A small test transfer turned disastrous as a user sent nearly $50 million USDT to a scammer in an address poisoning attack.

Theme Scam

Caroline Ellison has left federal prison for community confinement after serving part of her sentence for her role in the FTX collapse, as legal proceedings and bankruptcy payouts continue.

Rodney Burton, aka "Bitcoin Rodney", now faces a series of federal charges in the United States. Former promoter of the HyperFund project, renamed HyperVerse, he is charged with wire fraud, money laundering, and illegal transmission of funds. According to the indictment, millions of dollars of investments were allegedly diverted. The case marks a new step in the crackdown on abuses related to the promotion of unregulated crypto projects.

Hollywood director Carl Rinsch defrauded Netflix of $11 million, spending on crypto and luxury items. He now faces multiple charges and a potential long prison term.

Pressure is mounting ahead of Do Kwon’s upcoming U.S. sentencing as a federal judge reviews how his convictions relate to open cases in South Korea and Montenegro. The court is seeking clarity before deciding how long the Terraform Labs co-founder will stay in U.S. custody and whether his time abroad should factor into the final sentence.

The Argentine parliament has just made a big move: in a damning report, it qualifies the promotion of the crypto $LIBRA by Javier Milei as an alleged scam, a scandal that cost investors 400 million dollars. Yet, his allies see it only as a political "buffoonery." Who is telling the truth?

Crypto on promo, X turns a blind eye, Spain pulls out the fine book. Musk aimed for the stars but ends up with his feet in regulatory mud. Cryptos cost.

A recent token purge by Binance founder Changpeng Zhao (CZ) has brought unwanted memecoin drops back into the spotlight. His public donation address once again attracted developers seeking attention, and their deposits were removed in a decisive move signaling a firmer stance.

Stablecoins are becoming the preferred cryptocurrency for illicit transactions, outpacing Bitcoin and drawing increasing scrutiny from regulators.

Balancer has just published its preliminary report on the attack that shook the DeFi protocol on November 3. A technical flaw in the V2 pools allowed hackers to siphon 128 million dollars across seven different blockchains. But the real bill is much higher: the total value locked (TVL) collapsed by 58% in just two days. How could a protocol audited eleven times fall victim to such a debacle?

With scammers growing more sophisticated, Binance outlines essential security measures to protect user accounts.

Crypto phishing explodes in 2025, even targeting official accounts like BNB Chain. Faced with this growing threat, SEAL deploys a solution: a transparent and tamper-proof reporting system. How could this innovation change the game for your digital assets?

A new report by blockchain analytics firm Chainalysis reveals that more than $75 billion in cryptocurrency linked to illicit activity could soon be within reach of law enforcement. The findings come as governments consider forming official crypto reserves, raising questions about how seized digital assets could fit into national financial strategies.

Crypto hack losses fell sharply in the third quarter of 2025, signaling progress in curbing large-scale exploits. Still, September offered a stark reminder of ongoing risks, logging a record number of million-dollar hacks. While attackers stole less overall, their tactics continued to evolve, with wallets and centralized platforms increasingly targeted over smart contracts.

BNB Chain has restored control of its official X account after a phishing attack briefly misled users with fake reward links. Although limited in scale, the breach is the latest reminder of the growing threat of scams targeting crypto communities. Losses were contained, but the event comes amid a broader rise in phishing-related thefts across the industry.

Online seduction, blind trust, and promises of quick profits: it only took a few months for a retiree from Colorado to see 1.4 million dollars disappear. But behind this individual tragedy lies a more worrying reality: the proliferation of scams in a crypto sector still too little regulated.

When cryptos become mirages, scammers become experts: 100 million stolen, 23 countries affected, 5 crooks arrested. And meanwhile, Bitcoin looks elsewhere, impassive.

X is taking legal action against banned accounts that tried to regain access through bribery and fraud, some of which are linked to the larger Com network under FBI scrutiny.

Popular names like the Lazarus Group often make headlines when it comes to crypto scams. But in an interesting twist, market participants were shocked to learn that digital asset fraud has crept into the sacred corridors of religion. A U.S. court has convicted a Denver pastor and his wife of running a fake cryptocurrency scheme following their indictment in July.

The spectacular fall of SafeMoon continues to cause ripples. After the conviction of its CEO for fraud, the FBI now opens its doors to victims to try to recover part of the lost funds. But is restitution in the crypto universe as complex as hoped?

Nearly two years after his conviction, the former CEO of FTX sees his crypto future replayed in a judicial appeal. The Second Circuit Court of Appeals has set the hearing for November 4, a key step in the crypto trial.

