19,820 ETH Pulled From Exchanges as Whales Bet Big on Ethereum

In the booming crypto market, giant transactions have just caught attention: 19,820 ETH, worth over 40 million dollars, were withdrawn from the Binance and OKX platforms. These moves fit into a strong trend where whales are massively accumulating Ethereum. What is behind this strategy?

In brief

- 19,820 ETH withdrawn from exchanges by an Ethereum whale, thus reducing liquidity in the crypto market.

- Whales and institutional traders dominate the Ethereum market with 76.91% long positions, amplifying volatility risks.

- Ethereum shows strong bullish signals, but the concentration of leveraged positions raises the question of a bull run or a bubble.

Ethereum: 19,820 ETH withdrawn from crypto exchanges

A few days after Garrett Jin deposited 260,000 ETH on Binance, a whale took advantage to withdraw 19,820 ETH from exchanges, equivalent to 40.14 million dollars. This withdrawal adds to a previous transaction of 60,784 ETH, valued at 126 million dollars. A clear trend emerges: whales prefer to store their assets off-platforms, thus reducing available liquidity in the crypto market.

This massive accumulation is not trivial. It reflects a long-term holding strategy, often associated with an anticipation of price increase. By reducing Ethereum supply on exchanges, whales create buying pressure, which can mechanically push prices up. But why now?

Whales VS institutional traders: who controls Ethereum in the shadows?

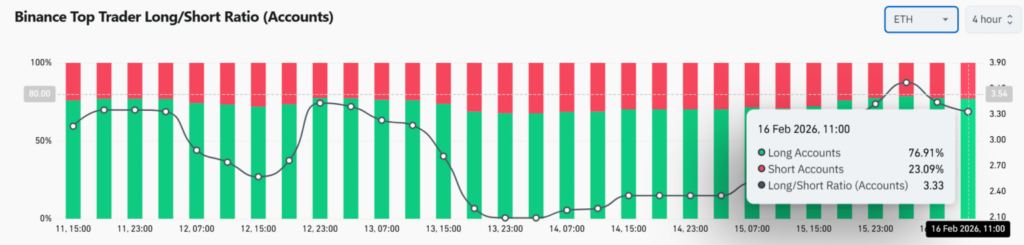

Behind these massive moves are influential actors: whales and institutional traders. Indeed, their weight in the Ethereum market is colossal. For example, 76.91% of top traders on Binance hold long ETH positions, against only 23.09% short positions. An imbalance showing an almost unanimous bullish conviction among professionals.

However, this concentration of long positions could lead to cascading liquidations if the market turns abruptly. By withdrawing their ETH from exchanges, the whales also reduce liquidity, which can make the market more sensitive to price fluctuations. Their influence is such that they alone can dictate short- and mid-term trends. Small investors, often influenced by these moves, must remain vigilant.

Ethereum: Bull run or speculative bubble to watch closely?

There are many bullish signals for Ethereum:

- Rising funding rates;

- Dominance of long positions;

- Massive accumulation by whales.

Everything seems to indicate that Ethereum is in a consolidation phase before a possible surge. But is that really the case? On one side, fundamentals are solid notably with the abandonment of Namechain by ENS to stay on Ethereum L1. On the other, risks of concentration of long positions persist, possibly creating a speculative bubble.

For crypto investors, caution remains necessary and blindly following whales can limit risks. Ethereum has huge potential, but its market remains unpredictable. Yet, the question remains: is this massive accumulation a sign of a bull run, or simply the echo of a bubble ready to burst?

Massive withdrawals of ETH by whales send a clear message: the market believes in a promising future for Ethereum. However, this conviction comes with major risks, especially in case of a brutal market reversal. In your opinion, how far will whales go to consolidate their control over Ethereum?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.