Monero Holds Ground Despite Exchange Delistings and Continues to Expand

The cryptocurrency sector is constantly evolving under the influence of economic cycles and regulatory authorities. However, Monero (XMR) follows a distinct trajectory. Recent data confirms a lasting trend: the use of this privacy-centered asset has been growing since 2020 and continues to advance despite the usual market fluctuations. This growth has persisted even after its delisting from several exchanges, with some darknet actors turning more towards XMR.

In brief

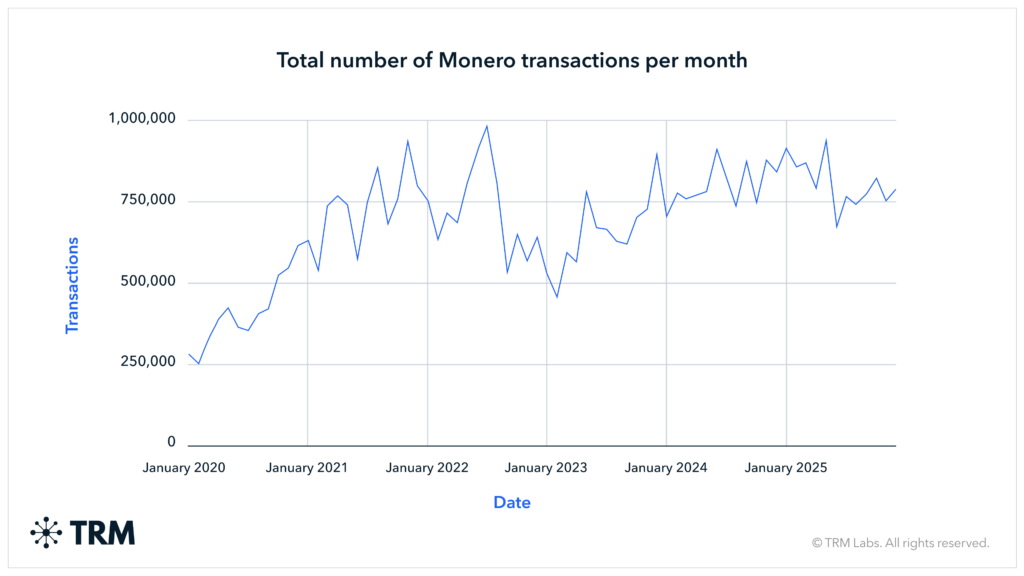

- Monero’s transaction activity has remained strong since 2020, with 2024–2025 volumes exceeding previous years.

- Despite being delisted from around 73 platforms in 2025, XMR usage remains robust, largely shifting outside traditional exchanges.

- Adoption is growing in high-regulation environments, where some darknet platforms now operate exclusively in XMR.

- Roughly 14–15% of nodes exhibit atypical behavior, a risk the “Fluorine Fermi” upgrade aims to mitigate by strengthening network security.

Stable and sustained transactional activity

According to an analysis by TRM Labs, transaction volumes recorded in 2024 and 2025 surpass those from the early 2020-2022 period. This growth brilliantly illustrates the current and essential value of the network. Tools for monitoring transparent blockchains are improving. In response, interest in opaque alternatives is increasing.

Activity on the Monero chain goes far beyond pure speculation. It stabilizes at a high level. Users carry out regular transactions. The network thus meets a concrete utility need rather than sporadic trading movements.

Resistance to exchange delistings

This persistent usage occurs in a complex context. Regulators perceive risks linked to anonymity. Data from the analysis indicate that many platforms limit access to XMR. Giants like Binance, Coinbase, or Kraken have stopped supporting it, and about 73 exchanges reportedly delisted Monero in 2025.

Liquidity leaves traditional infrastructures and now concentrates on offshore or less regulated venues, and token access becomes more complex. Yet, on-chain usage does not weaken. Current users specifically seek privacy. They accept frictions to make their transactions, according to TRM Labs.

Monero becomes the norm on the darknet

Adoption is also advancing in darknet markets (DNM). A structural evolution favors platforms exclusively denominated in XMR. This change primarily affects areas under intense regulatory pressure.

In 2025, nearly half of new darknet markets (48%) accepted only Monero, as the analysis indicates. This figure marks a notable increase. Actors in these networks react to bitcoin’s effective tracing. They now favor assets offering better identity protection.

Challenges related to network observation

While the fundamental cryptography of Monero remains unbroken, network observation reveals shadows. About 14 to 15% of accessible nodes exhibit “non-standard” behavior. These anomalies do not systematically prove malicious intent and may result from simple technical irregularities.

However, the concentration of these nodes worries experts. It seems some operators control a significant part of the infrastructure, potentially to capture information. This situation does not compromise data encryption but theoretically weakens anonymity.

Analyzing message propagation among these nodes, observers could eventually infer clues about user activity.

The “Fluorine Fermi” update strengthens defense

Facing this traffic analysis risk, Monero announced last October its new “Fluorine Fermi” update. It is a technical solution introducing a safer peer selection algorithm. The mechanism aims to block malicious or unreliable nodes.

The protocol thus strengthens its defense against “spy nodes.” These entities often try to link an IP address to a transaction. Developers describe this update as an essential barrier. It allows effective fight against blockchain surveillance attempts.

Trend analysis draws a clear path for the future of privacy-focused cryptocurrency. The network will likely continue to diverge from classic financial flows. Its use will focus on niches requiring strict privacy. The resilience of volumes, coupled with updates like Fluorine Fermi, suggests this asset will retain its unique role. Future success will depend on the code’s ability to maintain opacity against surveillance technologies.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Journaliste et rédacteur web passionné par l’univers des cryptomonnaies et des technologies Web3. J’y traite les dernières tendances et actualités afin de proposer un contenu de haute qualité à un large public du secteur.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.