Aave Founder Faces Scrutiny Over Token Purchase Ahead of Governance Vote

Aave founder Stani Kulechov is facing growing criticism after purchasing a large amount of AAVE tokens ahead of a key governance vote, a move some community members say threatens fair decision-making within the DAO. The controversy has intensified concerns about the concentration of voting power and whether governance outcomes still reflect broad community interests rather than the influence of large holders.

In brief

- A $10M AAVE purchase before a DAO vote raised concerns about voting influence and whether governance decisions still reflect wider community interests.

- Critics argue that token-based governance allows large holders to gain fast control, leaving minority voters with limited protection.

- Backlash grew after a brand asset proposal was pushed to a Snapshot vote despite ongoing debate and objections from key contributors.

- Snapshot data shows three wallets control over 58% of voting power, renewing calls for stronger checks within Aave governance.

Founder Token Activity Raises Fresh Concerns Over Aave DAO Fairness

The backlash followed Kulechov’s purchase of roughly $10 million worth of AAVE tokens shortly before a major DAO proposal went to a vote. The timing has drawn scrutiny because governance power in Aave is directly tied to token holdings, allowing large buyers to gain immediate influence over outcomes.

In a post on X, DeFi strategist and liquidity specialist Robert Mullins said the purchase appeared aimed at increasing voting power ahead of a proposal that could harm token holders. He argued that the situation exposes weaknesses in token-based governance systems, particularly when limits on the concentration of influence remain minimal.

Crypto commentator Sisyphus raised additional doubts by questioning the economic logic behind the move. According to his analysis, Kulechov may have sold millions of dollars’ worth of AAVE between 2021 and 2025, making the recent buyback appear inconsistent. The claim added momentum to ongoing discussions about founder influence and long-term alignment with the community.

Interestingly, the controversy widened with a separate proposal involving control of Aave’s brand assets. That proposal asked whether AAVE holders should reclaim ownership of domains, social media accounts, and intellectual property through a DAO-controlled legal structure.

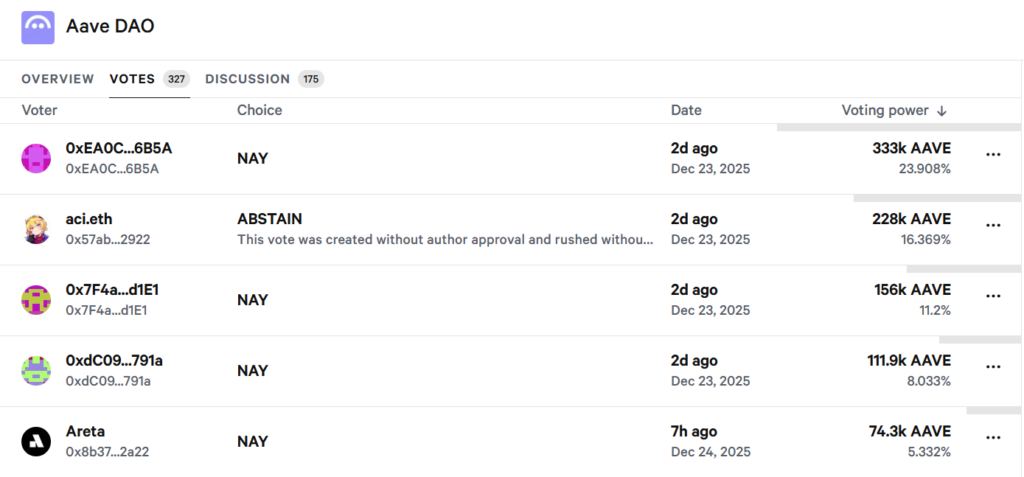

Snapshot Data Shows Heavy Voting Power Concentration

Although debate remained active, organizers moved the proposal to a Snapshot vote, prompting backlash from several stakeholders. Former Aave Labs CTO Ernesto Boado, listed as the proposal’s author, later said the vote was escalated without his approval and described the process as a breach of community trust.

Critics cite several issues driving the dispute:

- Large token purchases can alter voting outcomes.

- Founder-held tokens can dominate key decisions.

- Minority holders have limited safeguards against coordinated votes.

- Governance timelines can restrict open discussion.

- Transparency gaps can erode trust in DAO processes.

Samuel McCulloch of USD.ai also weighed in on the dispute. He described the vote as poorly balanced because of the concentration of voting power within the DAO. Snapshot data shows that a small group of wallets controls a large share of the total vote.

The top three voters account for more than 58% of voting power. One wallet alone controls 27.06%, equal to about 333,000 AAVE, while the second-largest voter holds 16.369%, or roughly 228,000 tokens.

While governance concerns dominated the discussion, market data showed continued weakness. AAVE was trading at $147.90 at press time, with a 24-hour trading volume of $404.27 million and a market cap of $2.26 billion. The price fell 1.69% over the past day and remains below the 200-day simple moving average.

Recent performance has also remained uneven. Only 14 of the past 30 days closed in positive territory, and the token is trading about 78% below its all-time high. Sentiment remains bearish, with the Fear and Greed Index at 24, signaling extreme fear.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.