Robinhood opens a new chapter in its history by launching its own layer 2 blockchain to offer tokenized stocks to European investors. This technological offensive places Europe at the center of its crypto strategy: allowing investors from the Old Continent to trade American stocks 24/7, without commission. An advancement that could well reshuffle the cards of traditional trading. Analysis.

Trading Exchange RSS

While Bitcoin and Ethereum are cautiously progressing in a calm market, it is Solana that is stealing the spotlight. In just one week, its price has soared by 16.5%, eclipsing the performances of the two historical pillars. This breakthrough is not trivial: it comes in the context of a return to fundamentals, where investors are once again scrutinizing technical signals and the robustness of projects. Solana, long relegated to the background, now seems to be repositioning itself as a serious contender for leadership in the next cycle.

The BNB Smart Chain is accelerating and scaling up. Since June 30, Binance's blockchain has been processing a block every 0.8 seconds thanks to the Maxwell update, a technical leap that brings it closer to the fastest standards in the industry. Behind this evolution is a clear objective: to remain competitive in the intensifying race for performance in DeFi. In an era where every millisecond counts, the BNB Smart Chain asserts its determination to dominate a Web3 where speed conditions adoption.

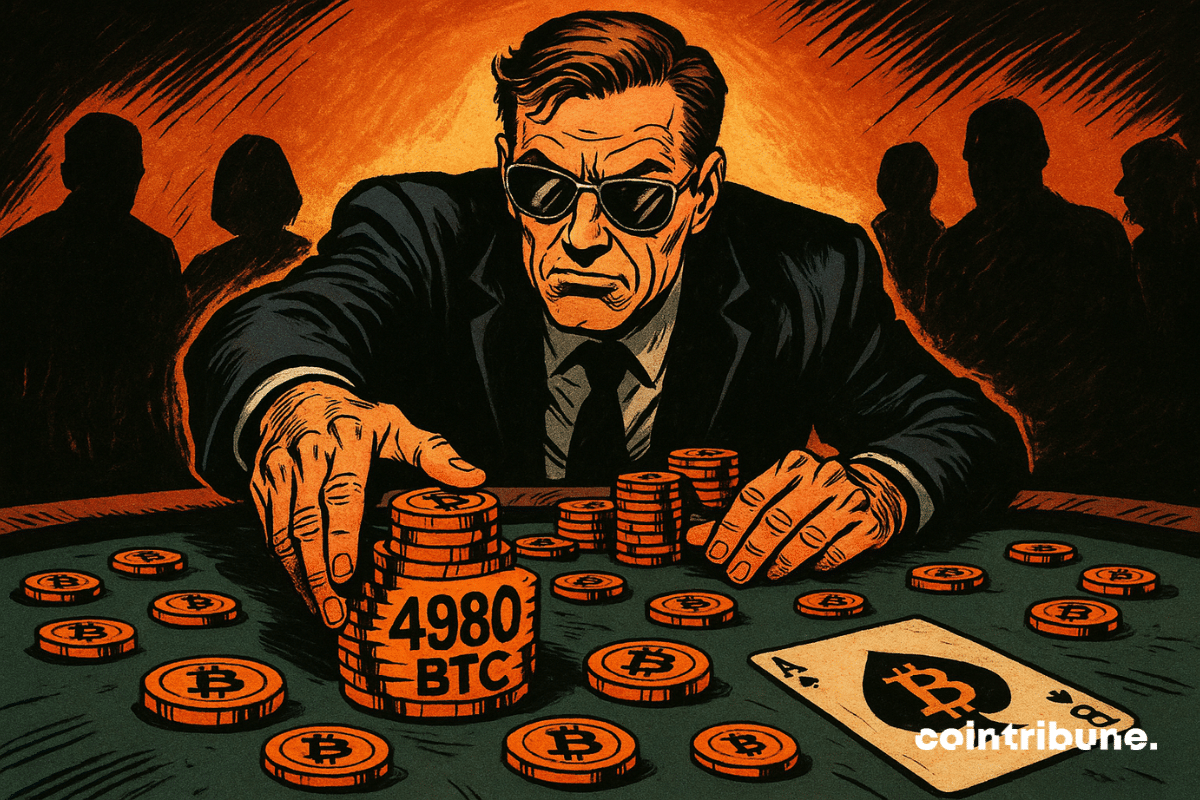

While the markets hesitate, Saylor is accumulating bitcoins by the thousands. Another 4,980 units? At this rate, it's the FED that will end up calling him.

Ultra inaugurates a new era of Web3 gaming with the launch of the closed community Alpha of EMPIRES, an economy-focused strategy game developed by its in-house studio, Black Ice Studios. Much more than just a game, EMPIRES serves as a foundational brick of the Ultra ecosystem, where players do not just play: they own, influence, and shape a multi-game universe.

As the second quarter comes to a close, Bitcoin may well be writing a new chapter in its history. The $109,000 mark is within reach, and the technical signals are converging. However, behind this bullish momentum, tensions are emerging: a demand deficit, liquidity games, and uncertainty about American interest rates. Could the June monthly close change everything?

The crypto market is taking a strategic turn. After a tumultuous June marked by geopolitical tensions and price volatility, July is emerging as an unprecedented window of opportunity. While Bitcoin remains firmly above $100,000, bullish signals are multiplying, supported by the return of institutional flows. In this climate full of expectations, five cryptocurrencies are emerging as must-haves to capture the momentum of the next bull run.

