USDCx: Circle plays the discretion card to attract large companies

Circle, the issuer of the famous USDC, takes a decisive step with USDCx, a stablecoin designed to offer companies and institutions the privacy of a traditional bank. Developed in partnership with Aleo, this project answers a burning question: how to leverage the power of blockchain without publicly exposing financial flows?

In brief

- Circle develops USDCx, a confidential version of USDC intended for banks and companies.

- This stablecoin hides transaction details while allowing Circle to provide a ledger to authorities if necessary.

- The project is part of a broader movement: Citigroup, JPMorgan, and Bank of America are also testing stablecoins.

Circle unveils USDCx, a new stablecoin focused on privacy

Circle, the issuer of the famous USDC, partners with Aleo to create USDCx. This new stablecoin promises institutions what they have demanded for years: discretion.

Howard Wu, co-founder of Aleo, confirms that the project specifically targets banks and large companies. The challenge? Finally enable financial giants to use blockchain without exposing their business strategies to public view.

Unlike classic stablecoins, where every transaction is publicly displayed on the blockchain, USDCx works differently. Wallet addresses and amounts remain hidden.

A revolution for companies worried that their competitors might spy on their financial flows. However, Circle retains the ability to provide a full ledger should regulators or law enforcement request it.

Aleo has long emphasized this message: “transparency becomes a handicap when it comes to sensitive payment data.”

The company is not alone in this space. Taurus, a specialist in digital asset infrastructures, has already developed a system of private smart contracts. The goal? Encourage companies to use stablecoins for internal payments and employee payroll.

This race for privacy addresses a major obstacle. Large institutions refuse to adopt systems where their competitors can analyze every fund movement. USDCx could lift this barrier and open the gates to institutional adoption.

America discovers stablecoins, Wall Street wakes up

The timing of Circle is no accident. The GENIUS Act has just created a clear regulatory framework for stablecoins indexed to the US dollar.

This law has triggered a real rush for digital gold. Citigroup has teamed up with Coinbase to test payments in stablecoins. JPMorgan and Bank of America are also exploring these technologies in utmost discretion.

Even Western Union, the century-old money transfer giant, is shifting to the crypto era. The company is building a settlement system on Solana and is preparing its own stablecoin. The US dollar dominates this rapidly growing market.

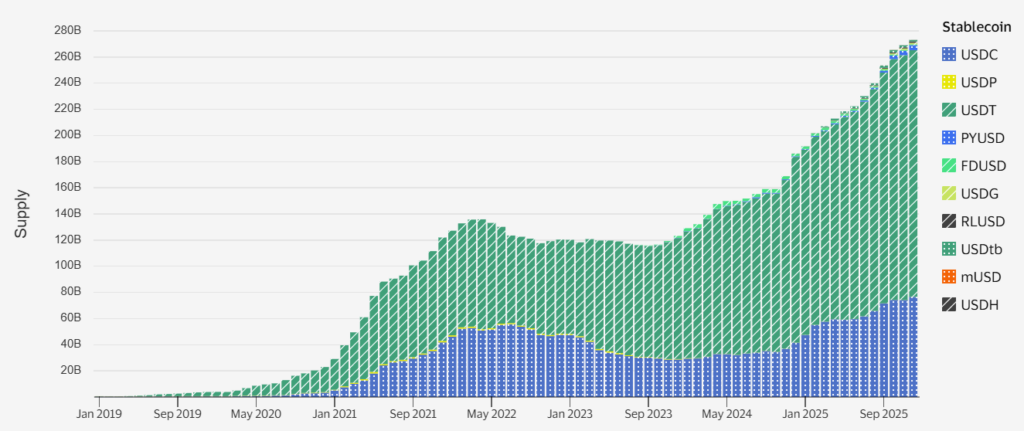

Circle’s USDC and Tether’s USDT together represent 85% of global stablecoin transactions. Other players like PayPal with its PYUSD are also trying their luck.

Visa, for its part, is expanding its offer in response to this growing competition. The numbers speak for themselves: the stablecoin market is exploding, driven by institutional demand that did not exist two years ago. The GENIUS Act has changed the game by providing companies with the legal security they were waiting for.

Circle is making a bold bet with USDCx. By combining the advantages of blockchain with traditional banking privacy, the company could trigger the massive adoption the entire ecosystem is waiting for. Financial institutions finally seem ready to make the leap. It remains to be seen if this level of privacy will be enough to convince the last skeptics on Wall Street.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.