Web3 aimed to give users control over their assets and identity. However, in reality, it has developed in a fragmented manner, with complex interfaces that are often inaccessible and sometimes insecure. Bitpanda aims to reverse this dynamic by proposing a new vision of Web3: a unified, intuitive ecosystem that is rigorously compliant with European standards. With its promise of "one wallet, one chain, one token," Bitpanda Web3 becomes the ideal gateway for investors seeking access to decentralized finance without sacrificing simplicity or security.

Exchange News

One can lose everything in crypto... even after death! Binance is offering to anticipate the irreversible with a "digital will." Should this be seen as an admission or progress?

While some stash their gold under the mattress, Binance piles up billions in bitcoin... and no need for a Swiss safe for crypto to keep shining!

The crypto exchange Bitget is transforming access to Web3 knowledge with unprecedented support for young people. All the details in this article!

Gemini takes a strategic step with the filing of an IPO project with the SEC. In an industry where every initiative from a historical player can reshape the market, the platform founded by the Winklevoss brothers aligns itself with traditional finance without renouncing its crypto roots. Against a backdrop of regulatory relaxation and renewed enthusiasm for cryptocurrencies, this decision is not merely a tactical move, as it lays the groundwork for a new balance between decentralized innovation and traditional stock market infrastructures.

Binance, one of the giants of crypto, reaches 275 million users, of which 80 million joined the platform in five months. This staggering growth highlights the continuous rise of cryptocurrencies in global finance. In a sector undergoing major transformation, Binance positions itself as a key player in this evolution. How can we explain such enthusiasm, and what challenges lie ahead for this essential platform?

In the ever-evolving world of cryptocurrencies, simply holding your assets is not always enough. With the rise in popularity of passive income solutions like staking, many crypto holders are looking for ways to make their holdings work for them. Kraken, a trusted name in the crypto industry, offers users the opportunity to earn up to 17% annual percentage yield (APR) through staking and restaking, all while maintaining full control over their assets. Whether you are new to staking or an experienced crypto investor, Kraken's platform is designed to cater to the needs of all types of users. Let’s explore how to get started and take advantage of these opportunities.

Robinhood is betting big on crypto with Bitstamp! 200 million, 50 licenses, institutional players, and a plan to regulate tokenized assets... The platform is scaling up. Discover why this acquisition could revolutionize global digital finance. Thought you knew it all? Wait until you read the rest.

The SEC turns the page on its standoff with Binance, bringing an end to a landmark proceeding of the Gensler era. By withdrawing its complaint against the exchange, its founder CZ, and Binance.US, the regulator sends a strong signal: the political gravity in Washington is shifting. This judicial withdrawal goes beyond mere legal considerations and illustrates a strategic repositioning, as the lines of crypto regulation in the United States are being redrawn under the Trump administration.

A crypto revolution is underway: Binance allows live trading through its social platform. Details in this article!

When Kraken gives wings to Wall Street: US stocks on the blockchain, without schedules or borders, while traditional finance counts its hours and intermediaries... Guaranteed suspense.

More than 69,000 Coinbase customers victims of an internal crypto attack. We provide you with all the details in this article!

In an ecosystem where judicial decisions influence both trajectories and technologies, a ruling made this week dampened the hopes of thousands of Bitcoin SV (BSV) investors. On Tuesday, May 21, the UK Court of Appeal partially dismissed a class action lawsuit against Binance and several other exchange platforms, bringing a halt, at least temporarily, to legal proceedings that have been under way for five years.

Binance is breaking records! A wallet that scoops up 95% of the crypto market, thanks to a mysterious Alpha. Coincidence or a new revolution? Suspense and tokens await!

Cybersecurity is no longer an abstract issue for players in the crypto space. At Coinbase, a recent leak of personal data has triggered a tangible risk: the risk of physical attacks. Michael Arrington, founder of TechCrunch, states that this breach "will lead to deaths." In an ecosystem where anonymity is often a guarantee of security, this incident raises a latent concern: that digital vulnerabilities may spill over into the real world.

Bribed agents, massive data leaks, exposed clients… The crypto exchange Coinbase in the middle of judicial turmoil. Details here!

Attacks against cryptocurrency exchanges, especially those targeting market-leading companies, have taken a worrying turn in recent years. Coinbase, one of the most popular exchanges in the crypto market, has just faced a major extortion attempt of 20 million dollars. This situation not only reveals the vulnerabilities of crypto platforms but also highlights how Coinbase has responded, thereby reinforcing its reputation for excellence in security. In an environment where data and fund protection is becoming paramount, security is now the number one criterion for cryptocurrency investors.

FTX reopens the floodgates with 5 billion to distribute. Crypto investors rejoice, but in the background, Sam Bankman-Fried is still scheming in the shadows. Guaranteed suspense in the crypto world!

Coinbase is about to potentially capture 9 billion dollars in passive purchases thanks to its entry into the S&P 500. A massive injection that could push the crypto market capitalization towards 8 trillion dollars. But behind this unprecedented institutional influx, a silent trap threatens the strategic freedom of the company...

While panic looms over small investors, the whales are resurfacing at Binance, depositing their digital gold, and patiently waiting for the storm to pass.

