Bitcoin ETFs surpass 20 billion. One might have thought it was gold, but no, it's digital!

BlackRock

The crypto market is going through a turbulent period. Bitcoin is teetering below the $61,000 mark, sowing panic among individual investors. However, far from being intimidated, giants like BlackRock and Metaplanet are showing opportunism. Taking advantage of this decline, they are strengthening their positions and once again highlighting their confidence…

Bitcoin is increasingly establishing itself as an essential player. While individual investors were the first to jump into the crypto race, it is now large financial institutions that are turning massively to Bitcoin ETFs (exchange-traded funds). This major shift in market dynamics reveals much more than just a passing craze for cryptocurrencies. It marks a profound evolution in the way investors perceive and adopt these new asset classes.

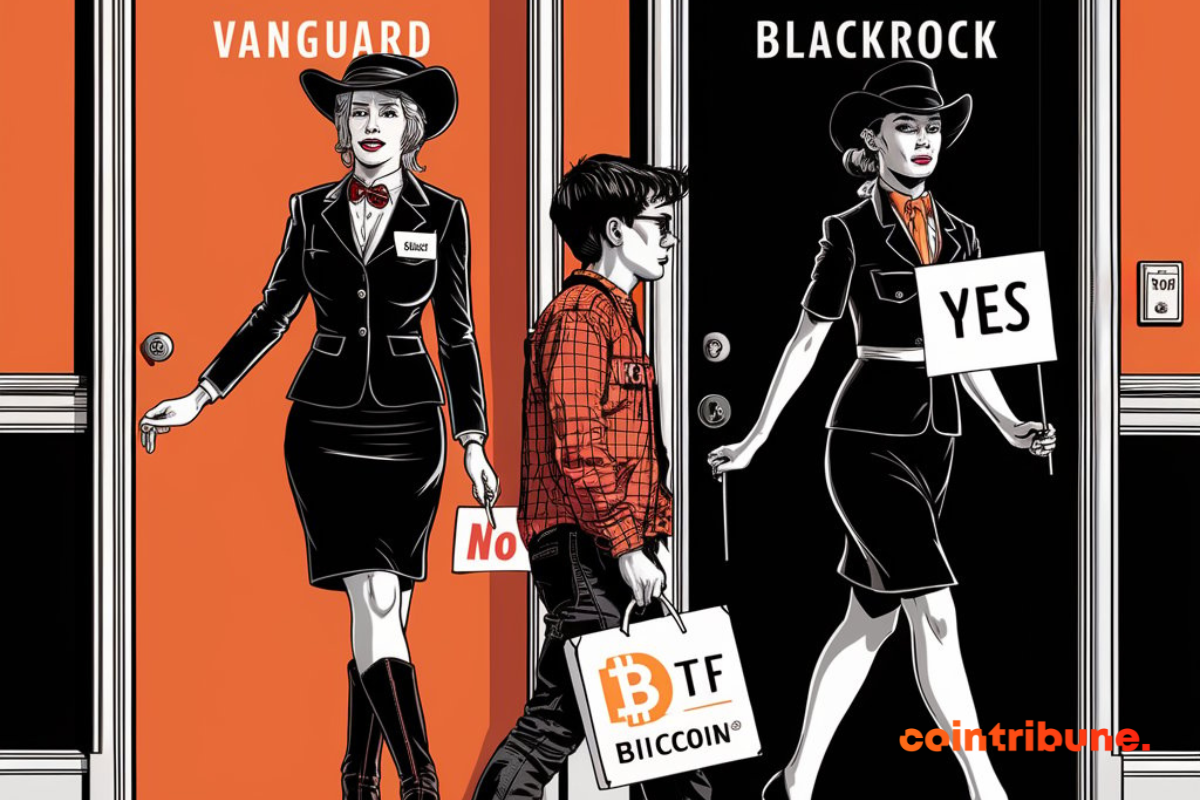

The crypto market continues to evolve at a steady pace, but certain asset classes are struggling to convince investors. This is particularly the case with Ethereum ETFs, which, despite their potential, have failed to capture the expected interest. BlackRock, one of the world’s largest asset managers, has expressed its disappointment…

