital, an old rival is waking up with rare intensity: XRP. This Ripple token, long stuck in a corridor of indifference, has just slammed the door on the technical status quo. And this time, the offensive is taking shape against Bitcoin.

In just a year and a half since the launch of the first U.S. spot Bitcoin ETFs, institutional investors have poured over $50 billion into crypto through regulated financial products. The message is clear: Bitcoin is going mainstream, and it's happening fast.

While traditional markets struggle to gain momentum, bitcoin reaches a new all-time high. Fueled by a wave of regulatory optimism in Washington, the crypto sphere is excited. This surge is not just a simple technical rebound or an isolated influx of capital. It coincides with a major political turning point: the House of Representatives is set to review a set of laws that could reshape the contours of the crypto sector in the United States. The market is anticipating, and prices are soaring.

While Wall Street counts its points, Bitcoin takes the prize, ridicules the S&P 500, and shoots at full speed into the coffers of a stunned BlackRock. Who would have believed it?

Crypto is at a crossroads. Under the cold neon lights of the Capitol, the fate of a digital world is being decided with ink and calculations. Starting from July 14, Washington begins its "Crypto Week": a decisive parliamentary sequence where three major bills will be debated. Three texts, three possible directions for the future of digital assets in the United States.

When ETFs fill up like broken pockets and bitcoin breaks through the ceiling, traditional markets wonder: have cryptos become acceptable to the suit-and-tie crowd?

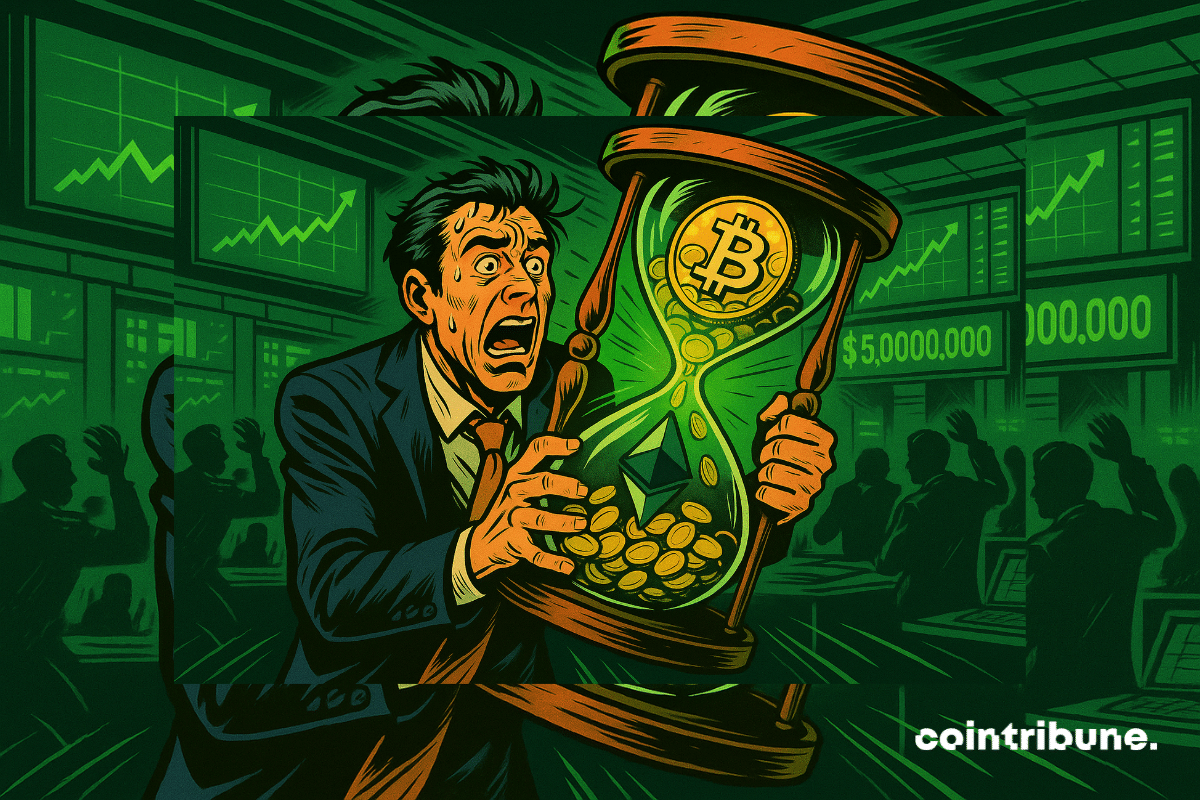

The crypto markets are gearing up for a decisive day with the simultaneous expiration of over 5 billion dollars in Bitcoin and Ethereum options. This massive expiration comes as Bitcoin reaches new historical highs beyond 118,000 dollars. But what do these data reveal about investor sentiment, and what movements should we anticipate?

