Tether : The USDT Stablecoin Outperforms a Declining Crypto Market

Tether shows an impressive record in the fourth quarter of 2025. Moreover, the stablecoin issuer attracts more and more users every day. This success occurs during a complex period for digital assets where investors show a marked aversion to financial risk. Thus, the overall cryptocurrency market has lost 30% since October, and the total capitalization has undergone a real massive liquidation. However, the Tether USDT asset strongly resists this downward trend. Furthermore, the token supply continues to increase very steadily. Today, it positions itself as an essential and unavoidable global store of value.

In Brief

- USDT continues to grow rapidly despite a sharply contracting crypto market.

- Tether attracts millions of new users thanks to rising global adoption.

- The stablecoin’s reserves strengthen with diversification including Treasury bonds, Bitcoin, and gold.

- Parity stability remains a major issue amid increasing regulatory oversight.

The reasons behind the explosion in the number of USDT users

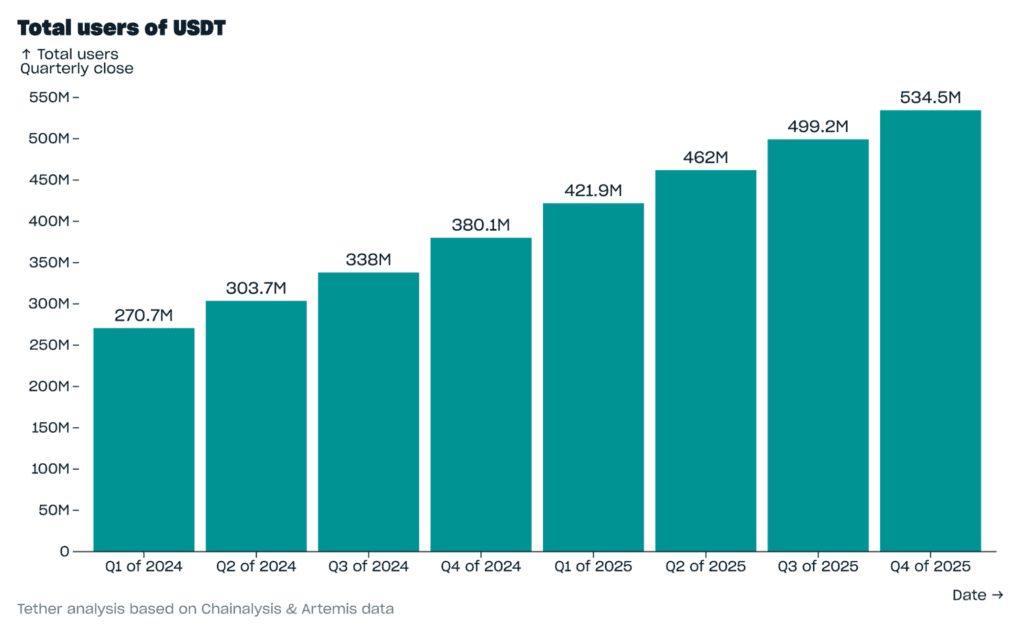

The latest financial report confirms this promising dynamic. Tether now counts 534.5 million users worldwide. The company attracted 35.2 million new people in the last quarter of 2025. This quarterly increase marks a true record for the company. This quarter becomes the eighth consecutive one above 30 million.

This calculation aggregates wallet holders on the blockchain. These users held their funds in USDT for at least 24 hours. The estimate also includes clients from centralized exchange platforms. This data blend complicates independent verification.

The asset’s market capitalization reaches 187.3 billion dollars. This impressive figure represents an exact jump of 12.4 billion. Some competing stablecoins have however declined in the same time. Tether explains this massive enthusiasm by concrete economic needs.

Individuals use USDT for daily savings. They favor payments and cross-border money transfers. Purely speculative operations have now taken a back seat. Data recorded on the blockchain strongly support these claims. Balances continuously increase among long-term investors.

Why does this stablecoin expansion matter so much?

Tether continuously consolidates its huge financial base. Reserve-related data shows ongoing expansion. The total collateral reaches 192.9 billion dollars. Moreover, the company holds 141.6 billion in US Treasury bonds. That is why this volume places it among the world’s most prominent holders, virtually rivaling the treasury of many countries.

Additionally, it also diversifies its collateral beyond basic cash. Notably, the company currently holds exactly 96,184 Bitcoins in its reserves. In addition, it also keeps 127.5 metric tons of gold in its vaults. Thus, this diversification strategy strengthens the overall solidity of the project.

A clear impact on liquidity and blockchain technology

Network activity records very exceptional historical highs. Thus, the number of on-chain holders reaches 139.1 million people. Moreover, monthly active users stand at 24.8 million. Consequently, issuance activity suggests sustained demand into early 2026.

Indeed, analytics platforms report massive creations in early February. For example, the Lookonchain account notes issuance of one billion dollars. Furthermore, the company and its rival Circle generated 3 billion. It is crucial to note that these stablecoins were produced in only three consecutive days. Thus, traders perceive these issuances as an inflow of liquidity. However, newly created tokens do not always circulate immediately.

Risks and concerns regarding USDT parity persist

Tether’s growing dominance thus attracts much greater scrutiny. Indeed, most trading volume passes through this stablecoin. Thus, this essential function positions the token as a true indispensable pillar of the market. Recently, attention has strongly focused on the system’s stability. The USDT price briefly dropped to 0.9980 dollar.

At this level, it represents its lowest point in five years. The price gap was small and very short-lived. However, a lasting loss of confidence would have serious consequences. Indeed, it would destroy the current commercial infrastructure of the entire crypto sector. All liquidity heavily depends on these currency pairs. Thus, this situation concentrates systemic importance in a single instrument.

In this context, Tether’s USDT evolution will depend on its ability to maintain long-lasting confidence in USDT. Moreover, if demand continues to increase, the stablecoin will reinforce its central role in digital payments and international transfers.

In conclusion, this rapid expansion implies increased responsibility to ensure rigorous reserve management and permanent token stability. The slightest flaw could trigger a major shockwave in a crypto market still very fragile and sensitive to tensions. Approaching 2026, the company will have to reconcile sustained growth, credible transparency, and increasingly strict regulatory requirements.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Journaliste et rédacteur web passionné par l’univers des cryptomonnaies et des technologies Web3. J’y traite les dernières tendances et actualités afin de proposer un contenu de haute qualité à un large public du secteur.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.