The global financial landscape continues to transform at a dizzying pace. And Bitcoin, once seen as a risky bet, has gradually established itself as an asset of choice for large institutional investors. Among them, BlackRock, the largest asset manager in the world, marks a new milestone in the adoption of Bitcoin. With new strategic acquisitions, this company has seen its Bitcoin holdings reach nearly $24 billion, thereby confirming its key role in the evolution of the crypto ecosystem.

Last Wednesday, a massive new acquisition by BlackRock shook the bitcoin market, with an impressive purchase of 2,913 BTC, representing $184.3 million. This move comes in the context of a rebound in inflows to exchange-traded funds (ETFs) in the United States, an undeniable sign of growing interest in bitcoin. The…

Bitcoin is regaining altitude, and four factors make it very optimistic for the end of the year and next year.

In 2023, Tether, the issuer of the USDT stablecoin, surpassed the largest asset manager in the world, BlackRock, in terms of profits. What seemed improbable a few years ago is today a reality that raises questions. Indeed, this contrast between traditional finance and crypto illustrates a paradigm shift in the way investors perceive stability and profitability. While USDT dominates the stablecoin market, Tether has managed to leverage this momentum to achieve historic performance.

Approval by the SEC of trading options for BlackRock's Bitcoin ETF, a major breakthrough for cryptocurrencies.

BlackRock has published a laudatory report on bitcoin. The giant fund entertains the idea that it could become the international reserve currency.

With a market capitalization of 12 billion dollars, the RWA sector is leading a revolution in crypto finance. The details!

The recent market crash has not shaken the confidence of major institutional investors in Bitcoin. BlackRock, Fidelity, Grayscale, and MicroStrategy are holding their positions firmly, demonstrating a long-term vision of the potential of the leading cryptocurrency.

BlackRock surpasses Grayscale in assets under management for crypto ETFs! Marking a turning point in the digital asset industry.

Bitcoin ETF in crisis: BTCE fund liquidates its reserves as Bitcoin rebounds. Paradox or simple anomaly?

Vanguard on the crypto touch: "We do not copy BlackRock, nor their Bitcoin ETFs." There, it's said!

Bitcoin is collapsing, ETFs are following. Investors are desperately looking for signs of recovery in this financial turmoil.

Crisis or not, Ethereum ETFs continue to attract funds, highlighting the stability and long-term attractiveness of ether.

BlackRock, Fidelity, Grayscale, and MicroStrategy maintain their positions despite crypto market volatility!

Bitcoin, economic refuge, supported by influential figures and political promises to integrate it into national reserves.

Unleashed crypto! Ethereum and its L2 blockchains see their activity surge by 127%. A bright future for technology.

The price of Polygon (MATIC) soars 743% in 24 hours, fueled by the arrival of Ethereum ETFs and intense whale activity. Details!

The horizon is clearing after a disappointing second quarter. $100,000 still in sight.

The Bitcoin ETF market reaches $15.8 billion, highlighting the increasing importance of Bitcoin as a crypto flagship for investors.

Massive Capital Outflows: Are Investors About to Abandon ETFs?

BlackRock adopts Ethereum, paving the way for deeper integration of public blockchains into traditional markets.

Gary Gensler's comments have reignited hope for the imminent approval of Ethereum ETFs. More details in this article!

The Bitcoin ETFs thrive, attracting investors despite a volatile and ever-evolving crypto market!

The Bitcoin wallet of BlackRock reaches new heights with 291,563 BTC. More details are provided in this article!

BlackRock's Bitcoin ETF sees 50% growth! With indicators suggesting a sustained bullish trend for BTC.

BlackRock's Bitcoin ETF has just surpassed its competitor Grayscale by accumulating $20 billion in assets.