Altcoins may be positioning for a rebound after months of subdued price performance. Market data indicates that many tokens are trading above key support levels established in October. Analysts say these signals could point to a renewed appetite for risk across the broader cryptocurrency market.

Altcoin Trader

They promised the moon, but XRP falls silently. Even robots are worried... What if the dreamed crypto became the forgotten anecdote of New Year's Eve?

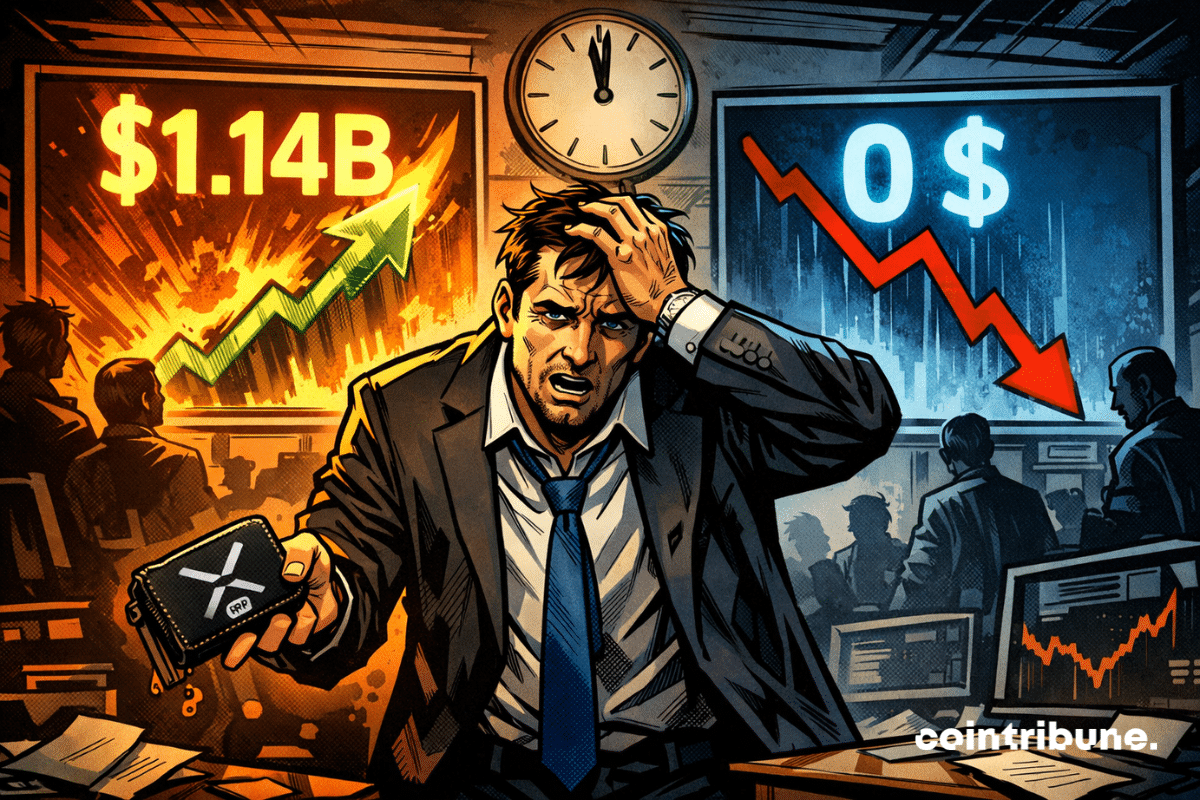

After siphoning off millions for a month, the XRP ETF coughs one day, stops... and everyone holds their breath: simple cold or crypto liver crisis?

In December 2024, memecoins were leading the trends. Their capitalization flirted with unprecedented highs. And then, in 2025... everything collapsed. Who would have thought that only one year would separate the spotlight from oblivion? Digital fortunes melted away. Beloved tokens disappeared. What could possibly have happened? Volatility, scams, saturation, or mutation? An analysis of a sharp turn in the ruthless world of the most bizarre cryptos. Nothing hinted at such a reversal for such a popular crypto market.

Ethereum is stagnating: whales are accumulating, ETFs are flowing, but the breakout is on strike… Behind the scenes, there is movement, but the chart breakout still boycotts the party.

CMC messes up, CZ takes a risk, Aster takes off... and the curious watch the screen. When an altcoin creates a rebound while the crypto universe collapses, should you believe it or flee?

It was said to be gone, buried, burned... But here comes Shiba Inu barking again! A crypto building in the shadows, while others play disposable stars.

