Crypto: Aster launches its layer-1 blockchain on testnet. A new step towards a trading-oriented infrastructure. All the details here!

Theme Decentralized Exchange (DEX)

Crypto portfolio management platform adds real-time position monitoring for three major perpetual trading protocols

While the crypto market is struggling, onchain perpetual contracts are breaking records. A discreet but massive explosion that reshapes the backstage of an overheated DeFi.

Uniswap approves UNIfication, setting the stage for a 100M UNI burn, fee changes, and key protocol updates.

Hyperliquid progresses as a crypto desk that doesn't want to waste time with slogans. No big speeches "DeFi for all." Instead, two very concrete levers in pre-alpha: portfolio margin and BLP Earn vaults. Translation: more flexible risk management, and a yield and borrowing component directly connected to Hypercore. The kind of addition that makes no noise, until the day traders understand what it changes.

In a DeFi market seeking stability, the launch of StandX on November 24, 2025, does not go unnoticed. This new DEX, dedicated to perpetual contracts, introduces an automatic yield stablecoin, without staking action. Supported by a team from Binance Futures and Goldman Sachs, the project claims a community-driven and self-financed approach. Unlike classic models, StandX aims to establish itself in a sector still largely dominated by centralized platforms.

Jupiter Lend clears up claims of 'zero contagion' and explains how vaults operate amid user concerns.

The Fusaka update nearly caused Ethereum crypto network finality to be lost. We give you all the details in this article!

While the SEC digests its shutdown, Grayscale speeds towards Wall Street. An IPO? Yes, but under tight control. Crypto enters the stock market... and not democracy.

No bridges but with panache, Pact Swap slashes fees and smashes complexity: crypto finally discovers a DEX that does not chain its users.

Under Atkins, the SEC pulls out the highlighter to sort tokens. Congress, meanwhile, is stalling. And crypto projects? They are sharpening their passports for more stable skies.

In October, decentralized platforms reached a historic milestone. More than $1.3 trillion in perpetual contracts were traded in one month. A symbolic threshold, never reached before, illustrating a profound shift in the crypto ecosystem. Long dominated by centralized platforms, the derivatives market is witnessing a new dynamic, driven by DeFi. This rapid growth is not by chance but the result of a structural change in usage, tools, and trader confidence.

Blockchain shows its claws: billions flowing, apps that are booming, and crypto finally wanting to work for real. To follow, or to avoid?

Spot is making a comeback, Binance still reigns, and ETFs attract big fish: crypto hasn't said its last word... except for altcoins that are sulking.

Jupiter dives into decentralized betting with its prediction market on Solana, challenging Polymarket. Between innovation, regulatory risks, and technological battle, this project could redefine crypto in 2025. Discover the stakes and challenges of this fierce race – who will come out on top?

The crypto world is a battlefield where innovation allows no respite. After the meteoric rise of Hyperliquid and the breakthrough of Aster, Solana responds with a project designed for speed and scalability: Percolator. Announced by Anatoly Yakovenko, this new perpetual contracts DEX could reshuffle the decentralized trading cards. Behind the evocative name lies a vision: that of a crypto exchange engine without compromise, where on-chain performance finally meets the simplicity of a centralized exchange.

MetaMask integrates perpetual contracts trading (Perps) via Hyperliquid, allowing users to access leveraged operations and rewards directly from their wallet. This development could change the role of centralized exchanges in the crypto ecosystem. #Crypto #DeFi #Metamask #Hyperliquid

As airdrop valued at 600 million dollars approaches, the decentralized platform Aster faces a crucial strategic choice. To avoid a collapse in the price of its ASTER token, the team is considering imposing a vesting on the beneficiaries. A decision that could redefine the balances within the highly contested sector of derivative product DEXs. Between loyalty, speculation and stability, Aster plays a decisive card for its short and medium-term future.

A brand new DEX, a former Binance boss behind the scenes, billions pouring in... Aster propels crypto into a frantic dance between hype, incentives, and suspicious concentration.

In a few days, wallets identified as whales moved several tens of millions of dollars from Hype to Aster, a newly launched token on a DEX supported by Changpeng Zhao. This massive capital movement, observed since September 17, quickly propelled Aster among the 40 largest global cryptos.

Pump.fun rejoices, Solana celebrates: PumpSwap dethrones its rivals. Crypto record at $878M, but already, criticisms and rug pulls darken the memecoins sky.

Ethereum Foundation sells 10,000 ETH on centralized platforms. Pragmatic or heresy? The community cries out DeFi betrayal, the foundation pleads transparency… Schizophrenic atmosphere among cryptophiles.

Hyperliquid’s rapid growth in decentralized derivatives is turning heads as its trading activity edges closer to rival Binance.

