Clarity Act Delay Sparks $952M Crypto ETP Outflows as U.S. Regulatory Uncertainty Weighs on Markets

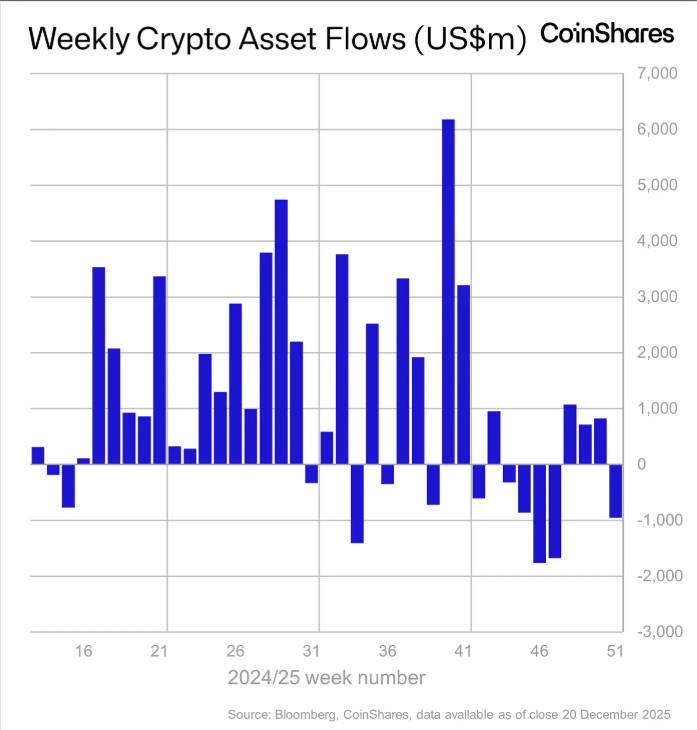

Global crypto exchange-traded products (ETPs) saw a sharp pullback last week amid a return to regulatory uncertainty. New data from CoinShares shows investors withdrew nearly $1 billion, ending a three-week streak of inflows. Delays around the U.S. Clarity Act played a key role in weakening sentiment, especially among U.S.-based institutions. Market activity also pointed to rising caution around large holders and near-term policy risks.

In brief

- Global crypto ETPs reversed three weeks of inflows as U.S. regulatory delays triggered $952M in withdrawals led by major issuers.

- U.S.-listed products accounted for most outflows, while Canada and Germany recorded modest inflows despite broader market pressure.

- Ethereum saw the largest asset-level outflows at $555M, reflecting sensitivity to ongoing regulatory debates in the U.S.

- Bitcoin products logged $460M in outflows, signaling softer institutional demand compared with the same period last year.

Ethereum Bears Brunt of Crypto ETP Selling Amid Clarity Act Uncertainty

Crypto asset investment products from major issuers, including BlackRock, Bitwise, Ark 21Shares, and Grayscale, recorded combined outflows of $952 million for the week. CoinShares Head of Research James Butterfill said the move represents the largest monthly outflow to date and reflects growing concern about stalled digital asset legislation in Washington.

Expectations for progress on the Clarity Act before year-end faded after confirmation that markup discussions will not begin until January, extending uncertainty across the market.

Regulatory ambiguity remains a key pressure point. CoinShares noted that delayed clarity around asset classification, exchange oversight, and issuer responsibilities has weighed heavily on U.S.-listed products. Concerns around potential whale-driven selling further reduced risk appetite during the week.

Market activity across regions and assets showed a clear split:

- U.S.-listed products posted $990 million in outflows, accounting for nearly all selling activity.

- Canadian crypto ETPs attracted $46.2 million in inflows.

- German-listed products added $15.6 million.

- Ethereum products led asset-level outflows with $555 million.

- Solana and XRP recorded inflows of $48.5 million and $62.9 million, respectively.

Ethereum saw the largest shift among major assets. CoinShares explained that the asset’s role in ongoing regulatory discussions has made it more sensitive to legislative delays. Despite recent selling, Ethereum inflows for the year remain strong at $12.7 billion, well above the $5.3 billion recorded during the same period in 2024.

Selective Buying Emerges as Bitcoin Products Face Ongoing Outflows

Bitcoin products followed with $460 million in weekly outflows. Year-to-date inflows now stand at $27.2 billion, compared with $41.6 billion at the same point last year. CoinShares observed that the gap points to weaker demand from U.S. institutions, which drove much of the previous cycle.

Smaller areas of strength appeared in other investment products. Solana and XRP continued to attract capital, extending a multi-week trend of relative resilience amid selling pressure in larger products. CoinShares added that investor interest in these assets reflects selective positioning rather than broader risk appetite.

Looking ahead, CoinShares does not expect total crypto inflows this year to exceed 2024 levels. Assets under management currently stand at $46.7 billion, compared with $48.7 billion last year.

At the time of writing, Bitcoin is hovering around $89,712 following a 2% weekly rally. Despite this modest uptick, the OG coin remains down 9% over the past year and below its 200-day moving average. Ethereum has reclaimed the $3,000 mark after posting a little weekly movement. Still, the asset is down 12% year over year, underperforming most major crypto assets.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.