The era of plastic is coming to an end. As Visa and Mastercard struggle under the weight of opaque fees and archaic delays, a new form of infrastructure is quietly taking power. Stablecoins, long relegated to the realm of traders' tools, are now establishing themselves at the heart of the Web as the "default settlement layer." This is no longer a futuristic hypothesis: it is a reality that is grounded in numbers and usage.

When the rich drop the mask to take matters into their own hands, Elon Musk becomes the inspiration for a game where the powerful have fun... killing. And what if the series were no longer fiction?

On June 17, the U.S. Senate passed the GENIUS Act, short for Guiding and Establishing National Innovation for U.S. Stablecoins Act, by a 68-30 bipartisan vote. If passed by the House and signed by the President, the bill would introduce the first comprehensive federal framework for regulating stablecoins in the United States.

Iran’s largest crypto exchange, Nobitex, is cautiously restoring services after a $90 million cyberattack linked to geopolitical tensions. Wallet access and withdrawals are reopening gradually as security checks continue.

Metaplanet becomes the 5th largest holder of bitcoin with 13,350 BTC, surpassing Tesla. All the details in this article!

Michael Saylor has just confirmed his 11th consecutive week of Bitcoin acquisitions, an impressive streak that perfectly illustrates his relentless accumulation strategy. With 592,345 BTC in reserve, his company Strategy is becoming a true fortress of Bitcoin. But how far will he go?

And what if one of the largest silent bets on Bitcoin had finally been brought to light? A recent analysis by Arkham Intelligence reveals that Tesla and SpaceX together hold over $2 billion in BTC, including $1.5 billion in unrealized gains. Until now, only Tesla had communicated about its purchases. SpaceX, for its part, had never leaked any information. These revelations shed light on Elon Musk's crypto strategy, which is much more committed than it appears.

While the crypto market is losing steam and volumes are dwindling, an unexpected movement is stirring Shiba Inu. In the span of 24 hours, whales have ramped up their purchases at an unprecedented pace, triggering an accumulation of SHIB of over 200%. This surge, which has gone under the radar of the general public, rekindles speculation about a possible reversal. Behind this renewed activity from large holders, it might be a phase change that is unfolding for one of the most closely watched memecoins in the ecosystem.

Ethereum is being hoarded by large holders, like nuts before winter. Meanwhile, the small ones are fleeing, scared. What if the whales are preparing a feast?

