19 billion liquidations in 24h: Here are the details of a historic crypto crash

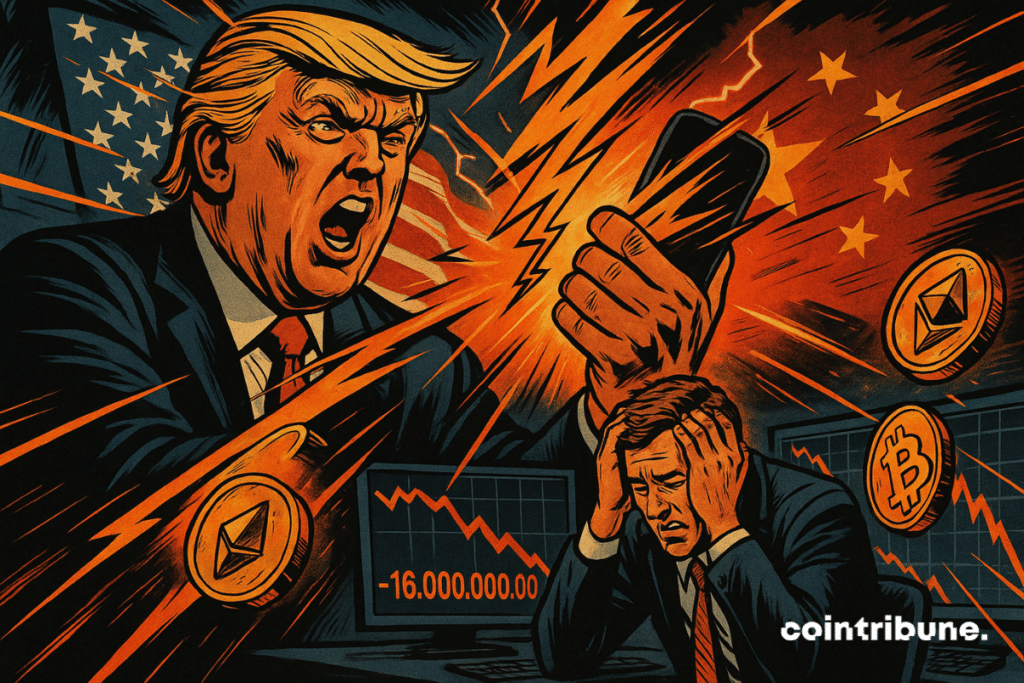

Donald Trump just pulled out his favorite weapon: taxes. Barely announced, his threat of 100% tariffs on Chinese imports causes a shockwave across all finance. The traditional market wavers, but it is in crypto that the shockwave is the most intense. In less than a day, nearly 19 billion dollars in positions are liquidated. This Black Friday in crypto history reminds us that volatility can arise at any time.

In brief

- Trump announces 100% tariffs, causing an earthquake on global financial markets.

- Crypto loses 19 billion in 24 hours, a historic record since the sector’s inception.

- More than 1.6 million traders liquidated, with a majority of heavily exposed long positions.

- The USDe stablecoin plunges, signaling systemic stress on crypto market derivatives.

Donald Trump reignites the trade war and plunges markets again

On October 10, 2025, Donald Trump, to whom a golden statue stands in Washington, unleashes a fiery message on Truth Social. He promises to impose 100% tariffs on all Chinese products starting November 1. The declaration reignites trade tensions and triggers a global chain reaction. Wall Street plummets, indices collapse, and investors panic.

Following this, all risk markets waver. The S&P loses ground, the Nasdaq retreats, tech stocks come under pressure. But the most spectacular reaction is in the crypto universe: the bitcoin price drops from $125,000 to $113,000, Ethereum loses over 12% in a few hours. The CoinDesk 20 Index drops 12.1%. The overall crypto market capitalization falls to 3.87 trillion dollars.

The partial US government shutdown worsens the scenario: many macroeconomic indicators are delayed, leaving markets without benchmarks. In this void, decisions become emotional. Panic spreads. And the crypto universe, never isolated, endures the storm.

The crypto carnage: 19 billion vanished, widespread panic

The crypto world had never seen such a tidal wave. In 24 hours, 1,618,240 traders are liquidated. 19.13 billion dollars in positions disappear, according to CoinGlass. Among them, 16.7 billion in longs, indicating many were betting on a rise. This turnaround exceeds the scale of FTX or Covid liquidations, multiplied by ten.

Even stablecoins feel the wind shift: USDe (Ethena), normally pegged to $1, briefly slips to 0.9996. A strong sign of stress in the derivatives market. HTX, on its side, records an individual liquidation of $87.53 million on the BTC/USDT pair. And on Hyperliquid, a whale shorts BTC/ETH for an estimated gain of 190 million dollars.

For some analysts, this shock is a warning. Perpetual products, very popular in crypto, played a multiplier role. Leverage amplifies movements. Several observers now mention a risk of contagion to other asset classes.

Strategies and lessons: reacting to the debacle

When the tidal wave hits, reacting is a matter of calm. Many were surprised. But others anticipated. Panic drowns out rational reflexes.

Here are 5 key figures to remember from this black Friday for crypto:

- 1,618,240 accounts liquidated;

- 19.13 billion dollars volatilized;

- 16.7 billion long positions liquidated;

- BTC drops to 102,000 dollars intraday;

- 190 million $ estimated gain on Hyperliquid.

This disaster reminds us of two bitter truths. First: in the crypto market, leverage without caution is a double-edged sword. Second: politics, macroeconomics, and the trade war are now integrated into the crypto matrix. No trader is isolated.

Reactions are pouring in: some analysts talk about deep corrections; others want to seize good picks. But all agree: resilience will be key. For the most seasoned, this tornado can be an opportunity — for the reckless, a fatal fall.

The dizzying descent was brutal. Yet some players persist in believing in the rebound. Arthur Hayes himself now states that the crash is no longer possible for bitcoin. A bold stance in a market still in shock. What if this chaos was not the end, but the prelude to a new, stronger cycle?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.