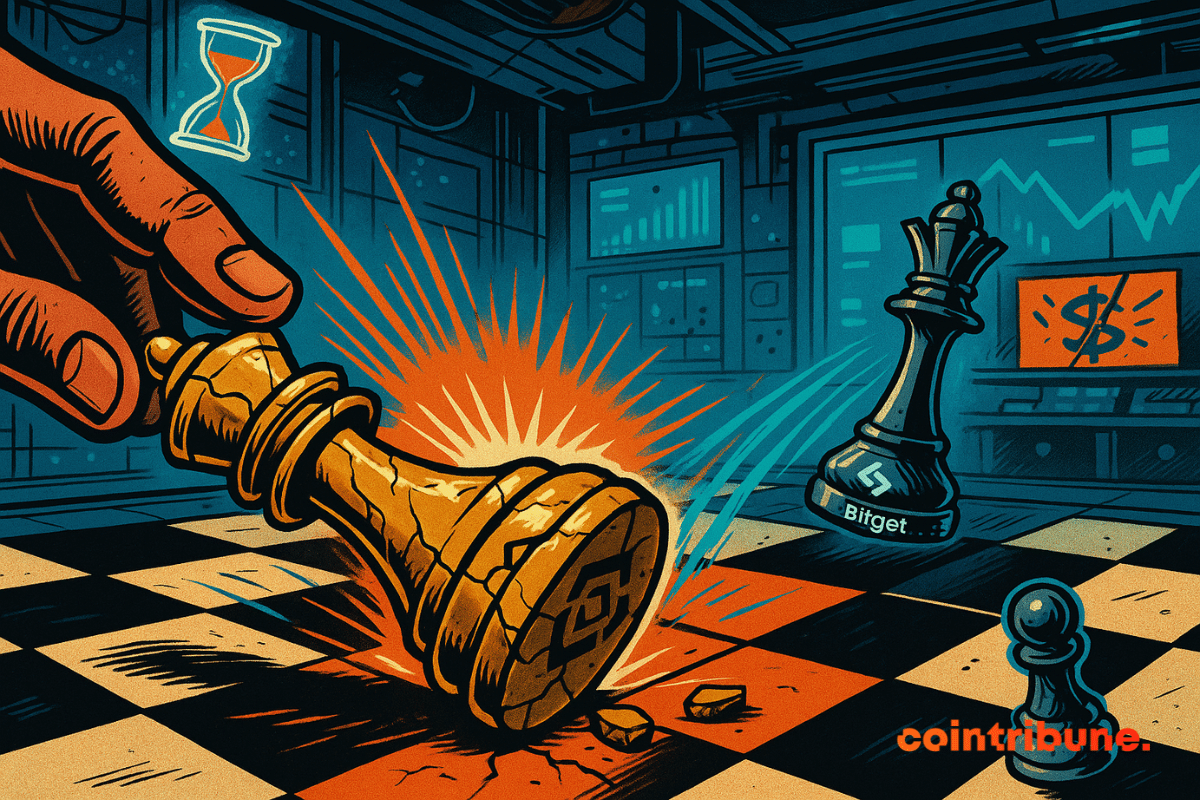

When a giant stumbles, the entire crypto ecosystem holds its breath. In April 2025, CoinGecko published an unfiltered snapshot of the centralized exchanges (CEX) market, revealing an unprecedented shift in the balance of power. While Binance remains at the top, its dominance is waning in the context of an accelerated reconfiguration of the players. The spectacular movements of Gate.io and Bitget, combined with a global contraction in volumes, raise questions about the future of the sector.

With the rapid advancements in quantum computing, the threat to traditional crypto systems is now an undeniable reality. The so-called "Q-Day"—the day when quantum computers become powerful enough to break current cryptographic systems—is no longer a distant possibility. For the crypto world, this moment represents an existential threat. How can we prepare for this looming danger? The answer: Naoris Protocol, a cutting-edge solution designed to secure blockchain and Web3 technologies against the post-quantum future.

While the crypto market regains its strength, a silent threat resurfaces. Binance, one of the main trading platforms, warns of the increase in scams related to fake tokens. Imitating legitimate projects, these scams are ensnaring more and more investors, sometimes seasoned ones. In a context of euphoria and a massive return of capital, this drift calls into question the security of exchanges.

As crypto platforms aim to reach wider audiences, marketing strategies are increasingly turning to sports and pop culture icons. A recent example is the new campaign launched by Bitget in partnership with LALIGA, featuring FC Barcelona’s winger Raphinha. The initiative reflects a growing trend: using mainstream ambassadors to bridge the…

As the standoff between Binance and the SEC shapes the regulatory future of crypto in the United States, both parties are seeking a new 60-day judicial stay. A strong signal, indicative of a possible strategic shift within the regulator, and a likely signing of an agreement between the two parties.

On April 7, 2025, the crypto exchange platform Bitget announced the launch of Bitget Onchain, a new feature integrated into its application. This aims to combine the characteristics of centralized exchanges (CEX) and decentralized exchanges (DEX), offering access to on-chain assets directly from a Bitget account.

Binance is giving away bitcoins, traders are balancing between euphoria and price headaches, and the CPI hovers like a sentence. The question remains who will suffer: the bulls or the bears.

"Kraken and Mastercard are teaming up to launch a crypto debit card in Europe and the UK. This announcement illustrates the willingness of industry giants to make cryptocurrencies a tangible payment tool, beyond speculation. In a market under regulatory pressure, this initiative embodies a new phase: that of usage and the real integration of cryptocurrencies into everyday life. It is a strong signal at a time when the industry is seeking tangible and compliant use cases."

Binance makes a significant move by announcing the removal of 14 tokens from its platform starting April 16. This unprecedented decision, guided by a community vote and enhanced quality criteria, marks a turning point in the giant exchange's strategy for selecting crypto projects.

Coinbase, a pioneer in crypto derivatives, is preparing to introduce XRP futures contracts. As regulation strengthens, the CFTC could pave the way for a new phase for XRP.