Solana Holds Around $192 as Fidelity and Gemini Drive Institutional Growth

Solana (SOL) hovered near $191.95 on October 25 after briefly testing $195 earlier in the day. The token has shown resilience amid shifting market momentum, with traders watching to see if it can turn the $192–$195 range into a new support zone.

In brief

- Solana trades around $192 after testing $195, with analysts watching $188–$195 as the next support zone.

- Fidelity adds Solana to its brokerage platform, boosting institutional exposure to the blockchain asset.

- Gemini launches a Solana credit card with up to 4% SOL rewards and new auto-staking features for users.

- A breakout above $195 could target $200+, while losing $188 support risks a pullback toward $183.

Solana Strengthens Institutional Reach as Analysts Highlight $188 Support Zone

During the week, Solana experienced a mix of technical and fundamental developments that continued to shape sentiment around its native token. Market analysts highlighted key support levels, while institutional exposure expanded through new offerings from Fidelity and Gemini.

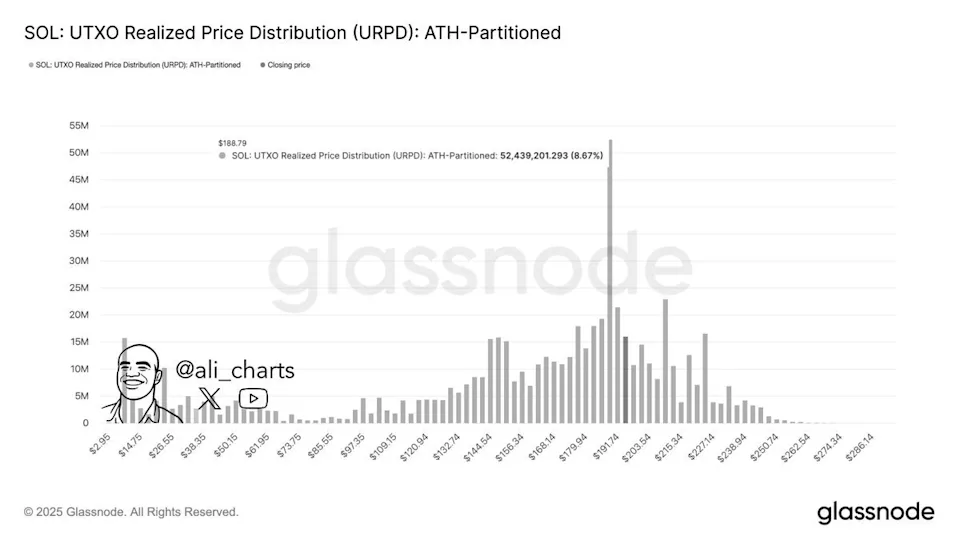

On Saturday, market analyst Ali Martinez identified $188 as Solana’s most significant support level, citing data from Glassnode’s “realized price distribution” chart. The histogram illustrates where large volumes of SOL last changed hands, revealing a dense supply cluster near $188.

These clusters often act as price floors: when prices hold above them, selling pressure tends to ease, but if they break below, additional supply can enter the market. This zone remains a key area for traders monitoring whether Solana can maintain its uptrend.

Institutional adoption continued to grow this week. A few days ago, Fidelity added support for Solana on its U.S. brokerage platform, extending client access beyond Bitcoin (BTC), Ether (ETH), and Litecoin (LTC). While such listings may not directly affect daily price movements, they enhance visibility and broaden Solana’s potential investor base.

Gemini Introduces Solana Credit Card, Adds Auto-Staking for Rewards

Earlier in the week, Gemini introduced a Solana-branded edition of its Gemini Credit Card, which was first launched in 2023. The new design allows cardholders to earn rewards in SOL—up to 4% back on gas, EV charging, and rideshare purchases; 3% on dining; 2% on groceries; and 1% on all other spending.

Select merchants offer up to 10% back in rewards. The card carries no annual fee or foreign transaction fees, and there’s no charge for receiving crypto rewards. Gemini also added an option for users to automatically stake their Solana rewards, though staking yields remain variable and not guaranteed.

Buyers Defend $189 as SOL Stays Above 200-Day Average

At the time of writing, Solana is hovering around $195, with a market dominance of 2.79%. From a technical standpoint, data shows that SOL gained roughly 1.9% over the previous 24 hours.

Market data shows that:

- Solana gained about $5.24, with buyers defending $189.25 and sellers active near $195.

- Key support levels are set at $189.25 and $186.

- Main resistance is around $195.49, with an intraday pivot near $192.50.

- SOL remains above its 200-day simple moving average, signaling continued strength.

- The token recorded 16 green days in the last 30, a 53% positive streak.

- Trading volume peaked at 09:00 UTC, jumping 47% above average to 786,000.

- SOL briefly slipped from $193.73 to $192.53, confirming $195 as a short-term cap.

Analysts suggest that a sustained close above $195 could pave the way toward $200–$208. On the other hand, a dip below $192.50 may prompt a retest of $189.25—or even $186. Furthermore, a breakdown of the $189–$188 support zone would likely shift attention to $183 as the next downside target.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.