Bitcoin Rockets Past $111,000 — Is a Crash Coming?

Bitcoin has just broken a legendary ceiling at $111,000, heightening hopes for a financial revolution. But behind this euphoria, the threat of a sudden crash looms. This new record reveals both the strength and fragility of a market disrupted by scarcity, regulation, and global tensions.

In brief

- Bitcoin surpassed $111,000, driven by post-halving scarcity and enhanced institutional adoption through ETFs.

- Macroeconomic risks, such as a strong dollar and geopolitical tensions, could trigger a sharp correction.

- Regulatory developments, notably the GENIUS law, and institutional interest will heavily influence bitcoin’s future trajectory.

The bitcoin rocket takes off and could soon reach the stars

Bitcoin, after smashing a crazy record at $110,000, has just shattered a new historic record by surpassing the symbolic $111,000 mark. This milestone evokes a dual emotion: the euphoria of a major asset becoming essential and the tension of a market where risks accumulate in the background. Among the factors driving the rise, we have:

The halving

This periodic event that halves the creation of new bitcoins is beginning to heavily weigh on the available supply. Indeed, this contraction in quantity injected fuels intense upward pressure.

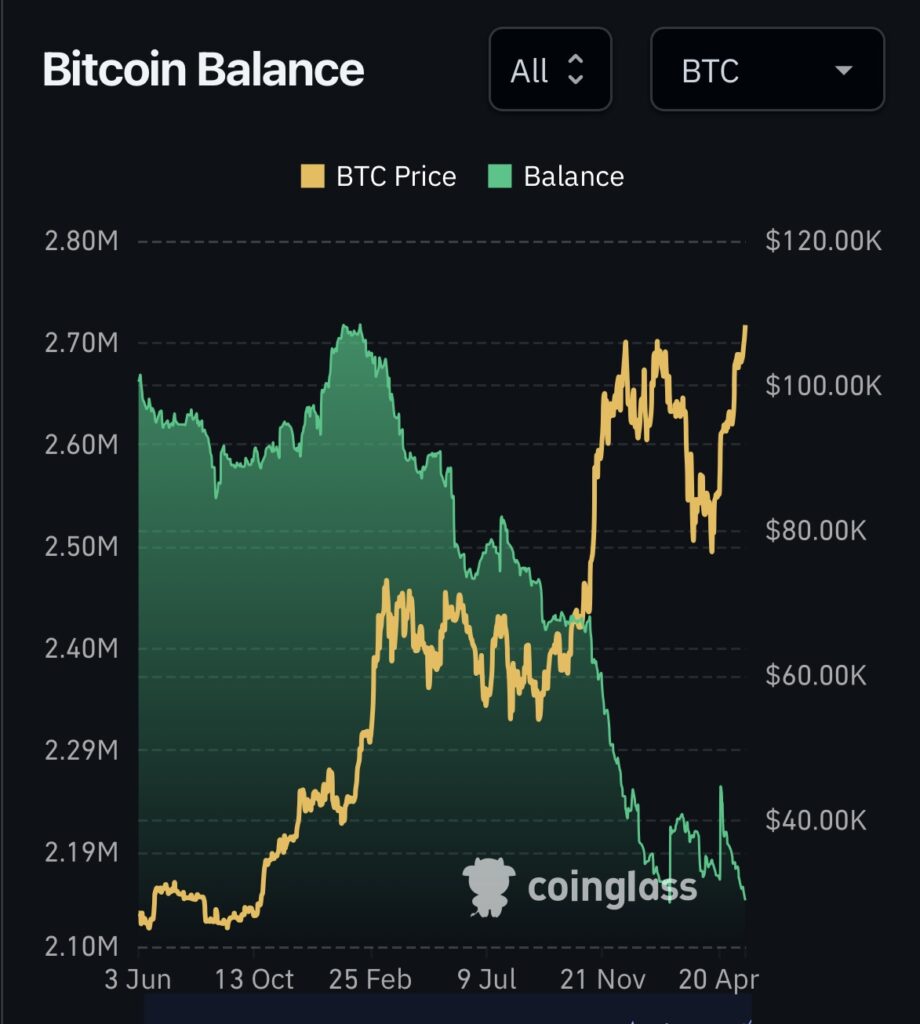

The decrease of bitcoins on exchanges

Meanwhile, BTC availability on trading platforms is dwindling, intensifying the scarcity effect. Investors now face a market where bitcoins for sale are rare, mechanically boosting its valuation. This could further propel BTC to new heights.

Why could BTC soon collapse despite $111,000?

Despite its decentralized aura, bitcoin remains sensitive to the upheavals of major economic powers, and these factors could abruptly halt BTC’s progress:

- A strengthening dollar, with the DXY index rising more than 5% in three months, makes foreign assets more expensive and dampens appetite for bitcoin, often causing pullbacks;

- Geopolitical tensions, like the US-China conflict and crises in the Middle East, increase volatility of risky assets, making BTC vulnerable to sudden movements linked to political events.

These external factors could shake investor confidence and trigger violent corrections.

Institutional hope to save BTC?

Ryan Lee, chief analyst at Bitget Research, points out that institutional adoption and the rise of Bitcoin spot ETFs provide strong market support. However, he reminds us that BTC’s trajectory is far from linear:

Bitcoin has reached a new historic high, surpassing $110,000, with accelerating institutional adoption and increasing regulatory clarity. The demand for Bitcoin spot ETFs continues to rise, amplified by a tightening post-halving supply that sharpens market dynamics and sets the stage for further price appreciation […] Bitcoin’s momentum seems strong for now, but the path ahead will still be fraught with obstacles.

Additionally, the progress of the GENIUS law, currently under investor scrutiny, will play a decisive role in reinforcing or weakening this BTC momentum.

Bitcoin outlook in the short and medium term

In the short and medium term, the scenario remains fragile. Some analysts even forecast volatility reaching 30% in the coming months, with a risk of a temporary pullback that could bring bitcoin down to around $90,000 before a possible rebound. The key for investors is to adopt a flexible stance, attentive to macroeconomic and regulatory signals. Confidence in BTC relies mainly on a precarious balance between financial innovation and an uncertain global context.

Bitcoin’s recent surge to $111,000 is not just a new record but a turning point revealing a new reality: a crypto driven by institutional investors. Moreover, the bold bet by several states on funds like Strategy could propel BTC to $500,000, further increasing institutional interest. Will this new momentum mark the beginning of an era or precipitate a major correction? Only time will tell.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.