The so-called Ethereum Killer blockchains are stirring to nibble away market shares and gain media spotlight. But deep down, in reality as in collective perception, there is only one master. Its name comes up in every conference, every strategic plan, every institutional tweet. Ethereum is no longer just a technology…

Theme Non-Fungible Token (NFT)

End of the Web3 dream for Nike. The company quietly sold RTFKT, its NFT subsidiary. All the details in this article.

Once shining symbols of speculative euphoria, memecoins are going through a major crisis. Their market capitalization has collapsed from 100 to 35 billion dollars within twelve months, reflecting a radical shift in retail investors' appetite. Does this spectacular drop mark the end of an era for these controversial digital assets?

NFT markets closed the year on a weak footing, with prices and trading activity falling instead of posting a typical year-end rebound. December data pointed to declining participation, softer sales, and lower valuations across most collections, signaling continued strain as the sector moves into the new year.

Crypto transactions are becoming more common due to their borderless nature. And with the festive season here, some are looking to gift digital assets to their loved ones. For beginners, however, the whole process of sending these modern Christmas presents might feel a bit complex. This article explains the main ways to gift crypto and how various jurisdictions regulate such transactions.

The Christmas season often raises the same question each year: what gift will have lasting value? For people involved in crypto, interests extend far beyond standard tech gadgets. Crypto users form a global community focused on digital ownership, financial independence, and long-term participation in blockchain networks. And as such, selecting a crypto-related gift shows awareness of these priorities. This article presents practical, beginner-friendly crypto gift ideas suited to different interests while remaining useful long after the holidays.

The NFT market collapses in 2025: with only $320 million in sales in November and a free-falling capitalization down 66%, the crypto winter hits hard. Which collections resist? Why is Ethereum shaking? Complete analysis of the numbers and upcoming risks.

Strong market interest returned to TON, with the token climbing to $1.60 after an 8.33% daily rise. Growing activity across Telegram-linked applications, steady technical signals, and a packed month of ecosystem releases added fresh confidence to traders. Even while the broader market continues to struggle, TON stands out as one of the sharpest moves among major networks.

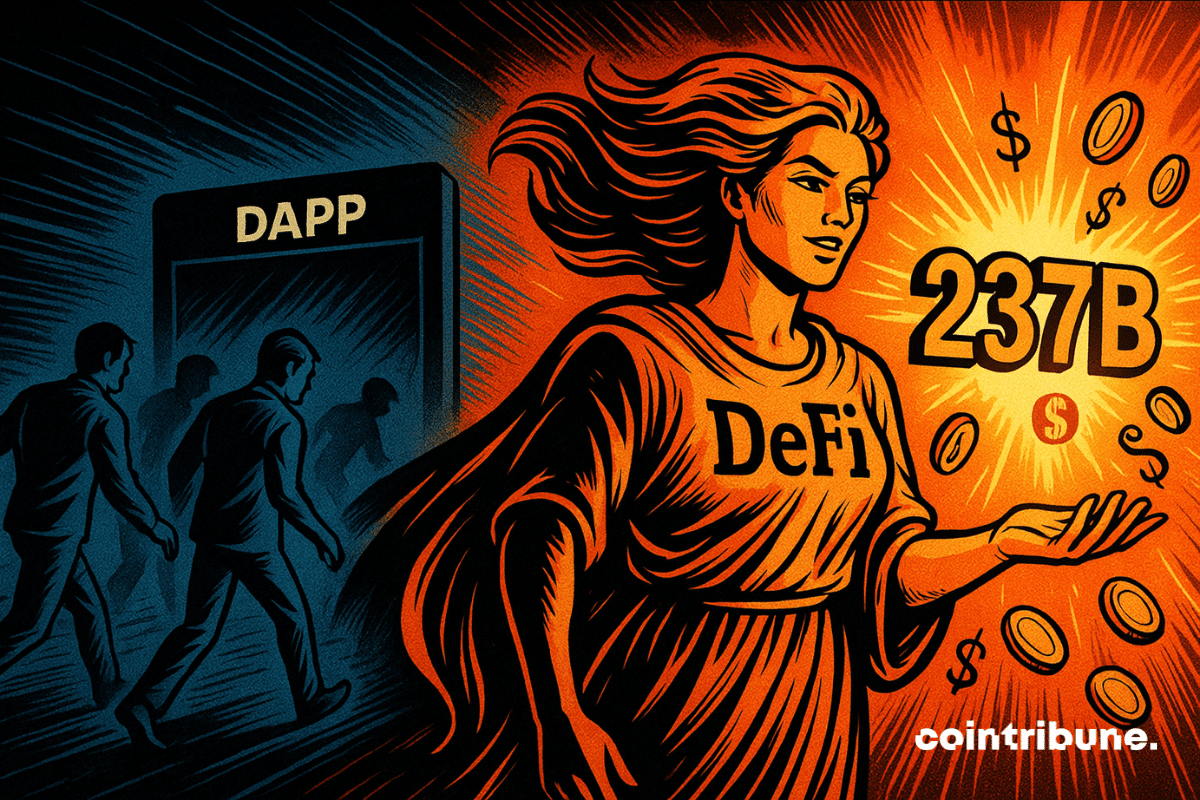

A site fades away, a token collapses: DappRadar takes its bow, leaving its DAO stranded and the crypto market searching for a new GPS for its scattered data.