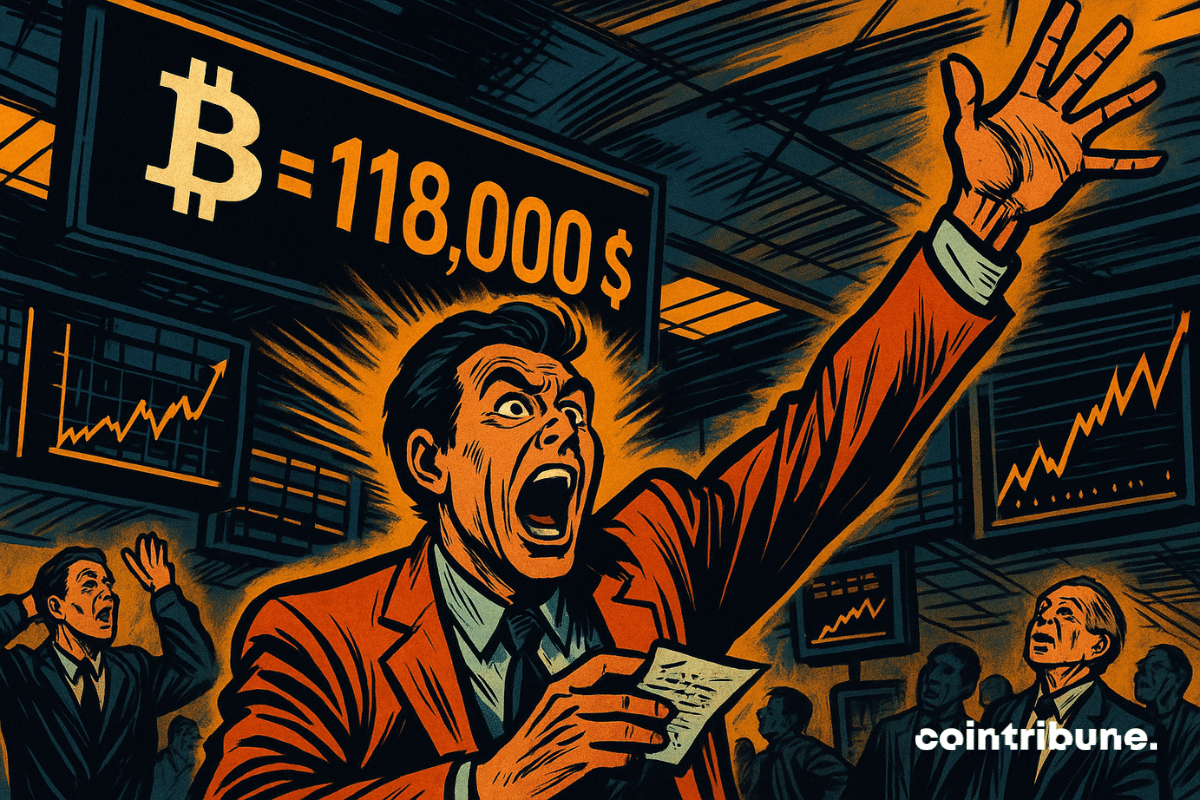

Bitcoin surpassed the 118,000 dollar mark this Friday morning, just two days after setting a historical record above 112,000 dollars.

It is no longer just a sudden rise; it is a controlled explosion: bitcoin has just reached $118,000, driven by an institutional appetite rarely seen in the history of crypto. Meanwhile, Ethereum exceeds $3,000, like a second wind in this dizzying ascent. But how far can this madness go?

The CEO of Bitwise is extremely bullish. He aims for $200,000 for a bitcoin by the end of the year and $1 million by the end of the decade.

Bitcoin continues to defy predictions. While some declared it to be out of breath after its recent peaks, the market shows clear signs of a resurgence. This is no longer just fevered speculation: on-chain data paints a much more nuanced, yet terrifically optimistic picture. Heading towards $130,000, the indicators proclaim. The inflection point is approaching, and the signals are clear: Bitcoin is far from having said its last word.

