As institutional flows reshape its trajectory, Standard Chartered maintains a target of $200,000 for Bitcoin by the end of this year. This forecast is based on a major shift: ETFs and listed companies now dictate the trend. Speculation is giving way to a logic of strategic allocation. Thus, the market is changing hands, tempo, and profile.

Crypto News

While Bitcoin is flirting with the $110,000 mark, new data shows whale supply has dropped to its lowest point since 2019, signaling a wave of profit-taking that could threaten the rally’s momentum.

The Democratic governor of Arizona, Katie Hobbs, has once again vetoed a pro-Bitcoin bill. The state could have created a public reserve from seized cryptocurrencies, as Texas and New Hampshire are already doing.

While the old hands cash in their winnings, Bitcoin is performing acrobatics: it wobbles, balances, and might even leap. The suspense continues, hats off to the moles.

In a market searching for benchmarks, even the slightest regulatory rumor can tip the scales. XRP is a perfect illustration of this: trapped between $2 and $2.35, the asset is drawing increasing attention amidst speculation surrounding an ETF. Far from the usual tumult surrounding bitcoin, this tension places Ripple's crypto at the convergence of a double issue: technical unlocking and institutional recognition.

Bitcoin shows $1.2 trillion in unrealized profits. Why is no one selling despite +125% gains? Analysis of the signals to know.

Less than 15% of bitcoins are still accessible on exchanges. Behind this figure lies a silent dynamic: the scarcity of liquid supply. As institutions appropriate the asset, analysts see it as a signal of an increasing imbalance between available stock and strategic demand. A shift is looming in the mechanics of the market.

The crypto ecosystem takes a symbolic leap with the accelerated validation by the SEC of the conversion of the Grayscale Digital Large Cap Fund (GDLC) into an ETF. This green light is not limited to Grayscale. It marks the entry of altcoins into the regulators' field of action. In a context where the political climate is softening towards cryptos, this decision could pave the way for a new generation of ETFs focused on assets like XRP, Solana, or Cardano.

