3.3 Billion Invested In Crypto ETFs In One Week

Investors are turning away from traditional markets. In one week, $3.3 billion flowed into crypto ETPs, revealing a new rush towards digital assets. With $10.8 billion captured in 2025, these products are breaking records. Why this sudden enthusiasm? Discover the reasons behind this strategic shift.

In brief

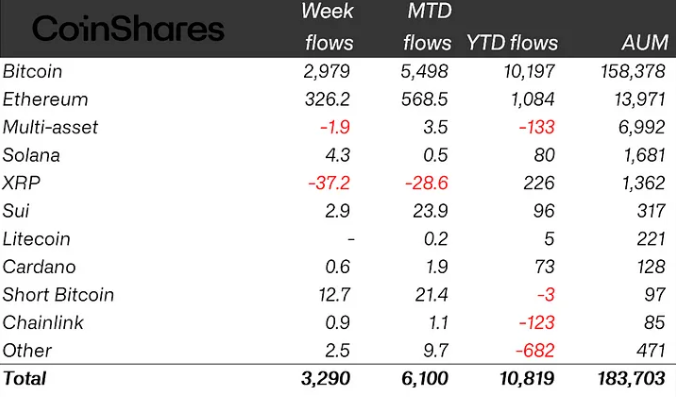

- $3.3 billion was invested in one week in crypto ETPs, bringing the annual total to $10.8 billion.

- Bitcoin dominates with $2.9 billion inflows, while Ethereum regains momentum and XRP suffers outflows.

- This massive flow reflects a loss of confidence in traditional finance, exacerbated by American economic tensions.

An unprecedented wave of money floods crypto ETPs and breaks all historical records

In the first quarter of 2025, investment products related to cryptocurrencies recorded massive capital outflows, totaling $7.2 billion since February. This downward trend raised concerns about the stability of crypto ETPs. However, a spectacular reversal recently occurred, with a weekly inflow of $3.3 billion, bringing the total annual inflows to $10.8 billion.

This massive flow has pushed assets under management to $187.5 billion, a record level since the creation of these products. An impressive momentum suggesting a renewed confidence by investors in crypto assets, despite economic turbulence and uncertainties in traditional markets.

Bitcoin breaks records, Ethereum rebounds, XRP plunges: the big gap among cryptocurrencies

Unsurprisingly, Bitcoin leads the dance with $2.9 billion in weekly inflows, capturing nearly a quarter of this year’s flows alone. Ethereum, often sidelined, makes a notable comeback with a fifth consecutive week of gains, totaling $326 million.

In contrast, XRP disappoints. Products linked to this asset face $37.2 million in outflows, ending an impressive 80-week streak of uninterrupted inflows. This reversal reflects a shift in investor perception, sensitive to regulatory signals and unmet promises from the crypto project.

Cracks in the American economy push capital towards safe-haven crypto ETPs

This $3.3 billion influx in one week into crypto ETPs is not without cause. It takes place in an uncertain economic climate:

- Downgrade of the U.S. sovereign credit rating by Moody’s;

- Rising bond yields;

- Tensions in the credit market.

All these signals shake confidence in the traditional pillars of finance.

Faced with these shocks, digital assets appear as a dam against the storm. Capital flows in, not merely due to technological appeal, but because the need for protection becomes urgent. The crypto ETP is no longer an exotic product reserved for pioneers: it becomes a serious option in the wealth management arsenal.

Crypto ETPs attract billions, a sign of a strategic shift in response to the instability of traditional markets. This massive flow reflects a profound mutation in the relationship to trust. Let us only hope that this momentum will last, because in February 2025, investors left crypto ETPs after 19 weeks of inflows.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.