Malicious actors are at it again, this time targeting the account of a well-known software developer's node package manager (NPM). Investigations revealed that the hackers added malware to popular JavaScript libraries, primarily attacking crypto wallets. However, after launching what industry sleuths describe as the largest supply chain attack in crypto history, the hackers managed to steal only $50 worth of crypto assets.

A hijacked NPM account was at the center of a major supply-chain breach, putting the JavaScript ecosystem and crypto users at risk.

A BNB whale fell victim to a $13.5 million phishing attack on Venus Protocol. The platform paused operations, but the stolen funds were later recovered.

Rumors are circulating about the possible kidnapping of a CEO of a crypto platform that allegedly took place this morning in Le Bourget in the 93. A video is circulating showing the kidnapping live. For now, no official confirmation has been given by police services.

Onchain analytics platform Bubblemaps has published a detailed investigation suggesting that crypto figure Hayden Davis (also known as Kelsier) may have been behind a coordinated snipe of the newly launched $YZY token, allegedly generating $12 million in profits.

A Denver pastor and his wife have been indicted for allegedly running a $3.4 million cryptocurrency scam targeting their own faith community.

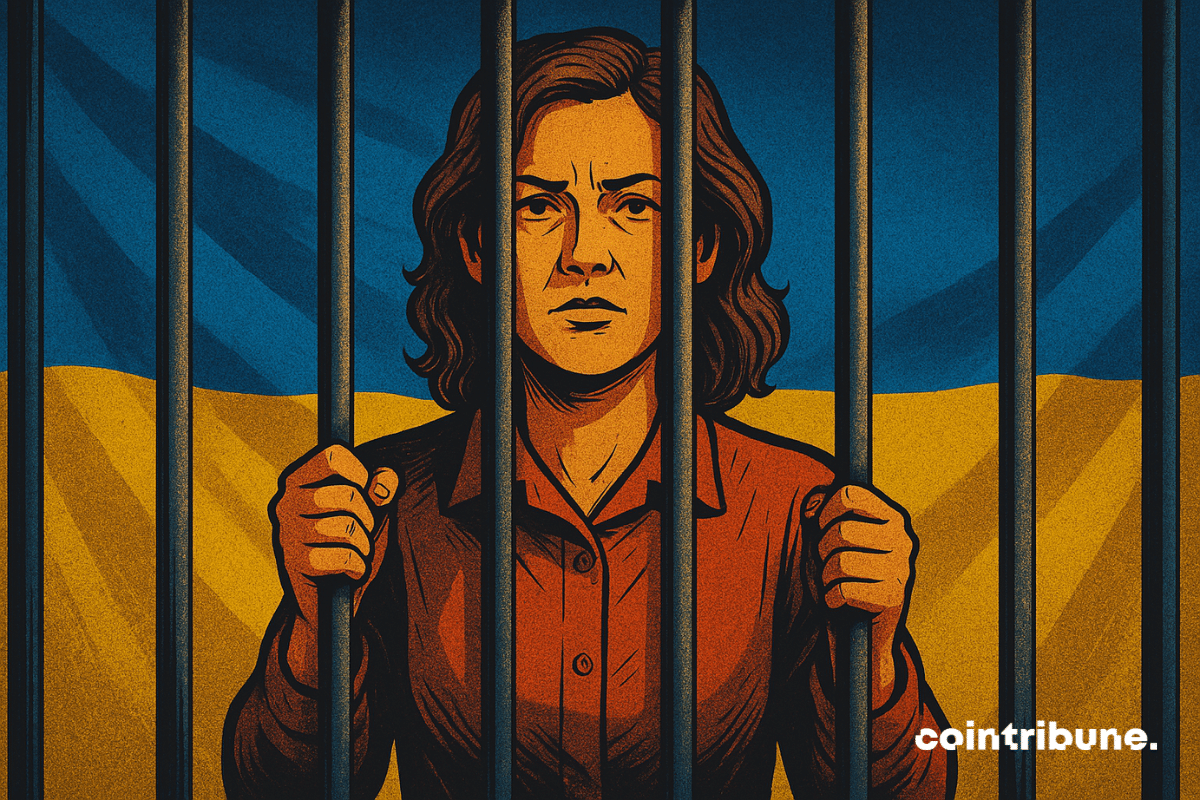

Valeria Fedyakina, a 24-year-old Russian influencer known online as “Bitmama,” has been sentenced to 7 years in a prison colony after running a major crypto scam that stole over $21 million from investors. Russian prosecutors say some of the stolen funds were used to support Ukraine’s military, a claim that adds a geopolitical twist to this case.

A coffee, an unfindable place, a disappearance: in Maisons-Alfort, crypto comes out of the virtual to end up in a bag, version grand banditisme 3.0.

New development in the crypto jungle: the police have apprehended another suspect, while the alleged leader, hiding in Morocco, awaits extradition... The noose is tightening.