PwC Report: Institutional Crypto Adoption Reaches Irreversible Stage

Year after year, crypto adoption is reaching new milestones. What seemed just yesterday like a speculative bet has become a structural transformation. Figures, behaviors, and regulations converge: there is no turning back. From multinationals to central banks, everyone is getting involved. PwC’s 2026 report puts precise words on this turning point: institutional adoption has crossed the “point of no return”.

En bref

- Institutions are adopting crypto for payments, treasury, and international settlements.

- Stablecoins are becoming trusted tools, integrated into traditional global finance.

- PwC asserts that this institutional adoption has passed a point of no return.

- Europe is imposing crypto regulation “by design,” combining innovation, transparency, and built-in compliance.

When Crypto Becomes the Hidden Infrastructure of Finance

For PwC, financial institutions like JPMorgan or Morgan Stanley no longer wonder if they should integrate crypto, but how to include it in their systems. The firm talks about a pivotal moment: “institutional involvement has crossed the point of no return.”

Stablecoins, long considered mere trading tools, now establish themselves as the backbone of payments, settlements, and treasury operations. Banks, funds, and payment companies already use stablecoins for internal transfers and cross-border payments. This discreet integration transforms the crypto-sphere into an essential infrastructure, invisible but omnipresent.

The PwC report emphasizes that these systems, once embedded in financial circuits, become impossible to unplug. This is the logic of functional lock-in: when crypto starts moving money, it cannot be withdrawn without jamming the machine. We are no longer talking about a phenomenon parallel to the financial system but about an invisible foundation of modern finance.

Stablecoins: Financial Trust at the Heart of Crypto Transformation

The debate on stablecoins has changed nature. It is no longer a question of whether they belong, but how quickly they will impose themselves. Jeremy Allaire, CEO of Circle, summarizes this shift: banks no longer question if they should use stablecoins, but how quickly they can deploy them. The 40% annual growth rate seems a reasonable baseline.

Stablecoins are no longer just hedging assets for crypto traders: they become business tools, used to pay suppliers, settle transactions, or balance sheets. Visa and Mastercard are already testing networks where stablecoins replace interbank transfers.

This transformation is not just economic: it touches trust. Companies see crypto regulation and proof of reserves as new guarantees. As Matt Blumenfeld, head of digital assets at PwC, points out:

Regulation is no longer a constraint; it now actively shapes markets and allows digital assets to become the architecture that offers them responsible growth. Regulatory momentum accelerates, as does the pace of institutional adoption.

Stablecoins have thus become trusted products, not marginal alternatives. They embody the convergence between technological innovation and institutional caution, two forces long seen as antagonistic.

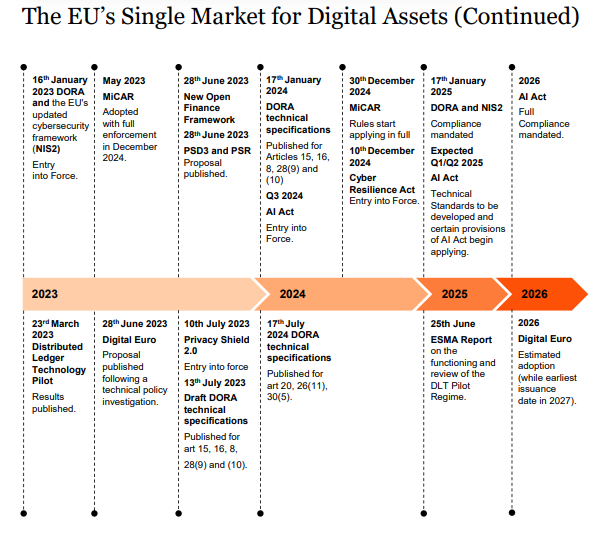

Europe Paves the Way for “By Design” Crypto Regulation

In 2026, Europe establishes itself as the global laboratory of crypto regulation. The PwC Global Crypto Regulation 2026 report describes a region moving from debate to implementation. The MiCA regulation comes into force, framing stablecoins and issuers with strict requirements on reserves, governance, and transparency.

According to Dr. Michael Huertas, partner at PwC Legal, the institutions that will come out ahead in 2026 are those that managed to embed compliance right from the design of their systems. In other words, those capable of embedding proof of reserves, operational resilience, and transparency directly into code, contracts, and control mechanisms.

A pragmatic, almost engineering vision where regulation is no longer imposed after the fact: it becomes a component of the financial design itself.

This approach, also adopted in the UK and Switzerland, enshrines the logic of compliance by design. Crypto regulation becomes a driver of adoption. It provides a framework of trust where institutions can innovate without fearing arbitrary legal decisions.

Europe is no longer a follower but a conductor, able to impose a model of global transparency. In practice, this rigor already attracts international players: banks, fintechs, and asset managers want to align their systems with the European standard.

Key Takeaways from the PwC 2026 Report

- Institutional adoption of cryptocurrencies is now structural and irreversible;

- Stablecoins become the new global payment rails;

- The annual growth rate of stablecoins approaches 40%;

- European crypto regulation (MiCA) enters its execution phase;

- Compliance by design becomes a lever for innovation and trust.

By 2030, the boundary between traditional and decentralized finance may disappear. Players like Chainlink already show the path towards full DeFi integration, where smart contracts and on-chain data will unify the global financial ecosystem. A transition underway, with no turning back.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.