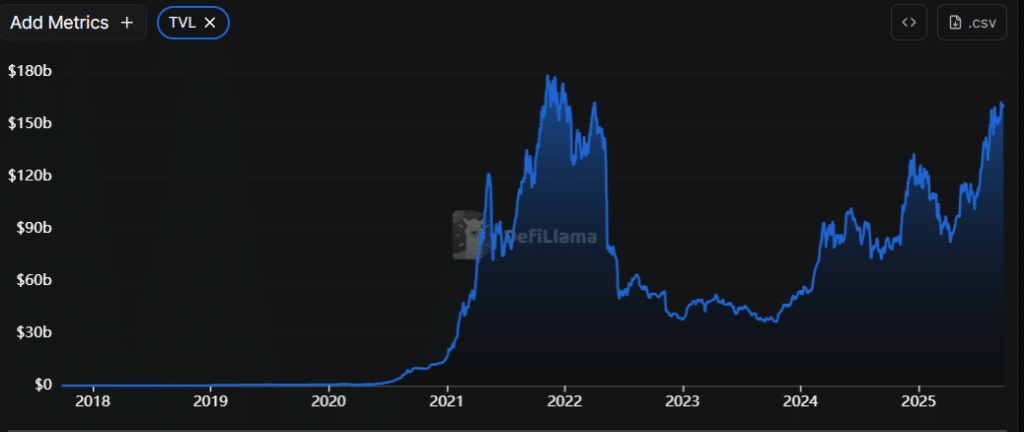

DeFi Market Nears All-Time High as Lending, RWAs, and Stablecoins Drive Growth

With renewed confidence in the crypto market following macroeconomic events, the decentralized finance (DeFi) niche is showing strong performance, as evidenced by its recent growth. The latest data now shows that the sector could be poised to touch the previous peak it reached nearly four years ago.

In brief

- DeFi TVL climbs to $161B, just 10% shy of its 2021 all-time high of $177.42B, signaling renewed confidence in the sector.

- RWAs see 7% weekly growth, reaching $15.6B as tokenized assets continue to gain traction among institutional investors.

- Aave leads with $42.84B in lending collateral, while Lido and Eigenlayer strengthen liquid staking and restaking momentum.

- Pendle, Morpho, and Spark show strong monthly gains, highlighting growing interest in new yield and credit-focused protocols.

DeFi TVL Hits $161B as RWAs and Stablecoins Surge

Defillama data shows that the total value locked (TVL) of DeFi platforms stands at $160.98 billion—about 10% below its November 2021 peak of $177.42 billion. This impressive figure follows a modest uptick over the past day, capping off the sector’s best run since the last cycle.

Real World Assets (RWA) TVL also surged nearly 7% week-to-date to $15.60 billion, aligning with the recent boom of tokenized assets. For context, TVL is a measure of the total value of assets—in U.S. dollars—locked or staked in a DeFi protocol.

Stablecoins are also soaring off the recently approved GENIUS Act, which has offered clarity regarding the operations of fiat-pegged assets. As per recent data, the stablecoin market cap is currently pegged at $292.62 billion.

Of this figure, about $16 billion is held in 24-hour decentralized exchange (DEX), while perpetuals account for $22.74 billion. Perpetuals are futures contracts with no expiration date, allowing traders to hold a position indefinitely.

Aave Leads Rankings as Lending Reclaims the Top Spot

After a strong monthly outing of about 15.98%, Aave tops the rankings with $42.84 billion in lending collateral. Liquid staking platform Lido ranks second with $38.33 billion following a relatively flat monthly outing. Eigenlayer holds $19.01 billion in restaking—up 4.85% on the weekly scale.

Here are the other protocols that make up the top ten:

- Binance Staked ETH holds $15.75 billion, up 15.4% this month in a clear uptrend.

- Ethena controls $14.22 billion after a 5.1% weekly rise, steady but gaining ground.

- Pendle logs $13.32 billion, flat on the day yet powering ahead with 35.2% growth over the month.

- Ether.fi commands $11.09 billion, sliding 7.3% on the week as momentum cools.

- Spark locks $8.93 billion, adding a healthy 19.3% this month.

- Morpho is one of the stronger movers, holding $8.28 billion after a 26.3% monthly surge.

- Babylon Protocol completes the top ten with $6.82 billion in restaking after a 21.27% monthly climb.

At eleventh place, Sky holds $6.13 billion, while Uniswap completes the dozen with $5.88 billion—down 4.96% in the last seven days.

Lending has reclaimed the top spot this cycle, while liquid staking remains a major force despite softer weekly trends. Restaking continues to attract steady long-term capital. At the same time, yield platforms like Pendle and newer credit protocols such as Morpho and Spark are gradually gaining ground, even as established players work to defend their lead.

Following the Fed’s recent quarter-point rate cut, analysts are expecting a bullish market, which would strengthen trust in DeFi and boost participation. Against this backdrop, experts believe the sector could reach its previous peak levels.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.