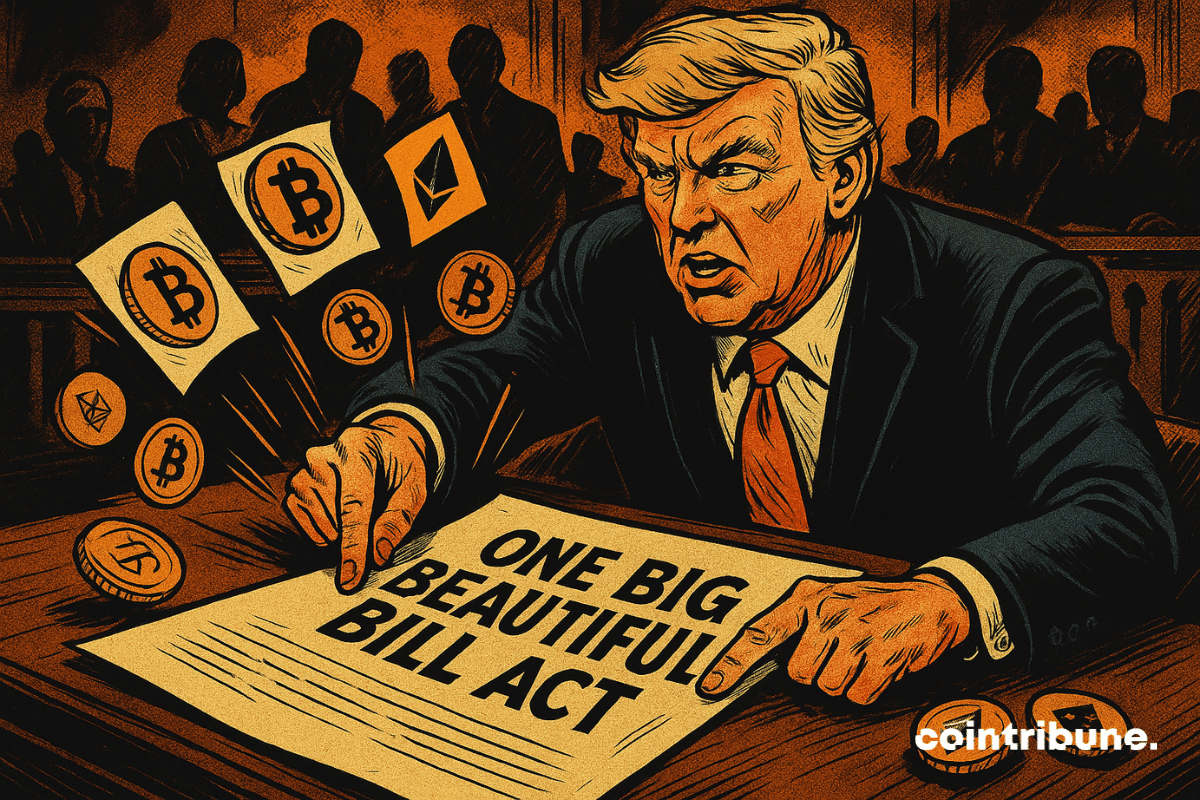

Trump exults, Warren rises up, Lummis screams into the wilderness... The Senate votes, cuts through, carefully avoids crypto, and signs a XXL law, as silent as it is deafening for digital miners.

The world of crypto is often built on the fringes of institutions. However, some companies choose to swim against the tide by seeking to fully integrate into them. This is the case with Circle, the issuer of USDC, which is no longer content to be just a tech player. The American company has officially applied to become a national trust bank in the United States. This is both a bold move and indicative of a broader shift in the crypto ecosystem: integration into the federal banking system to better ensure trust.

Bitcoin’s price holds steady while traders shift from buying puts to selling calls, signalling growing confidence amid rising institutional demand and hints of a possible breakout later in the year.

Crypto ETPs attracted $17.8B in H1 2025, nearly matching 2024 levels, driven by strong institutional demand and Bitcoin’s lead.

Pi Network is entering an unstable period. On July 4th, a massive influx of tokens will inflate the available supply in an already pressured market. After declining for six days, the PI cryptocurrency is struggling to convince, especially since the announcements from Pi2Day left investors wanting more. Between community disappointment and upcoming tensions, the project has a lot at stake in the coming days.

Blockchain holds great promise, but few projects can bridge the gap between technological ambition and institutional reality. With its new ACE compliance engine, Chainlink aims to overcome this hurdle. The stated goal: to unlock $100 trillion in institutional investments that have been stalled by regulatory barriers. An initiative that could change the game in the crypto universe.

Michael Saylor and Adam Back have just unveiled a bold roadmap to propel BTC to 3 million dollars. Their model aims to transform traditional businesses into ultra-efficient bitcoin acquisition machines.

Robinhood opens a new chapter in its history by launching its own layer 2 blockchain to offer tokenized stocks to European investors. This technological offensive places Europe at the center of its crypto strategy: allowing investors from the Old Continent to trade American stocks 24/7, without commission. An advancement that could well reshuffle the cards of traditional trading. Analysis.

While Bitcoin and Ethereum are cautiously progressing in a calm market, it is Solana that is stealing the spotlight. In just one week, its price has soared by 16.5%, eclipsing the performances of the two historical pillars. This breakthrough is not trivial: it comes in the context of a return to fundamentals, where investors are once again scrutinizing technical signals and the robustness of projects. Solana, long relegated to the background, now seems to be repositioning itself as a serious contender for leadership in the next cycle.

As the second quarter comes to a close, Bitcoin may well be writing a new chapter in its history. The $109,000 mark is within reach, and the technical signals are converging. However, behind this bullish momentum, tensions are emerging: a demand deficit, liquidity games, and uncertainty about American interest rates. Could the June monthly close change everything?

