RWA: These Four Projects Capture 70% of Activity in 2026

In 2026, Real World Assets (RWA) transform finance by connecting physical assets and the blockchain. Hedera, Chainlink, Avalanche, and Stellar dominate this rapidly growing sector, attracting investors and businesses. Why are these projects skyrocketing in development rankings?

In brief

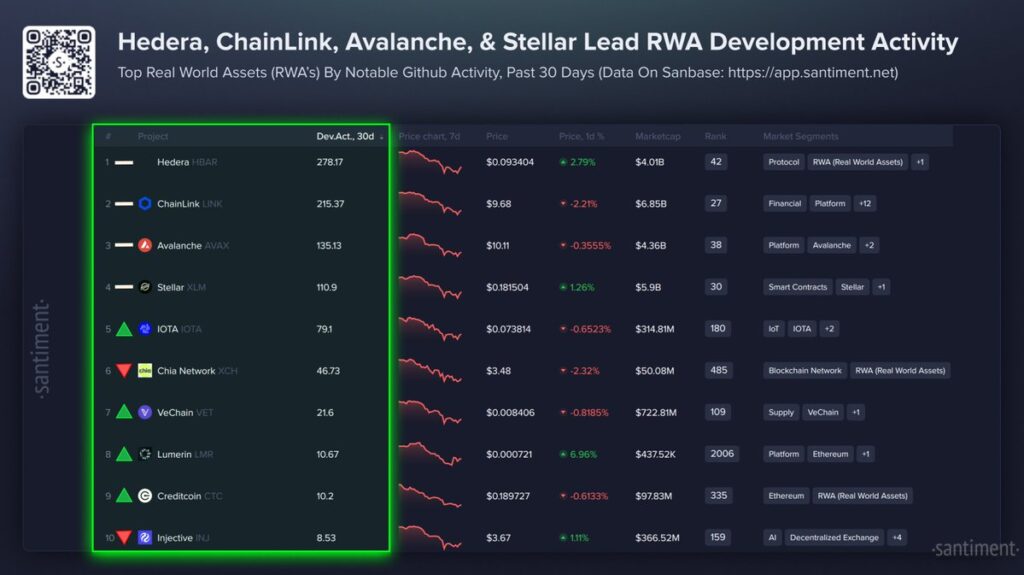

- Hedera, Chainlink, Avalanche, and Stellar dominate the RWA sector in 2026, with 70% of the activity.

- Their success relies on strategic partnerships, innovative technology, and growing adoption by institutions.

- These projects open opportunities for investors, especially in luxury, tech, and Asian markets.

RWA: Hedera, Chainlink, Avalanche, and Stellar Explode Activity in 2026

In 2026, the Real World Assets (RWA) landscape is clearly dominated by four projects: Hedera, Chainlink, Avalanche, and Stellar. According to Santiment’s data, these capture the majority of development activity, with impressive scores over the last 30 days! Hedera (HBAR) leads with 278.17 activity points, followed by Chainlink (LINK) with 215.37 points, Avalanche (AVAX) with 135.13 points, and Stellar (XLM) with 110.9 points.

This concentration shows that these projects are not only popular, but also the most active in terms of innovation and adoption. Hedera, for example, stands out with its enterprise-focused approach, while Chainlink remains essential for its decentralized oracle solutions. Avalanche and Stellar focus respectively on scalability and cross-border payments.

Why Do These 4 Projects Dominate the RWA Sector in 2026?

Several factors explain the domination of these four RWA projects in 2026. First, their ability to attract strategic partnerships plays a key role. Hedera, for example, benefits from support by companies like Google and IBM, which strengthens its credibility with institutions. Chainlink, meanwhile, has become an essential infrastructure for connecting RWAs to blockchains through its CCIP protocol.

Next, these projects have specialized in lucrative niches. Avalanche excels in asset tokenization thanks to its subnet technology, while Stellar focuses on low-cost international payments. Finally, their ongoing development activity, measured by indicators such as GitHub commits, proves their long-term commitment. This domination reveals that investors favor stable projects, especially in this context of economic volatility.

2026, the Year When RWAs Might Become Crypto’s New Treasures?

The year 2026 could mark a turning point for RWAs. With increasing institutional adoption and clearer regulation, these tokenized assets are on track to become a pillar of the crypto ecosystem. Projects like Hedera, Chainlink, Avalanche, and Stellar, already leaders, could see their influence extend even further.

RWAs offer a concrete solution to a major problem: cryptocurrency volatility. By anchoring real assets (real estate, bonds, commodities) on the blockchain, they attract traditional investors seeking to diversify their portfolios. Moreover, governments and regulators are beginning to recognize their potential, which could accelerate their integration into the global economy.

If this trend continues, 2026 could be the year RWAs move from promising niche status to industry standard. For investors, this means unprecedented opportunities, but also the need to choose projects carefully. However, what if the RWA market is actually worth very little?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.