Bitcoin Post-FOMC: Between Consolidation and Mixed Signals – Technical Analysis of September 23, 2025

Bitcoin consolidates around $112,500 after a bounce on support, but fails to regain clear momentum. Discover the technical outlook for the future evolution of BTC.

In brief

- Technical analysis: Consolidation around $112,500, declining momentum and falling volumes.

- Technical levels: Strong supports between $107,286 and $105,159, major resistances near $118,000 and the ATH.

- Market sentiment: Fear sentiment, institutional inflows present but insufficient to support a clear trend.

- Derived analyses: Stable open interest, positive but declining funding, massive long liquidations.

- Forecasts: Uncertain bias, maintaining above $107,286 opens bullish potential, break exposes to a marked pullback.

BTC/USD Technical Analysis

The spot price of BTC trades around $112,500, after a bounce on the support zone and a rejection from the high value area. The week ends with an almost zero change (+0.04%), forming a doji candle, a sign of hesitation. Weekly volumes drop by 9%, indicating declining engagement.

In the long term, the 200 SMA confirms a well-established bullish bias. However, shorter moving averages illustrate exhaustion: the 50 SMA has stabilized, while the 20 SMA shifts from bullish to neutral/bearish. The momentum reflects this pullback, after a technical rebound from its latest daily support.

Bitcoin (BTC) Technical Levels

The market remains framed by specific zones. Resistances are located at $118,000 then at the ATH of $124,277, representing critical distribution thresholds. On the downside, the $107,286 – $105,159 zone constitutes a major support. The daily break of $112,000 followed by a rebound has reinforced this level as a technical reference.

The monthly pivot point at $113,329 remains above the current spot. Value areas highlight a fragile balance: $118,000 at the upper bound, $104,900 at the lower bound. Their break could initiate a significant imbalance.

Market Sentiment

Sentiment has deteriorated, turning fearful after several weeks of neutrality. Investors’ caution is reflected in declining volumes and absence of massive institutional flows. Spot BTC ETFs still record moderate inflows, but these are not enough to trigger a clear recovery.

The current technical analysis was carried out in collaboration with Elyfe, investor and popularizer in the cryptocurrency market.

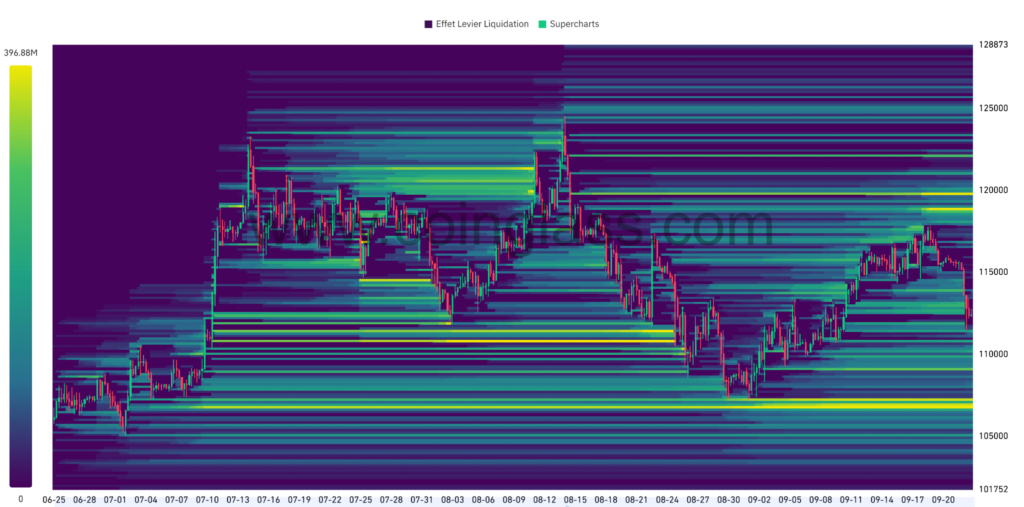

Derivatives Analysis (BTC/USDT)

Derivatives reflect a hesitant market. Open interest remains stable, suggesting an overall neutral to bearish positioning. The CVD shows flows stabilizing, but again oriented towards sellers. Recent massive long liquidations are the largest since June, indicating a brutal leverage cleanup. The funding rate, although still positive, gradually declines, reflecting a weakened bullish bias.

The selling liquidation zone between $118,000 and $120,000 appears as a critical threshold: a break could strengthen bullish momentum, but it could also serve as a distribution zone if the market weakens. Conversely, the buying zone located between $107,200 and $106,600 remains vulnerable to a break, likely to trigger accelerated bearish movement, while representing a potential point of interest for strategic accumulation.

Forecasts for Bitcoin (BTC) price

- Bullish scenario: if the price holds above $107,286, next targets are $118,000 then $124,533 (ATH), representing a potential +10.28% from the current level.

- Bearish scenario: a break of support at $107,286 would open the way to $105,159, $100,000 then $98,330, with a potential of -12.5% from the current level.

- Neutral scenario: prolonged consolidation between $107,000 and $118,000 remains possible, indicating a waiting phase before the next directional move.

Conclusion

Bitcoin is trading in a consolidation phase, supported by a still solid long-term trend, but weakened by a short-term dynamic decline and falling volumes. Identified technical zones will serve as references to anticipate the next impulse. In this context, close monitoring of price reactions at strategic levels will be essential to confirm or adjust current forecasts. Finally, remember that these analyses are based solely on technical criteria, and the price of cryptocurrencies can move rapidly based on other more fundamental factors.

Bitcoin settles into a maturity phase? Discover Michael Saylor’s viewpoint.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Spécialiste en analyse technique, Elyfe décrypte les tendances graphiques des marchés des cryptomonnaies avec une approche rigoureuse et en constante évolution. À travers ses analyses détaillées, il apporte un regard éclairé sur la dynamique des prix, aidant les investisseurs et passionnés à mieux comprendre et anticiper les mouvements du marché.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more