The crypto market is taking a strategic turn. After a tumultuous June marked by geopolitical tensions and price volatility, July is emerging as an unprecedented window of opportunity. While Bitcoin remains firmly above $100,000, bullish signals are multiplying, supported by the return of institutional flows. In this climate full of expectations, five cryptocurrencies are emerging as must-haves to capture the momentum of the next bull run.

The era of plastic is coming to an end. As Visa and Mastercard struggle under the weight of opaque fees and archaic delays, a new form of infrastructure is quietly taking power. Stablecoins, long relegated to the realm of traders' tools, are now establishing themselves at the heart of the Web as the "default settlement layer." This is no longer a futuristic hypothesis: it is a reality that is grounded in numbers and usage.

On June 17, the U.S. Senate passed the GENIUS Act, short for Guiding and Establishing National Innovation for U.S. Stablecoins Act, by a 68-30 bipartisan vote. If passed by the House and signed by the President, the bill would introduce the first comprehensive federal framework for regulating stablecoins in the United States.

Metaplanet becomes the 5th largest holder of bitcoin with 13,350 BTC, surpassing Tesla. All the details in this article!

Michael Saylor has just confirmed his 11th consecutive week of Bitcoin acquisitions, an impressive streak that perfectly illustrates his relentless accumulation strategy. With 592,345 BTC in reserve, his company Strategy is becoming a true fortress of Bitcoin. But how far will he go?

And what if one of the largest silent bets on Bitcoin had finally been brought to light? A recent analysis by Arkham Intelligence reveals that Tesla and SpaceX together hold over $2 billion in BTC, including $1.5 billion in unrealized gains. Until now, only Tesla had communicated about its purchases. SpaceX, for its part, had never leaked any information. These revelations shed light on Elon Musk's crypto strategy, which is much more committed than it appears.

While the crypto market is losing steam and volumes are dwindling, an unexpected movement is stirring Shiba Inu. In the span of 24 hours, whales have ramped up their purchases at an unprecedented pace, triggering an accumulation of SHIB of over 200%. This surge, which has gone under the radar of the general public, rekindles speculation about a possible reversal. Behind this renewed activity from large holders, it might be a phase change that is unfolding for one of the most closely watched memecoins in the ecosystem.

Ethereum is being hoarded by large holders, like nuts before winter. Meanwhile, the small ones are fleeing, scared. What if the whales are preparing a feast?

The bitcoin market is holding its breath. As the flagship crypto flirts with 109,000 dollars, a level never before reached in weekly closing, the spotlight is on an electrifying weekend. At the intersection of technical analysis and the psychological warfare between traders, BTC seems ready to break a symbolic and historic ceiling. The signs are there: a persistent bullish structure, affirmed technical signals, and above all, the striking return of a name that alone is enough to shift the market's lines. This is not just a simple rise; it is a potential shift in era for bitcoin.

At a summit in Washington on Bitcoin-related policies, Alex Gladstein, strategist for the Human Rights Foundation, made a shocking statement: "Bitcoin is bad for dictators." For him, it is a tool of resistance against authoritarian regimes. This stance resonates even more strongly as the United States, for their part, are quietly building their own strategic reserve in BTC.

Valeria Fedyakina, a 24-year-old Russian influencer known online as “Bitmama,” has been sentenced to 7 years in a prison colony after running a major crypto scam that stole over $21 million from investors. Russian prosecutors say some of the stolen funds were used to support Ukraine’s military, a claim that adds a geopolitical twist to this case.

Since Bitcoin established itself as a serious store of value in the eyes of companies, a new category of players has emerged: Bitcoin treasury companies. Presented as the pioneers of the finance of the future, they are now faced with a harsh reality. According to a chilling report from the venture capital fund Breed, the vast majority of them are on the verge of extinction, trapped in a spiral that is as predictable as it is fatal.