The bitcoin market is holding its breath. As the flagship crypto flirts with 109,000 dollars, a level never before reached in weekly closing, the spotlight is on an electrifying weekend. At the intersection of technical analysis and the psychological warfare between traders, BTC seems ready to break a symbolic and historic ceiling. The signs are there: a persistent bullish structure, affirmed technical signals, and above all, the striking return of a name that alone is enough to shift the market's lines. This is not just a simple rise; it is a potential shift in era for bitcoin.

At a summit in Washington on Bitcoin-related policies, Alex Gladstein, strategist for the Human Rights Foundation, made a shocking statement: "Bitcoin is bad for dictators." For him, it is a tool of resistance against authoritarian regimes. This stance resonates even more strongly as the United States, for their part, are quietly building their own strategic reserve in BTC.

It's hard to believe, but Donald Trump is favorable to bitcoin becoming the international reserve currency par excellence.

A Solana ETF that stakes, analysts rejoicing, and the SEC saying nothing... Could REX Shares be trying to make crypto dance on the regulatory floor?

Valeria Fedyakina, a 24-year-old Russian influencer known online as “Bitmama,” has been sentenced to 7 years in a prison colony after running a major crypto scam that stole over $21 million from investors. Russian prosecutors say some of the stolen funds were used to support Ukraine’s military, a claim that adds a geopolitical twist to this case.

Since Bitcoin established itself as a serious store of value in the eyes of companies, a new category of players has emerged: Bitcoin treasury companies. Presented as the pioneers of the finance of the future, they are now faced with a harsh reality. According to a chilling report from the venture capital fund Breed, the vast majority of them are on the verge of extinction, trapped in a spiral that is as predictable as it is fatal.

Polkadot aimed to become the backbone of Web3. However, the latest figures reported by Messari for the first quarter of this year reveal a sharp decline: decreased activity, falling users, and dropping market capitalization. While other ecosystems consolidate their traction, Gavin Wood's project struggles to fulfill its promises. The contrast between the network's advanced technical architecture and its low adoption fuels doubts: can Polkadot still embody the decentralized future it claimed to want to build?

Crypto cards are now competing with traditional banks for everyday purchases in Europe. With nearly half of transactions under 12 dollars, these new payment tools are transforming consumer habits. A silent revolution that is redefining the future of European payments.

When a crypto company enters the S&P 500 and then joins TIME's list of the 100 most influential companies, it is no longer just recognition: it is a signal of a shift in era. By 2025, Coinbase is no longer just an exchange; it becomes a symbol of the normalization of Web3 within the circles of global economic power. Its rise marks a clear break between the utopian promises of the sector and its integration into traditional structures of influence.

President Trump has criticised debanking, echoing concerns from the crypto sector as the White House revisits executive action.

After more than four years of legal battle and a globally scrutinized decision, Ripple is ending its showdown with the SEC. The withdrawal of its appeal, along with the one expected from the regulator, seals the epilogue of a landmark dispute for the crypto industry. In an environment where every action by the authorities influences the market, this outcome permanently clarifies the legal status of XRP and redefines the regulatory framework in the United States.

On the occasion of Pi2Day, celebrated every June 28, Pi Network unveiled two strategic features: a no-code application creation tool powered by AI and a community staking mechanism to promote projects. This initiative marks a turning point towards a more accessible platform, governed by its users. By focusing on intelligent automation and the decentralization of referrals, Pi Network aims to redefine the rules of mobile-first Web3, at the intersection of technological innovation and community engagement.

Fewer movements, more silence: Bitcoin breathes. But behind the candlesticks, Trump is getting angry, Powell is trembling, and the dollar is melting... Is it enough to awaken a sleeping crypto queen?

Kalshi has raised $185 million in new funding, boosting its valuation to $2 billion as it plans to expand access to its prediction markets and grow its technology team.