BitMine takes its Ethereum staking to 1.5 million ETH

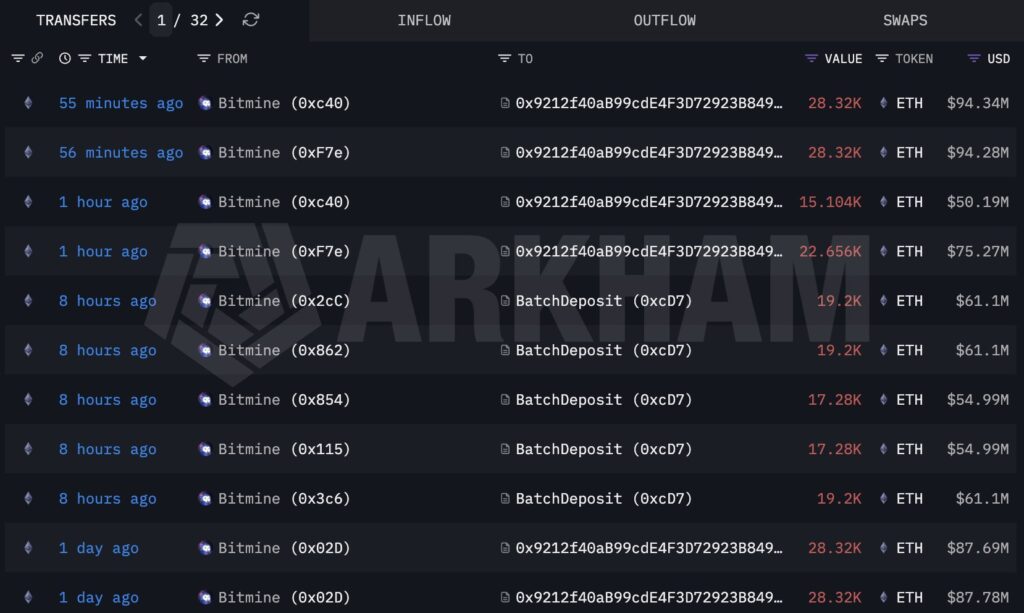

BitMine Immersion Technologies, chaired by Tom Lee, has just deposited an additional 186,560 ETH in staking. Its total climbs to 1,530,784 ETH, about 4% of all ETH currently staked on the Beacon Chain. This figure is significant. It comes at a time when the “validator entry queue” stretches to nearly 2.3 million ETH.

In Brief

- BitMine, chaired by Tom Lee, added 186,560 ETH in staking, bringing its total to 1.53 million ETH, a significant share of ETH staked on Ethereum.

- ETH has risen and the BMNR stock reacted positively, reinforcing the idea that some companies now treat Ethereum as a long-term treasury asset

An Ethereum Treasury that Looks Like a State Strategy

BitMine does not simply buy the ETH crypto. It organizes a treasury. The company has chosen an accumulation model, then staking to turn its asset into a yield machine. On paper, it is a crypto treasury but in practice, it is an assumed Ethereum exposure. Indeed, the platform even crossed the million mark of ETH staked.

The recent deposit amounts to 186,560 ETH at once. This brings the estimated value of the staked share beyond 5 billion dollars, according to rates cited by various sources. Indeed, the company wants to be perceived as a structural player, not as an opportunistic trader.

And the most intriguing part is that outside of staking, BitMine declared to hold more than 4.16 million ETH, as well as a Bitcoin residual and a large cash reserve. In other words, the staking leverage is not over. If the pace continues, BitMine’s relative share in Ethereum validation could still increase.

The queue is a discreet thermometer. When it lengthens, it is not a “bug.” It is a deliberate bottleneck. The more validator candidates there are, the longer one must wait to be activated. In this particular case, the queue is presented as close to 2.3 million ETH waiting.

This phenomenon tells a story of demand, not just yield. Staking ETH is not just about earning a rate. It is also about accepting a logic of time. Capital is locked, remuneration is received, and a bet is placed on network stability. When big players align, the queue mechanically swells.

Markets: ETH rises, stock follows

After a turbulent period at the end of 2025, the idea of a return to normal attracts. Indeed, Tom Lee himself mentions a kind of mini crypto winter passed, and a recovery cycle in 2026, with a more ambitious trajectory for 2027-2028. This type of discourse, whether one agrees or not, often prompts eager hands to position early.

ETH experienced one of its strongest daily jumps in 2026, around +7% over 24 hours, with a zone test around 3,375 dollars. The price matters, of course. But it alone does not explain the excitement around staking.

On the stock market side, the BMNR share also reacted. An after-hours increase is mentioned, and the title shows a positive start to the year. It remains a stock, therefore a more volatile vehicle than ETH itself.

The real question, however, is cooler. What happens if too much ETH is concentrated in a few corporate treasuries? Technically, Ethereum has safeguards. But economically, concentration changes the nature of arbitrage. A player holding millions of ETH does not have the same reflexes as an individual. They manage risk, perception, shareholders. And sometimes, they manage a narrative even before managing a private key.

Ultimately, this BitMine move acts like a magnifier. It enlarges a trend: Ethereum is no longer just a developer crypto. Moreover, Blockchain developers’ engagement was free falling on Ethereum. Thus, we must understand that Ethereum is also a treasury asset, with a native yield, and a queue that serves as a barometer.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Enseignante et ingénieure IT, Lydie découvre le Bitcoin en 2022 et plonge dans l’univers des cryptomonnaies. Elle vulgarise des sujets complexes, décrypte les enjeux du Web3 et défend une vision d’un futur numérique ouvert, inclusif et décentralisé.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.