Crypto venture capital is showing signs of slowing, but key startups in AI, DeFi, and blockchain infrastructure continue to attract major investments, signaling ongoing innovation in the space.

Theme Invest

What if finance was no longer a privilege reserved for those who know the market hours and the workings of traditional banks? Kraken shakes up the codes with xStocks, an innovation that allows users to hold tokenized American shares on the Solana blockchain. No more waiting for the opening of Wall Street or hidden fees: investment becomes fluid, fractional, programmable, and compliant with regulations. With BackedFi as a regulatory anchor, Kraken opens a new path that combines financial discipline and technological freedom. A new era begins for those who want to grow their wealth according to their own rules.

France's economy recorded a trade deficit of 7.6 billion euros in May. A concerning trend for investors.

While the markets hesitate, Saylor is accumulating bitcoins by the thousands. Another 4,980 units? At this rate, it's the FED that will end up calling him.

Metaplanet becomes the 5th largest holder of bitcoin with 13,350 BTC, surpassing Tesla. All the details in this article!

Kalshi has raised $185 million in new funding, boosting its valuation to $2 billion as it plans to expand access to its prediction markets and grow its technology team.

Cointribune invites you to take part in a brand-new Read to Earn quest in partnership with Runbot. This time, your reading can earn you much more than just knowledge: in just a few simple steps, you can unlock exclusive credits on Runbot and enter a draw to win a share of the $400 prize pool.

Has the crypto casino definitely closed its doors? Probably. There are signs that cannot be mistaken...

"Driven by an unexpected easing in the Middle East and a resurgence of stock market optimism, the S&P 500 closed this Thursday at 6,141.02 points, nearing its all-time high. Increasing by 0.8%, the benchmark index marks a significant rebound since its low in April, despite ongoing uncertainties regarding trade tariffs and regional stability."

Crypto reserve in Arizona: a bill passed despite criticism from the governor. Discover the details in this article!

While Bitcoin struts its stuff, Ethereum is digging its furrow. Discreet but robust ETFs, stealthy rebalances, rock-bottom fees... what if the little brother became the darling of the big wallets?

Despite a decline in profits, companies in the CAC 40 are increasingly attentive to their shareholders. In 2024, they maintain record payouts, contrary to traditional economic signals. In an environment marked by sluggish growth, rising inflation, and unstable markets, this strategy raises questions. Is it a sign of strength or a risky bet? While shareholder profitability remains a priority, the gap between distributed profits and actual performance raises doubts about the sustainability of this model.

Japan is wielding its fiscal sword: crypto ETFs on the horizon, lower taxes... and investor samurais soon converted to Bitcoin? In Tokyo, traditional finance shakes under its kimono.

Donald Trump's surprise announcement of a ceasefire between Iran and Israel has caused a real earthquake in the energy markets. Oil prices plunged by more than 5%, while global stock markets soared. Is this geopolitical calm sustainable?

Financial markets are going through a fascinating period, where the boundaries between traditional finance and cryptocurrencies are increasingly blurred. BNB, the native token of the Binance ecosystem, is taking a bold new step by becoming the cornerstone of an institutional initiative listed on Nasdaq, fueled by an impressive raise of 100 million dollars.

Trump Media dives into bitcoin with $2.3 billion. But behind the announcement, there is a colossal stock buyback and a strategy that is shaking up U.S. regulations. Will it take everything?

Pompliano bets one billion dollars on Bitcoin. Huge merger with a SPAC. Its goal: to turn Bitcoin into an institutional financial asset. But beware of volatility!

Between financial scandal and assumed strategy, Michael Saylor remains committed to his bet on bitcoin. The details in this article!

After two years of suffocation, the French real estate market is showing measurable signs of recovery. Driven by falling interest rates and price stabilization, the first concrete signals are confirmed by FNAIM figures and field observations reported by Laforêt. Caution is gradually giving way to a recovery, admittedly still fragile but tangible. In an uncertain economic environment, this flicker gives new life to a sector long paralyzed. The question remains whether this momentum can be sustainable.

Inflation impoverishes billions of people while enriching a few million millionaires. Bitcoin is the antidote.