Ripple parades with Mastercard and Nasdaq, raises 500 million… but XRP collapses. In the crypto world, golden speeches do not always prevent wallets from lightening.

A dog CEO, a playful tweet, a skyrocketing price: in the crypto jungle, Musk barks again... and traders rush in, noses to the wind and wallets open.

A hacker fails his attempt, CZ drops a tweet, and here is a stranger pocketing 2 million with a useless meme. It’s beautiful, modern crypto-poetry…

BNB touches the heights while the US government stalls. Record, Kazakh investors and low-cost transactions: Binance fears neither shutdown nor speculation. A crypto that doesn't fall asleep!

A memecoin that collapses, 30 million disappearing, an AI as an excuse... At the Trumps, crypto sometimes smells more like a cover-up operation than a smart contract.

When crypto goes up, he goes down. @qwatio, a relentless speculator, burns millions on XRP… and could well blow up at the next green candle. What are we waiting for to stop him?

James Wynn, the man who flirted with billions in crypto, now bets on ASTER… An airdrop, a 3x leverage, and a lot of boldness: hold-up or hara-kiri?

At Pump.fun, yesterday's chaos becomes today's eldorado: a memecoin inflated with billions, crazy promises, and regulators grimacing at the show.

When Galaxy spends 700 million on Solana, it’s no longer poker: it’s the smashing entry of a crypto altcoin into the gilded halls of traditional finance.

This Monday, the World Liberty Financial (WLFI) project, supported by the president and his close associates, proceeded with the unlocking of 24.6 billion tokens. An operation that values their stake at nearly 5 billion dollars. Presented as a technical launch, this initiative fuels suspicions about Trump’s growing influence in a sector he now helps shape.

While Ethereum is losing its whales, Cardano attracts them. But behind these mysterious comings and goings, the crypto ocean hides monsters and a barely concealed war of influence.

Ethereum wavers between past profits and the cold sweats of summer: an explosive cocktail mixing variable rates, rapid predictions, and a DeFi that grits its teeth.

While Bitcoin slumbers, the whales stir and Ethereum prances. The altcoin dance begins, with institutions as conductors... How long will the music last?

As Bitcoin gallops ahead, altcoins are sharpening their weapons in the shadows... What if the king soon fell from his throne? Guaranteed suspense in the crypto arena.

Shiba Inu is burning its tokens by the millions, traders are getting excited, the price is taking a nap: what if this crypto hasn't said its last word yet?

While Bitcoin puffs its chest at 65%, altcoins are playing hide and seek with their fans. Altseason expected? Yes… but only in the wet dreams of sleepless traders.

Ethereum is hovering around $2,400. Arthur Hayes is betting on a spectacular rebound and surpassing Solana by 2025. Discover why.

Bitcoin dominates, altcoins are struggling. With a dominance of 64%, the altseason seems increasingly out of reach, even though a few tokens are still trying their luck. The struggle is unequal.

Bitcoin is playing the star, but altcoins are sharpening their promises. Between wild memecoins, restrained regulators, and creative projects, 2025 could well offer a dance of outsiders.

As the market regains its senses, SHIB lights the fuse. Fewer tokens, more ambition: what if the burn melts resistance at $0.00001570?

Behind the overwhelming losses of SHIB wallets, the infrastructure still roars. Between discouragement and rumors of resurgence, the ecosystem slowly burns, ready to reignite the speculative flames.

Four consecutive red months for ETH. A slow, silent hemorrhage, where each absent transaction digs a little deeper into the grave of an asset in search of a second wind.

The crypto market under pressure: altcoins lose up to 50% in a few minutes. Discover the reasons for this brutal crash!

." class="img img--ratio w-auto h-auto" src="data:image/svg+xml,%3Csvg%20xmlns='http://www.w3.org/2000/svg'%20viewBox='0%200%200%200'%3E%3C/svg%3E" data-lazy-srcset="https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP.png 1200w, https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP-300x200.png 300w, https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP-1024x683.png 1024w, https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP-768x512.png 768w" data-lazy-sizes="(max-width: 300px) 100vw, 300px" data-lazy-src="https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP.png">

." class="img img--ratio w-auto h-auto" src="data:image/svg+xml,%3Csvg%20xmlns='http://www.w3.org/2000/svg'%20viewBox='0%200%200%200'%3E%3C/svg%3E" data-lazy-srcset="https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP.png 1200w, https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP-300x200.png 300w, https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP-1024x683.png 1024w, https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP-768x512.png 768w" data-lazy-sizes="(max-width: 300px) 100vw, 300px" data-lazy-src="https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP.png">