As Bitcoin sets a new record, an unexpected segment of the crypto universe reasserts itself: memecoins. Once regarded as mere speculative curiosities, they now attract massive trading volumes and unprecedented media attention. Digital irony becomes the engine of the market, sometimes eclipsing so-called serious projects.

Bitcoin has just crossed the $116,000 mark, reaching an unprecedented peak that triggered massive liquidations in the derivatives market. This meteoric rise exposes the extreme vulnerability of short positions, swept away by the strength of the bullish movement. Beyond the technical shock, this historical crossing raises concerns about market balance and the new power of institutional flows.

While Trump dreams of tariffs and inflation recedes, Bitcoin rises... but how far? At $113,804, the oracles are stirring and the short-sellers are biting their nails.

The first half of 2025 saw massive crypto liquidations driven by market shocks and policy shifts, but recovery signs are now surfacing.

No one bets on a campfire when the rain is falling. Yet, NFTs continue to crackle, even in the downpour. While trading volumes shrink quarter after quarter, sales are holding firm: $2.82 billion collected in the first half of 2025. Fewer dollars per transaction, but more hands are reaching out. The market is no longer frantic; it breathes differently, calmer, denser. And that might be the best news crypto has had in months.

On July 9th, the queen of crypto shattered its previous record by briefly surpassing 112,000 dollars, sweeping away doubts about a fatigue in the bullish cycle. This symbolic breakthrough, occurring amidst geopolitical pressures and massive movements in the derivatives markets, reignites speculation about entering a new phase of expansion in the crypto market.

Less fear around inflation: Bitcoin rises to $109,000, supported by calmer economic forecasts. More details here!

Bitcoin is just a hair away from its all-time high. The volumes on ETFs, the rebellion of the BRICS, and the audacity of the United States are very promising for the future.

Although Bitcoin is shaking up the markets and gradually establishing itself as a pillar of modern finance, it remains curiously discreet in the columns of major traditional media. In the second quarter of 2025, while crypto reached a new historical peak, its media presence was revealed to be meager. This absence is all the more striking as it does not reflect either the intensity of its adoption or the economic upheavals it brings about. The latest report from the Perception firm presents a clear observation: Bitcoin is unsettling, and some prefer not to talk about it!

The past never dies in the blockchain. More than ten years after the Mt. Gox scandal, a bitcoin address containing the equivalent of 8.7 billion dollars resurfaces... targeted by a phishing attempt as discreet as it is ambitious. At the crossroads of cybercrime and digital memory, this new episode raises a troubling question: are the forgotten treasures of bitcoin doomed to become the eternal prey of modern fraudsters?

While crypto ETFs are hitting record highs, volumes are evaporating. Blackrock and Fidelity are leading the influx, but the market seems to be holding its breath. Boom on the surface, empty underneath?

As Bitcoin gallops ahead, altcoins are sharpening their weapons in the shadows... What if the king soon fell from his throne? Guaranteed suspense in the crypto arena.

Larry Fink endorses bitcoins faster than miners can produce them. While staking is making its appearance, the ETF is turning BTC into a nice, juicy pawn.

When an Asian soup brand turns into a bitcoin vault... DDC buys, cashes in, and starts over: 368 BTC later, the markets are hungry for a new model.

While Strategy, a pioneer in bitcoin balance sheets, temporarily suspends its purchases, two listed companies are opting for the opposite trajectory. Metaplanet and Semler Scientific are heavily betting on BTC, redefining the balance of power in the market. In a context of macroeconomic uncertainty and persistent volatility, these bold acquisitions raise questions: Is this a mere speculative bet or a sustainable strategic repositioning?

Strategy, ex-MicroStrategy, is intensifying its bet on Bitcoin with a record raise of $4.2 billion through perpetual preferred shares at 10%. Under the leadership of Michael Saylor, the firm is strengthening its accumulation strategy despite a noticeable pause in its BTC purchases. This tactical shift, between liquidity seeking and financial optimization, marks a new phase in the controversial alliance between traditional markets and cryptocurrencies.

Bitcoin is advancing, unperturbed, flirting with $110,000. The bullish momentum seems unstoppable, but beneath the surface, signals are multiplying. Trapped liquidity, extreme euphoria, macro tensions: this week could very well be the one for crossing over... or a false start.

Investor confidence stays strong as crypto ETPs see $1.04B in inflows, with Bitcoin leading and Ethereum gaining traction.