Finance: The savings rate of the French is the highest since 1979. We provide you with all the details in this article!

Despite some profit-taking, the bullish pressure remains strong. A new high awaits Bitcoin.

For the first time, the idea of putting France under the guardianship of the IMF has crossed the gates of Bercy. Long reserved for countries in crisis, this perspective, now acknowledged at the highest level of the state, reveals the extent of the budgetary derailment. An abyssal debt, soaring interest charges, and pressure from rating agencies form an explosive cocktail. The signal is clear: French economic sovereignty is wavering, and international institutions are now scrutinizing Paris with the same severity as struggling economies.

Bukele treats bitcoins like one treats croissants, defiantly challenging the IMF with flair and playing accounting hide-and-seek while promising mountains and wonders to skeptical Salvadorans.

While Saylor rallies the crowds, a Japanese outsider nibbles on 10,000 bitcoins... through zero-interest bonds. Metaplanet, or how to charm Tokyo with encrypted promises.

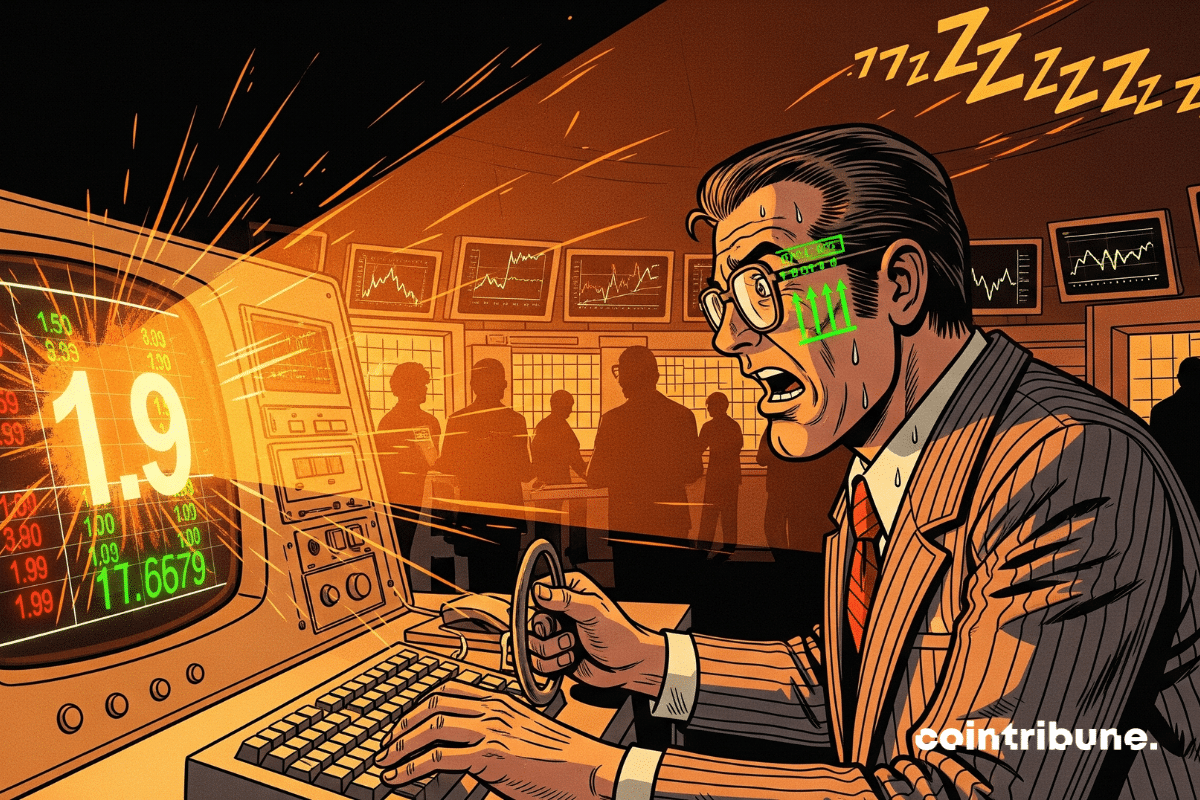

The crypto market attracts $1.9 billion in a week. Should we ride the wave or be cautious? Discover the key figures in this article!