Hyperliquid has just smashed a world record that redefines the meaning of efficiency. The young decentralized exchange is now generating $1.127 billion in annual revenue, with only 11 contributors. That comes out to a staggering $102.4 million per employee. No company, crypto or traditional, has ever reached this level of productivity.

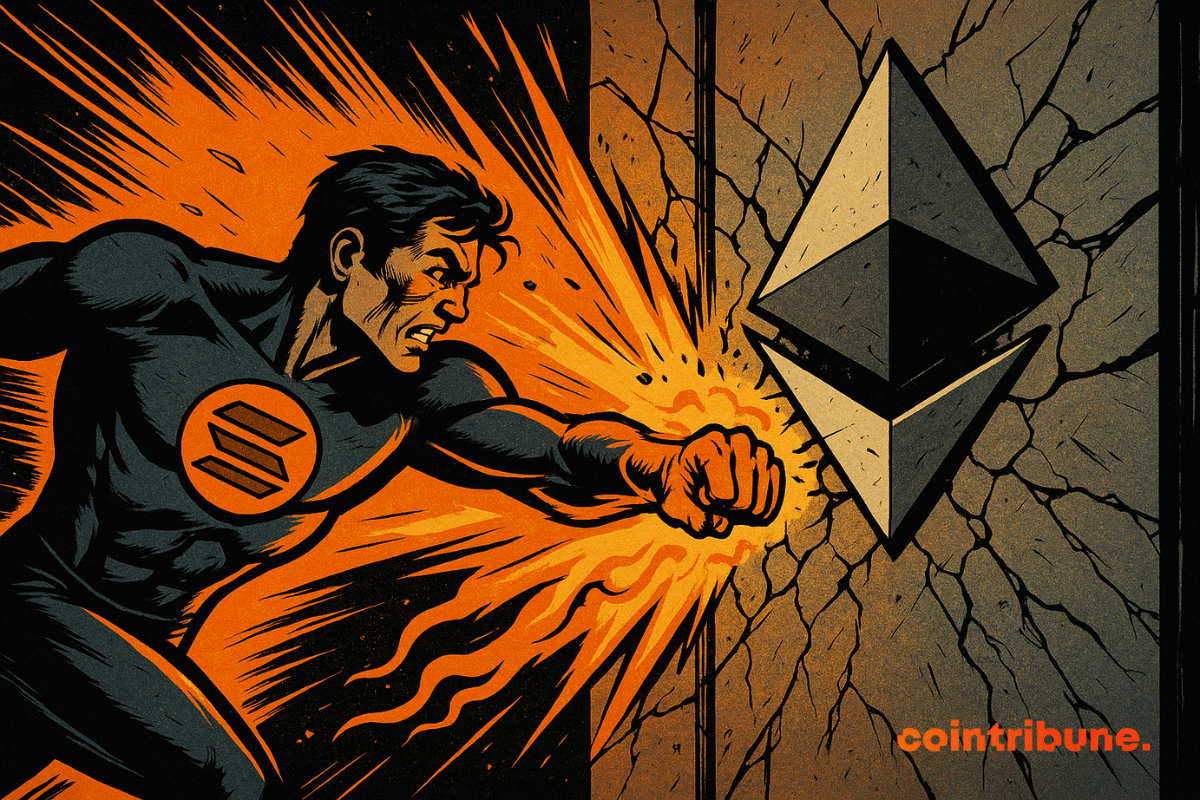

Solana continues to dominate the decentralized exchange (DEX) ecosystem, outpacing other veteran networks such as Ethereum. Platforms such as Jupiter are also witnessing active engagement, with four new private AMMs debuting on the network. This trend follows the recent emergence of token launchpads, which have helped drive overall trading activities.

DeFi platform CrediX Finance has disappeared from the web following a $4.5 million exploit that drained its liquidity pools, prompting suspicions of a coordinated exit scam. The incident was first flagged on Monday by blockchain security firms, who found that the attackers gained control of the protocol’s multisig admin and bridge wallets six days prior. Using this access, they minted new tokens, posted them as collateral, and then siphoned liquidity from CrediX’s pools.

The $NAORIS token debuted yesterday afternoon on multiple exchanges simultaneously: Binance Alpha opened trading, followed by a NAORISUSDT perpetual contract on Binance Futures. MEXC launched the spot market, Bitget listed NAORIS/USDT, and LBank opened within the same window.

The hacker behind the $40 million GMX exploit has begun returning the stolen crypto after accepting a $5 million white hat bounty offered by the GMX team.

While we debate decentralization, PancakeSwap is feasting: $530 billion traded and a barely concealed dominance over DeFi... centralized? Who said "free finance"?

Solana bombards DEXs, Ethereum takes the hit... but behind the sparkle, a network coughs and memecoins tumble. The crypto king trembles, but can the prince reign without an active throne?