The crypto universe seems to be restarting: NFTs on fire, memecoins going wild! Discover why the market is exploding.

Crypto venture capital activity continued its steady recovery in October, closing the month with $5.11 billion in reported deals. Investor confidence strengthened after a slower summer, and funding levels nearly matched the March 2025 peak of $5.79 billion. Early data suggests that October’s final total could rise further once all undisclosed rounds are reported.

OpenSea does not turn its back on NFTs. The platform is transforming into a universal hub to trade all onchain assets. With a record volume of 2.6 billion dollars and a $SEA token in preparation, this evolution could well redefine the future of the crypto market?

Switzerland’s gambling watchdog has filed a formal complaint against FIFA’s NFT platform, accusing it of operating as an unlicensed gambling service. The move signals growing regulatory pressure on digital collectibles and Web3 ventures as authorities grapple with how blockchain-based reward systems fit within traditional gambling laws.

The NFT market radically changed in 2025. Exorbitant fees (gas fees) and endless confirmation delays are a thing of the past. The sector is maturing: major brands are massively adopting NFTs for their digital collectibles, access tickets, and loyalty programs.

Crypto crash: NFTs lose $1.2B, then timidly recover. Are investors really coming back? Full breakdown.

Web3 loses its visionary stylist! Pagotto, the pope of NFT sneakers, takes his bow. And meanwhile, Nike is re-lacing its strategies... failing to revive its promises.

While dApps are looking gloomy, DeFi is gorging on billions. Decline in clicks, increase in liquidity... traders are deserting, but capital has never been so loyal.

In September, the Base network (Coinbase's Ethereum solution) made an unexpected breakthrough in the NFT universe. Fueled by the game DX Terminal, the ecosystem surpassed its rivals in number of sales. A sign that a mix of creativity, AI and fun can awaken a market generally losing momentum.

American Express is letting travellers collect NFT passport stamps to capture trips digitally and personalise memories securely.

OpenSea has quietly doubled its trading fees just days before launching its long-awaited SEA token. The platform will now charge 1% on NFT trades, up from 0.5%, marking a 100% increase. The adjustment, announced by Chief Marketing Officer Adam Hollander in a lengthy update on X, takes effect September 15.

OpenSea, the leading NFT marketplace, has launched a $1 million reserve to acquire and preserve culturally important digital art. The reserve began with the purchase of CryptoPunk #5273, marking a new chapter for the platform in showcasing NFTs as historical and artistic artifacts.

NFT sales dropped below $100 million in the first week of September, ending a two-month streak of strong summer performance.

Coinbase’s Layer-2 blockchain Base has taken a big leap in the NFT market, securing the third spot in global 30-day NFT trading volume.

The NFT sector lost more than $1.2 billion in market value within a week as Ether prices cooled. According to NFT Price Floor, the market capitalization of NFT collections fell 12%, dropping from $9.3 billion to $8.1 billion. The correction followed Ether’s decline of nearly 9% after recently reaching a high of about $4,700.

A new proposal in the New York State Assembly aims to impose a small tax on cryptocurrency sales and transfers. Assemblymember Phil Steck has introduced legislation seeking a 0.2% excise tax on digital asset transactions, including cryptocurrencies and non-fungible tokens (NFTs). The bill, if passed, could reshape the way the state approaches digital finance while channeling revenue into school-based substance abuse prevention programs.

They were thought buried under the dust of the bear market… NFTs re-emerge, stealing the spotlight from DeFi. A plot twist or the beginning of a new crypto empire?

The NFT market has just recorded its second-best month of the year, reaching $574 million in sales in July—a nearly unexpected rebound. While the number of buyers is declining, the average transaction value is rising, and Ethereum-based collections are surging. Is this just a temporary rebound—or the start of a more selective new cycle?

In July, the market capitalization of non-fungible tokens (NFTs) reached an unexpected peak of $6.6 billion, representing a spectacular surge of 94% compared to the previous month. This rebound is no coincidence. It is indeed driven by iconic figures of Web3 such as CryptoPunks, along with a new wave of speculative and cultural interest.

PENGU, the NFT of Pudgy Penguins on Solana, explodes after a record sweep of CryptoPunks. All the details in this article.

Ethereum NFTs saw $75M in weekly trading volume, marking a strong rebound as crypto market sentiment improves.