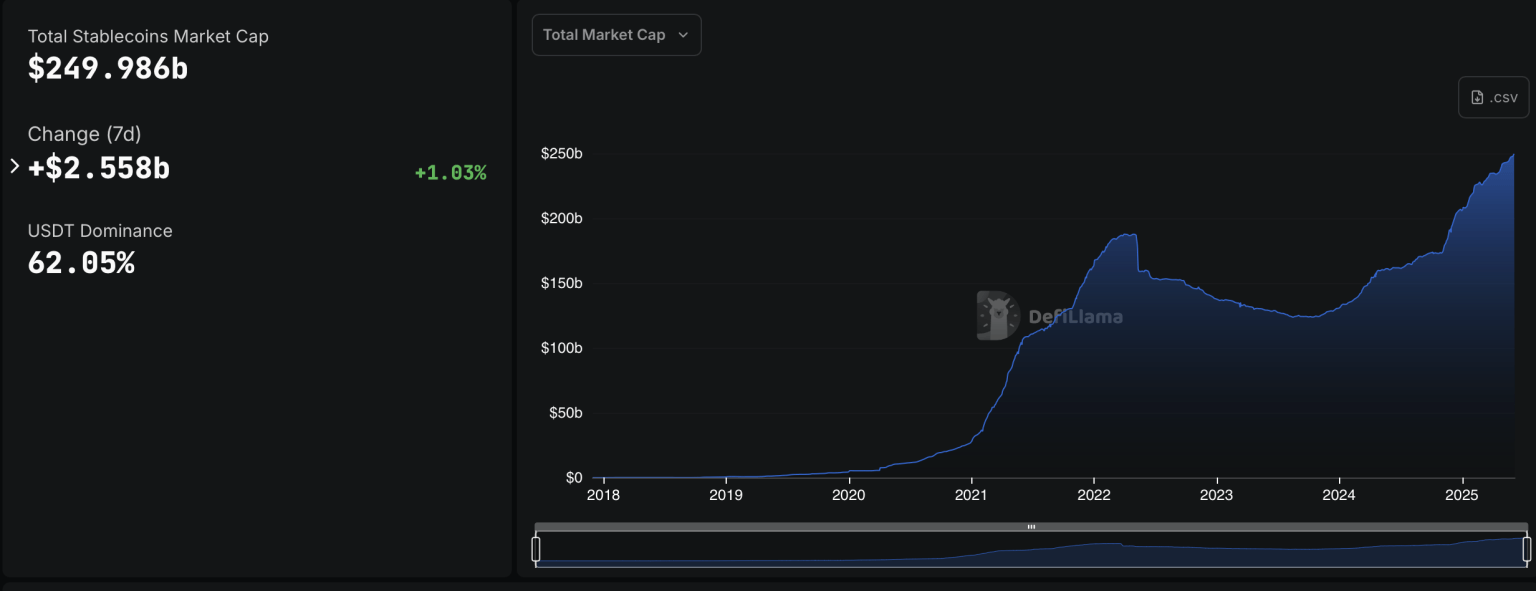

The Stablecoin Market Approaches $250 Billion After A Record Week

The crypto revolution is underway, but it doesn’t necessarily go through Bitcoin or Ethereum. It often starts with a more familiar option: stablecoins. Pegged to the dollar or other fiat currencies, these digital assets embody an ideal gateway to the blockchain economy. Less volatile, more accessible, stablecoins like USDT are now established as the beating heart of decentralized finance.

In brief

- USDT fueled 2.5 billion dollars of growth in the stablecoin market.

- Stablecoins are becoming an institutional gateway, used as native fuel for certain blockchains.

- Tether refuses any IPO despite a rumored valuation of 515 billion dollars.

USDT explodes: when liquidity fuels Tether’s yields

The Tether news: this week, USDT injected more than 1.45 billion dollars into the sector. This surge contributes to a total growth of 2.55 billion dollars for stablecoins. These figures are not trivial: they signal a new expansion of liquidity in the crypto markets.

USDT, issued by Tether, now plays a structuring role. By massively adding liquidity, it allows investors to act faster and with greater scope. Result: volatility is dampened, and arbitrage becomes more efficient.

The abundance of stablecoins also helps anchor DeFi yields. More USDT means more funds available for loans, liquidity pools, or staking strategies.

Tether thus fuels the oxygen of the crypto ecosystem. A record week for USDT can influence the dynamics of hundreds of platforms and players. This momentum also puts upward pressure on volumes and, indirectly, on prices of highly leveraged assets.

Stablecoins: the silent weapon of crypto adoption

The use of stablecoins is no longer the prerogative of traders. The Stable project, supported by Bitfinex, is a striking example. By using USDT as the native “gas” for its transactions, this layer 1 blockchain aims to attract institutions.

In this context, USDT becomes the engine of a complete infrastructure. No need for ETH or SOL to pay fees: the stablecoin does it all. And that changes the game. This design targets a “no fee P2P” logic, better suited for professional uses.

Simply put, USDT becomes the real blockchain’s currency. That of hospitals, land registries, or cross-border payment systems. Fewer intermediaries, less friction.

And this transformation is just beginning. Because if entire blockchains start integrating stablecoins into their DNA, institutional crypto adoption will experience a resurgence. A silent but structuring breath.

The crypto future of Tether: at the top without IPO

While Tether’s valuation has been mentioned at 515 billion dollars, its CEO Paolo Ardoino calls it “a bit low.” He candidly adds:

There is no plan for an initial public offering.

Tether is not chasing public visibility. Rather, it bets on its ability to generate massive revenues from its gold and Bitcoin reserves. The choice is clear: stay flexible, away from the constraints of public markets.

A few numbers that give you vertigo:

- Over 90 billion USDT in circulation, liquidity unparalleled in crypto;

- Bitcoin reserves exceeding 75,000 BTC, a strategic treasure;

- Gold exposure close to 4 billion dollars, prudent diversification;

- Net yield exceeding 6.2 billion dollars over one quarter, according to Tether Transparency;

- Zero major incident since 2021, according to public audit data.

This atypical positioning makes Tether a unique entity in the crypto sphere. Halfway between an informal central bank and an ultra-profitable unicorn, the company is redefining the rules of the game.

Tether’s performance continues to take your breath away. Recently, the company’s capitalization crossed the 150 billion dollars mark. A meteoric rise that gives USDT an almost hegemonic status in the crypto world. Far from media spotlight, Tether is building piece by piece the infrastructure of a new global financial system.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.