BREAKING NEWS CRYPTO - Ethereum Briefly Falls Below $4,000

The price of Ethereum briefly fell below $4,000, triggering massive liquidations. Behind this drop, technical signals turn red while the largest wallets are buying. Complete analysis in the following paragraphs!

In brief

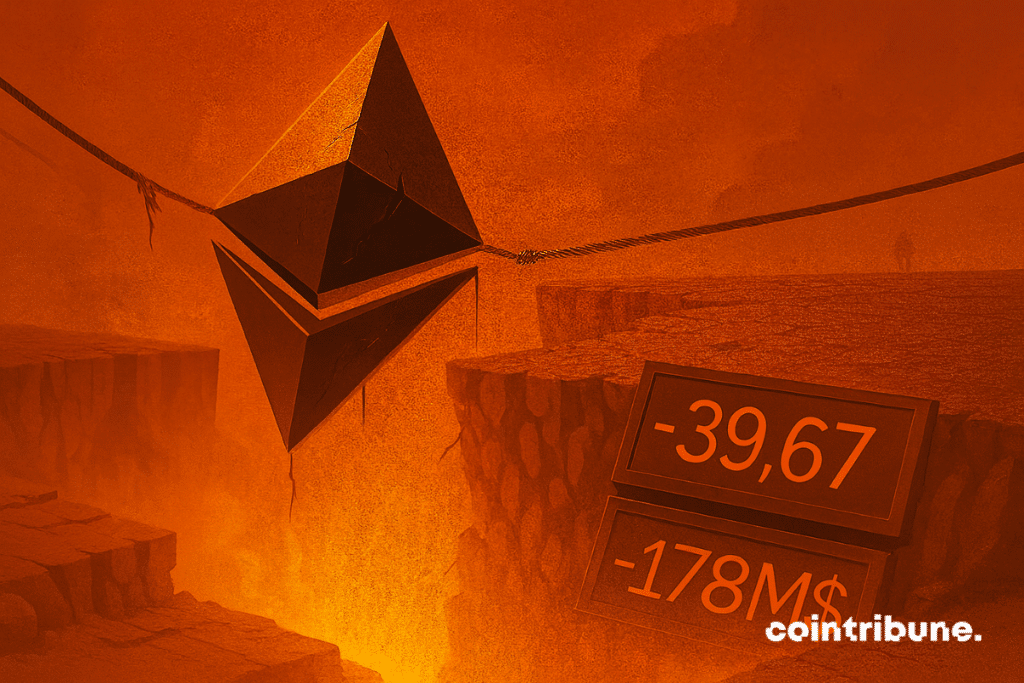

- Ethereum falls below $4,000 leading to massive liquidations and a general retreat in the crypto market.

- Despite the drop, institutional players are quietly accumulating hundreds of millions in ETH.

Liquidations, indicators in decline and withdrawal of institutional investors

Ethereum has dropped 4.4% in 24 hours to reach $3,967. At the same time, more than $178 million have been liquidated. $489 million are long positions according to data from multiple platforms. This decline continues a slide of:

- 12.5% over the week;

- 10% over the month.

The shock also extends across the entire market. Bitcoin and XRP also retreated, amid fears of a US government shutdown. This macroeconomic pressure increases distrust towards risky assets.

Technical indicators confirm the shift:

- The RSI falls to 34.5, close to the oversold zone.

- The MACD remains in negative territory.

Ethereum also barely holds above the lower band of its Bollinger Bands, while the price falls below the 20 and 50 day moving averages.

Negative funding rates (–0.0021) indicate a dominant sell bias on perpetual contracts. Spot ETFs add pressure, with $79.4 million in net outflows over three days. The largest outflows come from Fidelity (–$33.3 million) and BlackRock (–$26.5 million).

Discreet accumulation in a tense market

In this tense context, some players are taking advantage of the drop. In six hours, ten wallets bought more than 210,000 ETH through Kraken, BitGo, Galaxy Digital, and FalconX. This represents about $862 million according to the current price of Ethereum.

That’s not all! The supply of ETH on centralized exchanges also reaches a nine-year low. This suggests a long-term accumulation strategy rather than short-term speculation.

Technically, Ethereum is therefore struggling around the $4,000 support. A rebound could aim for $4,250 to $4,400. In case of a breakdown, however, the $3,850 and $3,392 levels will come into play. These correspond to the 200-day moving average.

In any case, the battle at $4,000 is now open. The future of Ethereum will depend as much on macroeconomic conditions as on crypto investors’ behavior.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

My name is Ariela, and I am 31 years old. I have been working in the field of web writing for 7 years now. I only discovered trading and cryptocurrency a few years ago, but it is a universe that greatly interests me. The topics covered on the platform allow me to learn more. A singer in my spare time, I also cultivate a great passion for music and reading (and animals!)

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.