USDT: Tether Sets New On-Chain Activity Record in Q4 2025

The year 2025 ended with a striking contrast in the digital ecosystem: while the overall cryptocurrency market underwent a major correction, Tether’s USDT showed a decoupled growth driven by unprecedented on-chain activity. This resilience, materialized by a record market capitalization and an ever-expanding user base, confirms the evolution of the stablecoin which, beyond its original role as a trading tool, now establishes itself as a true global financial infrastructure. Analysis of key data from this fourth quarter.

In brief

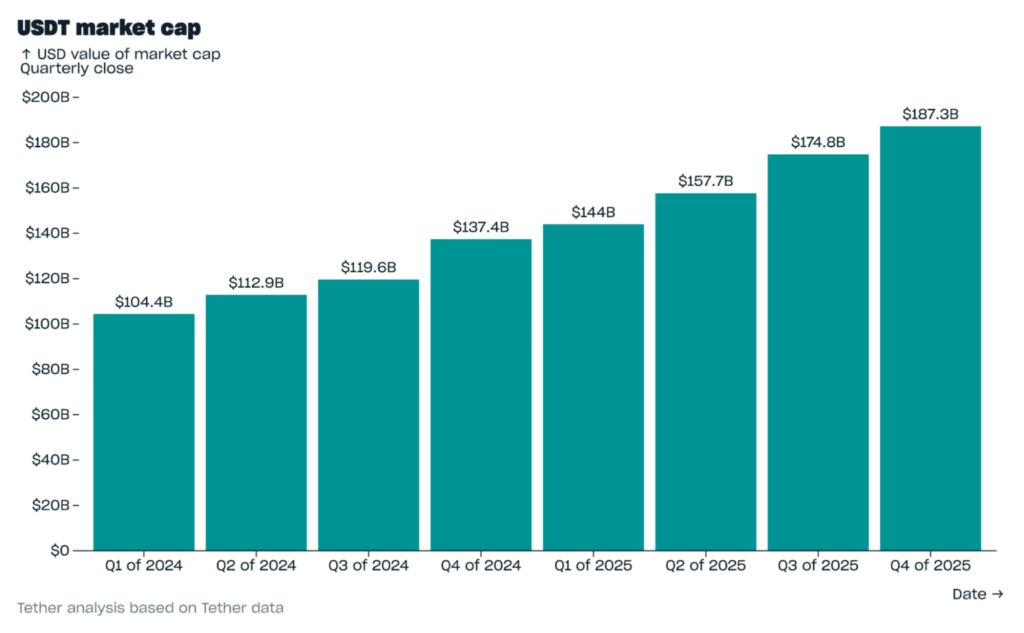

- USDT shows unique resilience with a record market cap of 187.3 billion dollars, up 3.5%.

- On-chain activity reaches historic levels, with 4.4 trillion dollars transferred and predominantly daily retail usage.

- USDT continues its global expansion with over 30 million new users and clear dominance in stablecoin wallets.

- Tether’s reserves strengthen significantly, combining gold, bitcoin, and U.S. debt to become a major geopolitical player.

Financial resilience facing market correction

The fourth quarter of 2025 will be remembered due to the liquidation cascade that occurred on October 10th. This event triggered a major contraction wiping out more than one-third of the total capitalization of cryptocurrencies until early February 2026. Yet, at the heart of this turmoil, USDT stood out as an exception.

According to Tether’s report, the main competitors (the second and third market stablecoins) suffered massive withdrawals, seeing their capitalization drop by 2.6% and 57% respectively. USDT increased by 3.5%. This dynamic translated into a record market capitalization of 187.3 billion dollars, a rise of 12.4 billion over the quarter. These figures, according to Tether, illustrate investors’ strong preference for USDT liquidity, used as a safe haven to preserve value against the volatility of other digital assets.

Historic on-chain activity and transfer volumes

Blockchain flow analysis reveals unprecedented economic vitality. The volume of value transferred in USDT reached a historic threshold of 4.4 trillion dollars in the fourth quarter. This colossal figure does not solely reflect speculation: 63.6% of this volume (2.8 trillion) comes from transactions where USDT was the only asset exchanged, indicating growing usage for payments and fund transfers.

The number of transactions also exploded, totaling 2.2 billion operations. Granular flow analysis shows massive adoption by the general public:

- 88.2% of transfers involved amounts under 1,000 dollars.

- Conversely, institutional transactions over 100,000 dollars represented only 0.2% of the total.

