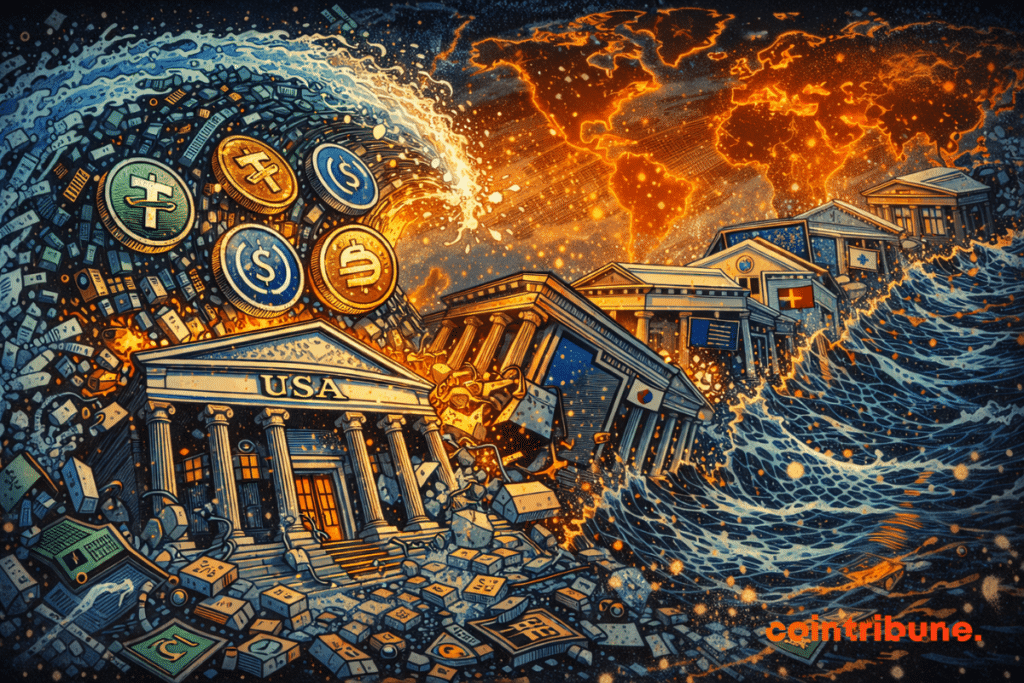

The adoption of stablecoins could drain US banks' vaults

Debates around stablecoins are picking up again, and tension is rising between bankers and crypto-sphere players. While some see it as an innovation capable of modernizing finance, others fear a ticking time bomb. Between alarming studies, ironic replies, and political deadlocks, the question becomes burning: do stablecoins represent a threat to banking stability or simply a new chapter in the crypto revolution?

In brief

- The Standard Chartered report predicts a massive outflow of bank deposits towards stablecoins.

- Regional US banks appear to be the most exposed to this capital movement.

- Regional US banks appear to be the most exposed to this capital movement.

- The growing demand for stablecoins mainly comes from emerging markets, far ahead of developed economies.

Stablecoins: the silent bank run worrying markets

On January 27, 2026, Standard Chartered released a report that caused a shockwave: stablecoins, these tokens backed by the dollar, could cause a massive outflow of US bank deposits. According to Geoff Kendrick, head of digital asset research, up to 500 billion dollars could leave bank accounts by 2028.

Regional US banks, like Huntington, Truist, or M&T, are the most vulnerable: their model relies on net interest margin (NIM), the engine of their profits. Fewer deposits, less margin, lower yield.

The problem worsens because Tether and Circle, the two main issuers, keep only a tiny share of their reserves in banks — 0.02% for Tether and 14.5% for Circle. In other words, funds leave the banking system without returning.

Kendrick does not mince words: for him, stablecoins are a real danger to traditional banks, a systemic risk that many still prefer to ignore.

So, it is no longer crypto bubbles that threaten traditional finance, but the very stability of its deposits.

Crypto regulation stalled: the CLARITY Act and the dollar shooting itself in the foot

At the heart of this silent crisis, a political duel opposes traditional finance to the crypto industry. The CLARITY Act, a bill regulating stablecoin issuers, is blocked in the US Congress.

It prohibits paying interest on stablecoins — a measure supported by large banks but rejected by Coinbase, which sees it as an attack on innovation.

Meanwhile, stablecoins multiply without a legal framework. They serve both as a refuge against crypto volatility and as an alternative to traditional bank payments.

But for Standard Chartered, this expansion fuels a lasting erosion of deposits and weakens regional banks.

Kendrick clearly points out: domestic demand for stablecoins dries up local bank deposits, while foreign demand does not. He specifies:

We estimate that about two thirds of the current demand for stablecoins comes from emerging markets, and one third from developed markets.

The paradox is clear: the tokenized dollar strengthens the dollar’s power worldwide but weakens its own institutions.

Key figures from the Standard Chartered report

- 500 billion $ of US bank deposits threatened by 2028;

- Global stablecoin market projected at 2,000 billion $;

- Bank reserves: Tether 0.02%, Circle 14.5%;

- Most exposed banks: Huntington, Truist, M&T, CFG;

- Adoption rising despite CLARITY Act blockage.

At the Davos Forum, Circle’s CEO, Jeremy Allaire, downplayed these fears, stating that fears surrounding stablecoins are “completely absurd“. According to him, these tools do not destroy finance: they transform it. But due to regulatory inaction, states risk letting the crypto market dictate the banking system’s stability.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.