172 Companies Now Hold 1.02 Million Bitcoins as of Q3 2025

In Q3 2025, bitcoin establishes itself as a pillar of companies’ financial strategies. With 1.02 million bitcoins held by 172 listed companies, the crypto queen moves beyond speculation to become an essential store of value. Decoding a revolution underway.

In brief

- In the third quarter of 2025, 172 companies now hold 1.02 million bitcoins, representing 4.87% of the total supply and a 40% increase compared to the previous quarter.

- Strategy, MARA Holdings and XX1 lead bitcoin adoption, with strategies ranging from aggressive accumulation to gradual integration.

- Despite volatility and regulatory risks, bitcoin asserts itself as a store of value and a diversification tool for companies.

Q3 2025: The historic rise of bitcoin in institutional portfolios

The third quarter of 2025 marks a turning point for bitcoin. Indeed, publicly traded companies holding bitcoin now represent nearly 40% of the total, that is 172 companies, compared to far fewer three months ago. Furthermore, the total volume has risen to 1.02 million bitcoins, accounting for 4.87% of the total supply. An increase of 20.87% in just three months, with a valuation exceeding 117 billion dollars.

Companies are no longer just observing: they are acting. In Q3 2025, 48 new companies have added bitcoin to their balance sheet, a record. Among them, historical players like Strategy, which has strengthened its position with an additional 40,000 bitcoins. But also newcomers attracted by the liquidity and market growth potential. This dynamic reflects a growing confidence in BTC as a safe haven asset and diversification tool.

Bitcoin giants: who holds what and why?

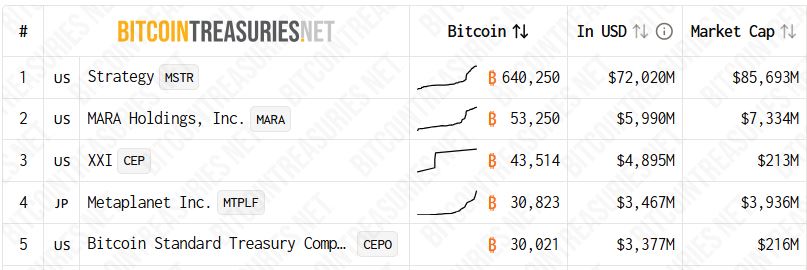

Among the 172 companies holding bitcoin in 2025, some stand out for the size of their reserves. Strategy, with 640,031 bitcoins, remains the undisputed leader, followed by MARA Holdings (53,250 BTC) and XX1 (43,514 BTC). These players adopt varied strategies:

- Aggressive accumulation for Strategy;

- Mining and targeted acquisition for MARA;

- Gradual integration for XX1.

Their motivation? A combination of inflation hedging, speculation on rising prices, and financial innovation. With 48 new players entering crypto treasury in the past 3 months, the movement is accelerating. Metaplanet, a Japanese company, embodies this trend in Asia, where bitcoin is increasingly viewed as a strategic asset. With 30,823 bitcoins, it demonstrates how Asian companies are embracing the topic. This, in response to unstable local monetary policies.

The record acquisition of 176,762 bitcoins in Q3 2025, mostly by American and Asian companies, highlights this race for adoption. Companies no longer just hold bitcoin: they integrate it into their business model. Whether to attract investors, optimize cash flow, or position themselves as pioneers in a booming market.

BTC: a legitimate corporate asset or a risky bet?

Despite its growing adoption, bitcoin remains a volatile and controversial asset. Its detractors point to sharp price fluctuations, such as the 20% drop recorded in 2024, or regulatory uncertainties, especially in the United States and Europe. For companies, these risks are not trivial: they can impact their stock market valuation and credibility with traditional shareholders.

However, the benefits are real. BTC offers a hedge against the depreciation of fiat currencies, a strong argument in a context of persistent inflation. It also allows companies to differentiate themselves by attracting investors and talent sensitive to technological innovations. Some companies, like Tesla, have already shown how bitcoin can serve as a communication and growth tool.

Bitcoin enters a new era dominated by companies, with reserves exceeding one million units. Between historic opportunity and calculated risk, its adoption raises a fundamental question: are we witnessing the emergence of a new financial standard, or a speculative bubble without a future?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.