These statistics confirm that on-chain activity is now driven by daily retail usage, validating the stablecoin’s utility in the real economy.

Expansion of the user base and typology of holders

USDT adoption shows no signs of slowing down. Data indicate the ecosystem welcomed over 30 million new users, bringing the estimated total to 534.5 million worldwide for the eighth consecutive quarter.

On blockchain, according to the same report, the number of wallets holding USDT jumped by 14.7 million to 139.1 million. USDT thus largely dominates the sector, being present in 70.7% of all stablecoin wallets.

The typology of users highlights its role as a store of value: a significant share of holders (over 30%) retain all received tokens without immediate spending. In fact, 75.1% of wallets identified as “savings” in the crypto universe favor USDT, consolidating its status as a digital wealth preservation asset.

Reserve composition: Gold, Bitcoin and Treasury bonds

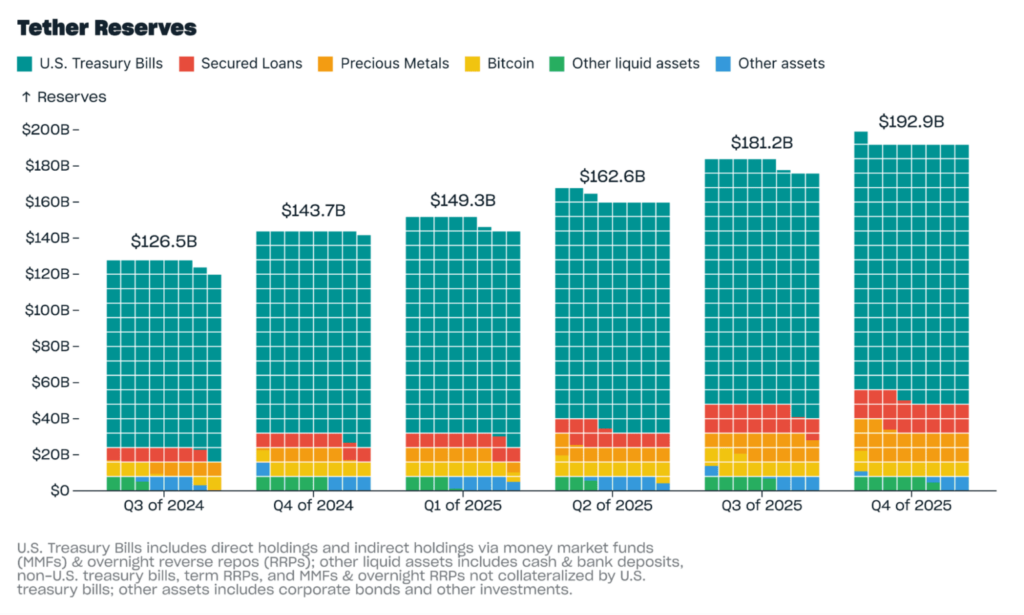

Tether’s financial strength has also increased, a crucial point for market confidence. At the quarter’s end, Tether announced total reserves of 192.9 billion dollars, generating net equity of 6.3 billion.

The diversification of underlying assets continues:

- Metals and Crypto: Reserves now include 127.5 tons of gold and 96,184 bitcoins, following continuous acquisitions.

- U.S. debt: exposure to U.S. Treasury bonds rose to 141.6 billion dollars.

This massive accumulation of sovereign debt places the company at notable geopolitical level. If Tether were a country, it would be the 18th largest holder of U.S. debt, ahead of Germany. In 2025, the issuer even positioned itself as the 7th largest global buyer of these securities, surpassing nations like South Korea.

Consolidation outlook for 2026

Alongside the USAT launched in January, the indicators from the fourth quarter of 2025 depict an asset that has successfully transitioned from a simple speculative instrument to a pillar of the digital economy. Continued growth in capitalization and user numbers, despite a contracting crypto market, demonstrates strong confidence in the stablecoin.

On-chain flow analysis suggests that 2026 could mark an acceleration in USDT use in everyday transactions and global savings, beyond the circles of initiated investors. Supported by diversified and liquid reserves, the asset appears ready to consolidate its dominant position, acting as a stable bridge between traditional finance and the blockchain innovation.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Journaliste et rédacteur web passionné par l’univers des cryptomonnaies et des technologies Web3. J’y traite les dernières tendances et actualités afin de proposer un contenu de haute qualité à un large public du secteur.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.