Kalshi Overtakes Polymarket as Weekly Trading Volume Hits a Record $2.3 Billion

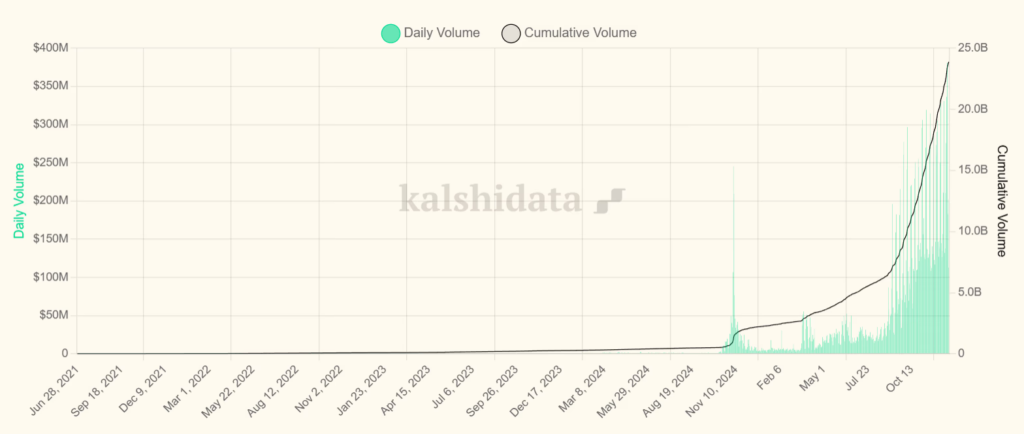

Kalshi saw a sharp rise in trading activity last week, pushing weekly volume to a new high. Data shows the prediction market processed more than $2 billion in trades, placing it well ahead of Polymarket over the same period. Increased demand for sports contracts and broader blockchain access supported the growth.

In brief

- Kalshi recorded $2.3B in weekly trading volume, nearly doubling Polymarket’s total and marking its first close above $2B.

- TRON network support for TRX and USDT deposits expanded access and helped attract higher short-term trading activity.

- Sports markets led platform activity, with Pro Football Champion contracts exceeding $65.8M in traded volume.

- September data shows Kalshi holding 62% of global prediction market volume after expanding into Solana, Base, and Robinhood.

TRON Integration Drives Surge in Trading Activity

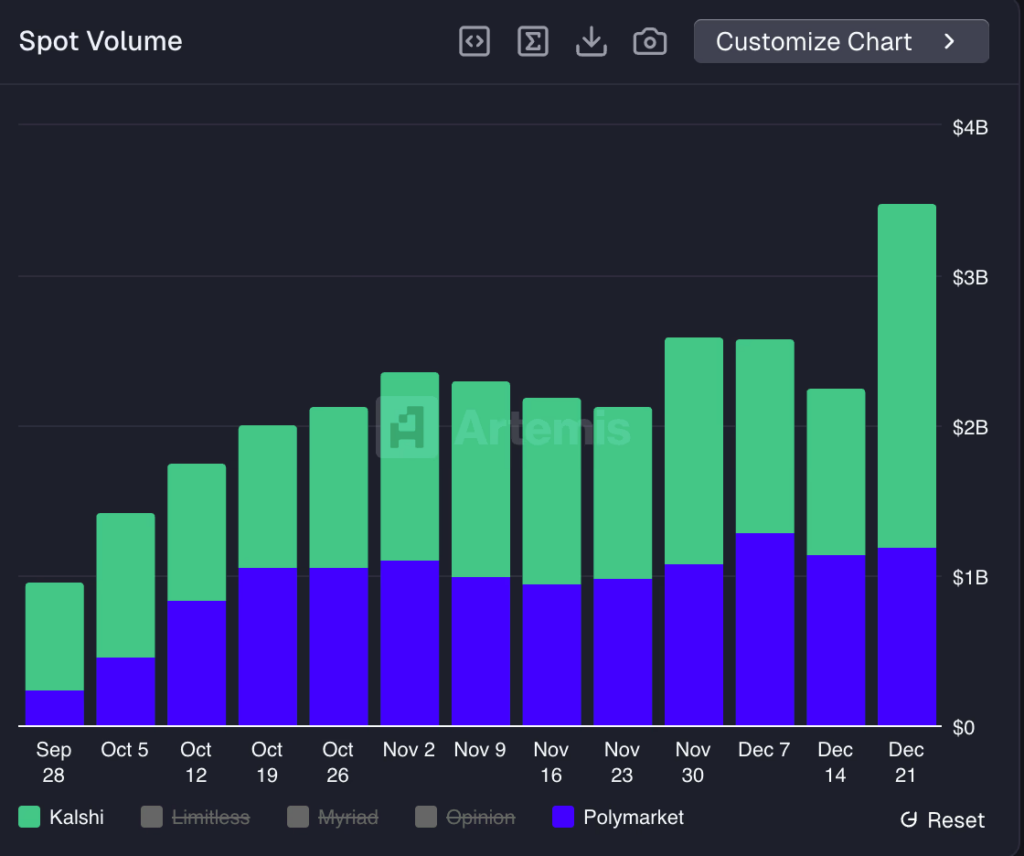

The platform recorded $2.3 billion in trading volume for the week ending Dec. 21, according to Artemis. That total was nearly double Polymarket’s $1.2 billion for the same week and marked Kalshi’s first weekly close above $2 billion. Adding to this performance, trading activity also increased across several market categories.

A key factor behind the increase in volume was Kalshi’s recent integration with the TRON network. Support for TRX and USDT deposits and withdrawals on TRON expanded access for traders seeking faster and lower-cost transactions. Additional payment options often contribute to short-term inflows from trading.

Kalshi’s performance over the past quarter reflects several platform developments:

- Weekly trading volume reached a record level above $2 billion.

- TRON integration added support for TRX and USDT transactions.

- Sports contracts accounted for the largest share of activity.

- Total platform volume surpassed $23.7 billion.

- Market share continued to increase relative to Polymarket since September.

Sports Trading Fuels Kalshi’s Market Share Gains Over Polymarket

Sports markets remain the platform’s largest category by a wide margin. Contracts linked to the next Pro Football Champion alone exceeded $65.8 million in trading volume as of press time. Earlier data showed Kalshi processing more than $1.1 billion in sports-related trades during a single week between Oct. 20 and Oct. 27, while political markets saw much lower activity.

During that same week, Polymarket reported $357 million in sports trading, reinforcing Kalshi’s lead in the category. Prediction markets attracted broader interest during the U.S. presidential election cycle last year, with Polymarket leading volumes for much of that period. The balance began shifting in September as Kalshi activity increased.

Blockchain-related expansions also supported growth. Earlier this month, Kalshi launched tokenized event contracts on Solana, giving traders access to crypto-based liquidity and additional privacy options. John Wang, Head of Crypto at Kalshi, said Solana access opens billions of dollars in liquidity through developer tools known as Kalshi Builder Codes.

Figures from September show the platform holding 62% of global prediction market activity, compared with Polymarket’s 37%. Expansion into platforms such as Robinhood, Solana, and Base supported growth across sports and esports markets. Recent data points to sustained user participation as prediction markets continue to broaden their reach.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.