A Historic First: Coinbase Joins The S&P 500

Coinbase enters the prestigious S&P 500 index, becoming the first crypto company to reach this milestone. This historic inclusion marks a turning point for the cryptocurrency industry, now integrated into the standards of traditional finance. A strategic evolution that propels Coinbase to the heart of global markets.

In Brief

- Coinbase becomes the first crypto company to join the S&P 500.

- Coinbase’s stock jumps after the announcement, supported by strong financial results.

- This entry strengthens the legitimacy of the crypto sector but raises questions about its ability to maintain its identity against traditional standards.

Coinbase joins the S&P 500, a first for crypto

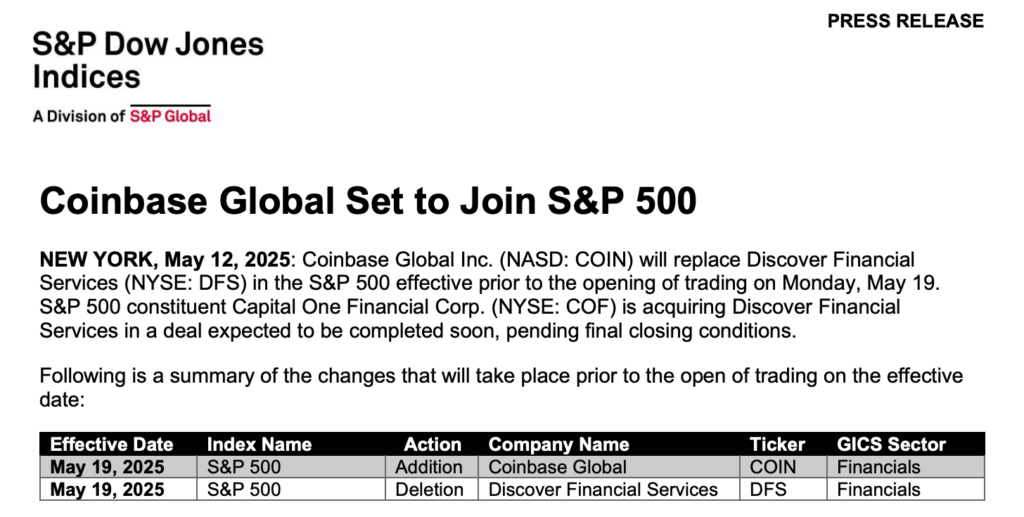

On May 19, 2025, Coinbase will officially become a member of the S&P 500, replacing Discover Financial, which was removed from the index following its acquisition by Capital One. This is a historic first: never before has a company born in the crypto ecosystem reached this level of institutional recognition.

This entry marks a shift in the sector’s perception: crypto is no longer confined to the speculative fringe; it enters the core of the market economy. This move reflects the desire of S&P Dow Jones Indices to integrate disruptive tech players who meet fundamental criteria of stability, liquidity, and capitalization.

Market Reaction and Coinbase’s Financial Performance

The announcement of joining the S&P 500 immediately boosted Coinbase’s valuation. At market close, the stock had already gained 4%, before jumping over 8% in after-hours trading, reaching $225.40. This reaction confirms the strategic interest represented by indexed companies, notably among passive funds.

On fundamentals, Coinbase recently reported a net profit of $65.6 million, despite a decline from the previous year. The profitability, market capitalization, and liquidity criteria required by the index have been met, reflecting the robustness of the business model despite the volatility of the crypto market.

Strategic Expansion: Coinbase Strengthens Its Offering with Deribit

Coinbase concurrently announced the acquisition of Deribit, a platform specialized in crypto derivatives products, for $2.9 billion. This operation reinforces its position in a rapidly growing strategic segment. The derivatives market has become a major expansion lever for platforms seeking to diversify their revenues. Through this acquisition, Coinbase displays several clear objectives:

- Expand its offering beyond spot trading to attract institutional clients;

- Strengthen its presence in emerging markets, notably in Dubai;

- Increase recurring revenues through fees on derivatives products;

- Position itself as a global reference in crypto-regulated infrastructures.

This strategy complements the evolution toward an integrated multi-product model.

What Joining the S&P 500 Means for the Crypto Ecosystem

Coinbase’s integration into the S&P 500 is a strong signal sent to institutional players. By joining an index followed by thousands of funds worldwide, the platform gains visibility, credibility, and stability. This could encourage other crypto giants to structure their governance and strategy to achieve the same recognition. The implications go beyond Coinbase’s valuation alone:

- Strengthening of the industry’s legitimacy with regulators;

- Spillover effect on ETFs and index products including Coinbase;

- Potential increase in volumes linked to passive arbitrage;

- Reduction of the perceived gap between traditional finance and crypto.

This milestone could mark the beginning of a new era for publicly traded crypto companies and potentially increase institutional risk appetite towards decentralized assets like bitcoin.

Coinbase’s arrival to the S&P 500 thus confirms the evolution of the crypto sector towards institutional legitimacy. Balanced between growth strategy and financial integration, the company redefines economic boundaries with innovations such as Gmail for bitcoin. However, this progress raises a question: can crypto truly integrate without diluting itself into the standards of traditional finance?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.