Strategy Reports $12.6B Q4 Net Loss as Bitcoin Prices Plunge

Strategy reported a fourth-quarter loss as Bitcoin prices fell sharply, significantly reducing the reported value of its digital asset holdings. As the largest corporate holder of Bitcoin, the company was heavily exposed to the market downturn, which led to a substantial balance-sheet write-down and resulted in one of the largest quarterly losses ever reported by a U.S. public company.

In Brief

- Strategy reported a net loss of 12.6 billion in the fourth quarter of 2025 driven by a sharp drop in Bitcoin prices.

- Unrealized losses on digital assets caused the operating loss to reach 17.4 billion far exceeding last year’s figures.

- Strategy’s stock fell more than 70% over the past year, reflecting waning investor confidence.

Heavy Bitcoin Write-Down Drives Quarterly Loss

In its earnings release, Strategy, formerly known as MicroStrategy, disclosed an operating loss of $17.4 billion for the fourth quarter of 2025. The loss was primarily due to unrealized declines in the value of its Bitcoin holdings and far exceeded the $1.0 billion operating loss reported in the fourth quarter of 2024. Net loss attributable to common shareholders totaled $12.6 billion, compared with approximately $671 million in the prior-year period.

Despite the steep losses, Strategy continued to add to its Bitcoin position. The company said it now holds 713,502 bitcoins, including 41,002 purchased in January 2026. The disclosure comes amid an unusually severe market downturn. Bitcoin recently recorded one of its sharpest single-day declines on record, falling from about $73,100 to near $62,400. At the time of writing, the cryptocurrency is trading around $65,000.

Stock Decline and Analyst Forecasts

The decline in Bitcoin and overall market turbulence has also affected Strategy’s shares, which began the day near $120 and ended regular trading around $107, later falling to approximately $102 in after-hours activity. Compared with a year ago, the stock has dropped more than 70%, reflecting that investor interest in the company’s Bitcoin-driven approach has waned.

Prior to the earnings release, a research analyst at crypto analytics firm Messari had projected that Strategy’s fourth-quarter loss would total about $17.4 billion, closely matching the company’s reported figures. The analyst added that a continued decline in Bitcoin into early February would lead to roughly $14 billion in additional unrealized losses, bringing the total mark-to-market decline in the company’s Bitcoin holdings since the end of 2025 to nearly $31 billion.

This ongoing market decline has directly affected Strategy’s Bitcoin position. The company purchased Bitcoin at an average price of around $76,000, and the recent drop in its value has turned what had been a significant paper gain into an unrealized loss exceeding $9.2 billion. Only four months ago, when Bitcoin approached record levels, the company’s holdings showed unrealized gains exceeding $31 billion.

Bitcoin Slips to Lowest Level Since October

Amid the downturn, Strategy Executive Chairman Michael Saylor made a brief post on X, writing “HODL,” a term commonly used to signal a long-term holding stance and discourage selling during market declines.

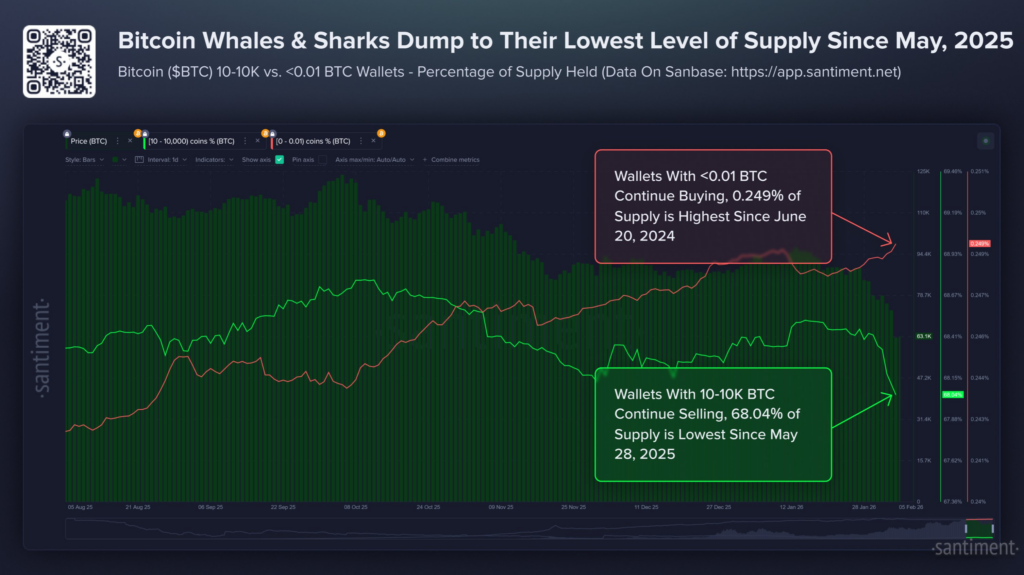

As of the time of writing, Bitcoin has fallen by more than 5%. Market intelligence platform Santiment attributed the continued weakness to shifting behavior among large holders. According to Santiment, whale and shark wallets holding between 10 and 10,000 bitcoins now control 68.04% of total Bitcoin supply, marking the lowest level for these wallets in the past nine months, following net sales of 81,068 BTC over the past eight days.

At the same time, wallets holding less than 0.01 Bitcoin now make up 0.249% of the total supply, reaching their highest level in the past 20 months. While the figure remains small, Santiment said the increase reflects persistent dip-buying by retail investors.

The platform noted that this mix of large holders selling while smaller investors continue to accumulate has historically coincided with bear-market cycles. Santiment added that until broader retail capitulation becomes evident, institutional and large investors may continue to distribute holdings with limited urgency to re-enter the market.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Ifeoluwa specializes in Web3 writing and marketing, with over 5 years of experience creating insightful and strategic content. Beyond this, he trades crypto and is skilled at conducting technical, fundamental, and on-chain analyses.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.