XRP and Solana: The Big Shift of Crypto ETFs in 2025

In 2025, XRP and Solana ETFs captured the attention of institutional investors, surpassing one billion dollars in assets under management. While bitcoin and ethereum suffer massive withdrawals, these two cryptos establish themselves as the new favorites. Why such enthusiasm?

In brief

- XRP and Solana ETFs attract more than 1 billion dollars in net inflows in 2025, while Bitcoin and Ethereum suffer 4.6 billion dollars in outflows.

- Regulatory clarity for XRP, scalability and the DeFi ecosystem for Solana, make them favored targets for institutions.

- Analysts target $2.50–$4.00 for XRP and $250–$350 for Solana in 2026, driven by institutional adoption, ETFs, and derivatives such as CME futures.

Crypto ETF: XRP and Solana, the new darlings of institutions

XRP-related ETFs have crossed the symbolic threshold of 1.12 billion dollars in assets under management, with daily net inflows since their launch in November 2025. Five major issuers, including Grayscale, Bitwise, and Franklin Templeton, dominate this market. XRP benefits from regulatory clarity after its victory against the SEC, as well as increasing utility in cross-border payments. Reduced or even zero crypto fees for the first billions attract traditional investors.

Meanwhile, Solana recorded more than 420 million dollars in net inflows in November, despite a 53% price drop since January. Players like Fidelity and CME bet on its scalability and DeFi ecosystem, which shows a total value locked (TVL) of 9.19 billion dollars. These institutional flows confirm a trend: investors seek crypto assets with concrete use cases.

Historic ETF rotation: why are Bitcoin and Ethereum losing ground?

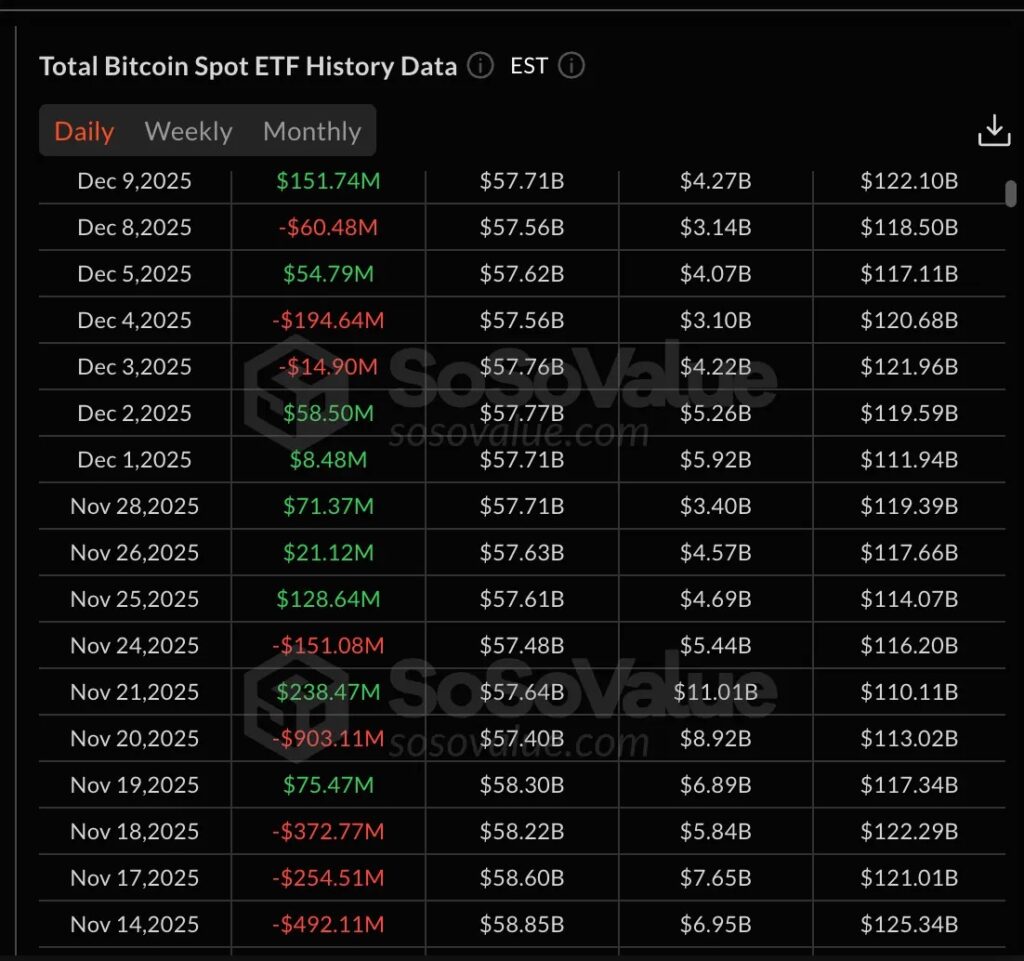

Bitcoin and Ethereum ETFs have suffered nearly 4.6 billion dollars in outflows since November 2025, while XRP and Solana have had no net outflow days. This divergence is explained by fatigue toward crypto “blue chips”, seen as too speculative or correlated with traditional markets. Institutions are turning to assets offering real utility: payments for XRP, DeFi for Solana.

Regulatory clarity around XRP, now considered a non-security asset, and Solana’s technological innovation reassure investors. ETF flow charts show a clear capital rotation, marking a turning point in crypto portfolio allocation. This trend could intensify if derivatives like CME futures gain popularity.

Moreover, staking products, such as those from Grayscale, could attract an additional 500 million dollars by March 2026. However, competition from Ethereum L2 solutions and regulatory risks remain major challenges. In case of crisis, a correction down to 1.50 dollars for XRP and 150 dollars for Solana is not excluded.

XRP and Solana ETFs mark a turning point in crypto adoption, where utility and regulation prevail over speculation. The first quarter of 2026 will be decisive to confirm this trend. And you, do you bet on these assets or wait for a correction before investing?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.