Ethereum’s Network Activity Soars as Stablecoin Volume Tops $6T, Price Holds Above $3,100

Ethereum has returned to levels above $3,100 after a shaky performance in November, but the headline price does not tell the full story. Activity on the network has picked up significantly, with capital flowing efficiently and stablecoin transactions surging, showing Ethereum’s growing role as a key hub for value transfer.

In Brief

- Daily stablecoin transfers on Ethereum have climbed past $85 billion, placing the network well ahead of other blockchains in real-world activity.

- In the fourth quarter alone, Ethereum handled nearly $6 trillion in stablecoin settlements, surpassing major traditional payment networks.

- Transaction costs have fallen to historically low levels, with median fees hovering near zero.

Ethereum Hits Record Activity

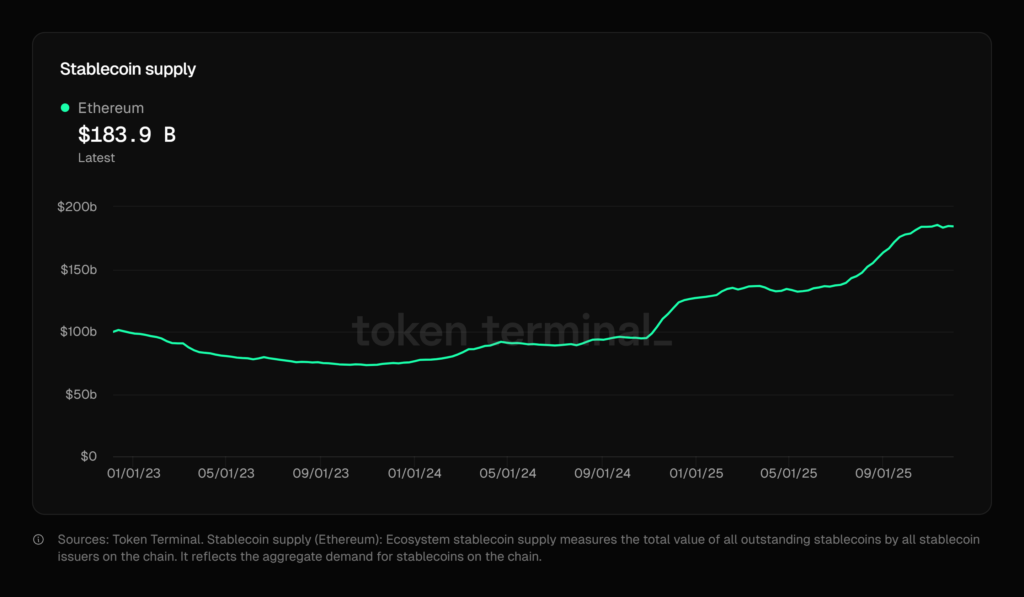

Data shared by Token Terminal on X highlights a clear rise in Ethereum’s real-world activity. According to the analytics platform, daily stablecoin transfer volume on the network has climbed beyond $85 billion, placing Ethereum far ahead of all other blockchains in the same dataset. The scale of this movement shows that the network continues to position itself as a central venue for digital value exchange.

Alongside the surge in activity, Token Terminal reported that the cost of using the network has fallen to historically low levels, with the median transaction fee near zero. Meanwhile, the total supply of stablecoins on Ethereum has grown to $183.9 billion. Liquidity and capital movement in low-risk decentralized finance, including lending and stablecoins, are now at record highs, while the delivery of Ethereum’s main development updates is also occurring at an unprecedented pace.

Adding to this context, a pseudonymous market watcher pointed out on X that Ethereum recorded $6 trillion in stablecoin volume in the fourth quarter, surpassing the transaction levels of major global payment networks such as Visa and Mastercard.

Ethereum Steady After November Drop

While on-chain activity remains strong, Ethereum is trading around $3,130, up more than 2% in the past 24 hours. This comes after a sharp drop in late November, with the asset finding support and beginning a gradual recovery. The rise has been steady rather than explosive, indicating that the market may still be searching for direction.

From a technical standpoint, the relative strength index sits close to 50.49, placing it firmly in the middle of the scale. This position signals neutral momentum, with no clear dominance from buyers or sellers. The RSI is also positioned slightly above its moving average, which often implies that momentum is beginning to lean upward, although the signal remains mild. Importantly, the indicator is not approaching the 70 or 30 zones, suggesting the market is not in an overheated or deeply oversold condition.

Long-Term Expectations Strengthen

Even with the market still moving cautiously, confidence in Ethereum’s long-term potential remains firm among prominent analysts. Tom Lee of Bitmine continues to take a bullish stance, stressing that Ethereum’s current price near $3,000 does not capture its underlying strength. He points to the asset’s eight-year average performance, which he believes supports a possible move toward $12,000. Lee also outlines higher-end projections that place potential future values at $22,000 and even $62,000 per coin, based on how Ethereum has historically behaved over extended periods.

Meanwhile, Ethereum is moving forward with stronger network performance following the activation of Fusaka. The upgrade brings improved scalability, lower fees, and a more seamless user experience, creating a firmer foundation that could help support further price growth as the network continues to operate efficiently.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Ifeoluwa specializes in Web3 writing and marketing, with over 5 years of experience creating insightful and strategic content. Beyond this, he trades crypto and is skilled at conducting technical, fundamental, and on-chain analyses.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.