Schiff gets carried away, gold soars, bitcoin wavers. What if behind the raging tweets lies a discreet farewell to the digital utopia?

Israeli airstrikes against Iran are disrupting the calculations of the American Federal Reserve (Fed). While Donald Trump is ramping up pressure for monetary easing, central bankers must now contend with a new factor of uncertainty: the geopolitical escalation that is driving oil prices up.

Seven giants align for Solana ETFs, the SEC plays the waiting game: suspense, thrills, and staking in the plush backrooms of the American regulatory temple. Stay tuned...

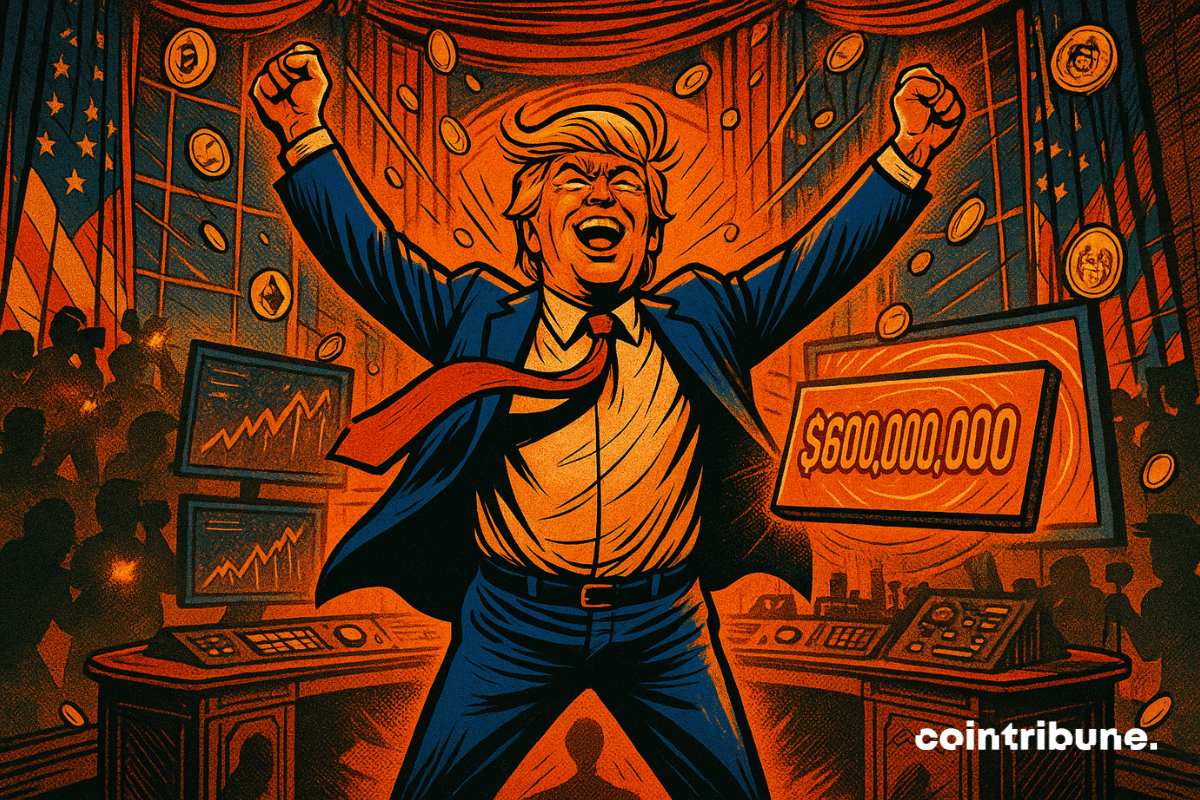

Donald Trump generated over 600 million dollars in 2024, with a major portion coming from the crypto universe. This figure, drawn from a financial disclosure document signed on June 13, confirms the president's strategic entrenchment in the crypto ecosystem. Between memecoins bearing his name and large-scale DeFi operations, Trump is no longer just observing the market: he is becoming a central player, with major financial and political stakes.