Tokenization explodes on Avalanche while AVAX price declines

Institutions are betting big on Avalanche to tokenize their assets. The network records a spectacular growth of 950% in one year, driven by BlackRock and other financial giants. Yet the AVAX token continues to collapse. How to explain this paradox?

In brief

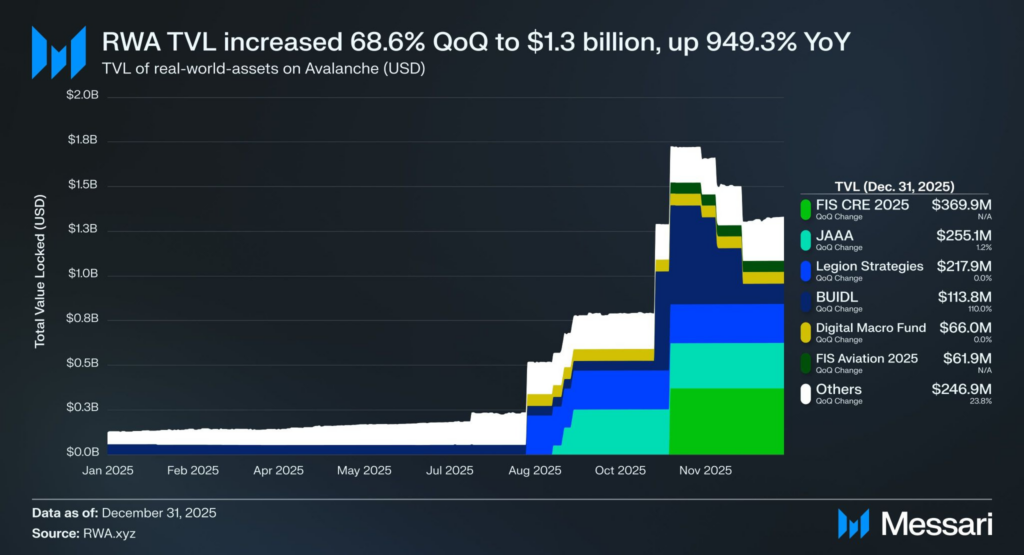

- Avalanche records a 68.6% growth of its tokenized assets in Q4 2025, reaching 1.3 billion dollars.

- BlackRock’s BUIDL fund, valued at 500 million dollars, joined the blockchain last November.

- The AVAX token drops 59% in Q4 and lost another 10.5% since January 2026.

BlackRock and financial giants bet on Avalanche

Avalanche is experiencing a remarkable institutional boom. According to Messari, the value of tokenized real-world assets on this blockchain jumps 68.6% in Q4 2025. Over one year, the explosion reaches 950%. November marks a turning point with the arrival of BlackRock’s BUIDL fund, injecting 500 million dollars into the ecosystem.

Traditional giants are rushing in. FIS, a Fortune 500 fintech company, partners with Intain to launch tokenized loans on Avalanche. This platform now allows 2,000 American banks to securitize over 6 billion dollars of receivables.

Meanwhile, S&P Dow Jones collaborates with Dinari to create an index tracking 35 crypto stocks and 15 digital tokens.

This massive adoption is explained by a favorable regulatory context. The SEC has adopted a more open stance towards crypto products over the past year. Financial institutions are coming out of their reserves and testing tokenization without fear of sanctions. Avalanche benefits from this window of opportunity thanks to its fast and interoperable technology.

A thriving DeFi ecosystem despite AVAX’s collapse

Paradoxically, this massive institutional adoption does not benefit the AVAX token. The crypto lost 59% of its value in Q4 2025, ending around 12.30 dollars.

Early 2026, it continues its plunge with a further 10.5% drop, now trading near 11 dollars. A gulf separates AVAX from bitcoin and Ethereum, both of which have reached new all-time highs during this cycle.

Yet, the activity on the blockchain explodes. The value locked in native decentralized finance rose 34.5% in the last quarter, reaching 97.5 million AVAX. Average daily transactions jumped 63% to 2.1 million, a sign of real and growing network usage.

Regarding stablecoins, the capitalization on Avalanche’s main chain remained stable at 1.741 billion dollars. Tether’s USDT took the lead from Circle’s USDC, now representing 42.3% of the total supply with 736.6 million dollars in circulation at the end of 2025.

Avalanche illustrates a profound transformation of decentralized finance. Institutions bet on the infrastructure while retail investors abandon the token. This dichotomy may reveal the true nature of tokenization: a revolution of financial rails that does not necessarily guarantee the appreciation of native assets. The year 2026 will tell if this institutional adoption will eventually be reflected in the AVAX price.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.