ABTC Unveils Bold U.S.-First Strategy to Lead Global Bitcoin Market

American Bitcoin Corp. (ABTC)—co-founded by Eric Trump—has released its October 2025 investor presentation, marking a major milestone in its evolution from a pure Bitcoin miner to a full-scale digital-asset ecosystem. The strategy focuses on building a U.S.-based Bitcoin powerhouse to reinforce America’s leadership in the global Bitcoin market.

In brief

- ABTC doubles its hashrate to 24.2 EH/s and targets 50 EH/s with fleet efficiency below 15 J/TH by late 2025.

- The company’s hybrid model blends Bitcoin mining profits with strategic reserve accumulation and market purchases.

- A $2.1B Nasdaq ATM share offering will fund expansion and build one of the largest U.S.-based Bitcoin treasuries.

- Eric Trump says ABTC’s mission is to unite America’s Bitcoin ecosystem and cement U.S. leadership in digital assets.

New Bitcoin Strategy Marries Mining Profitability With Treasury Growth

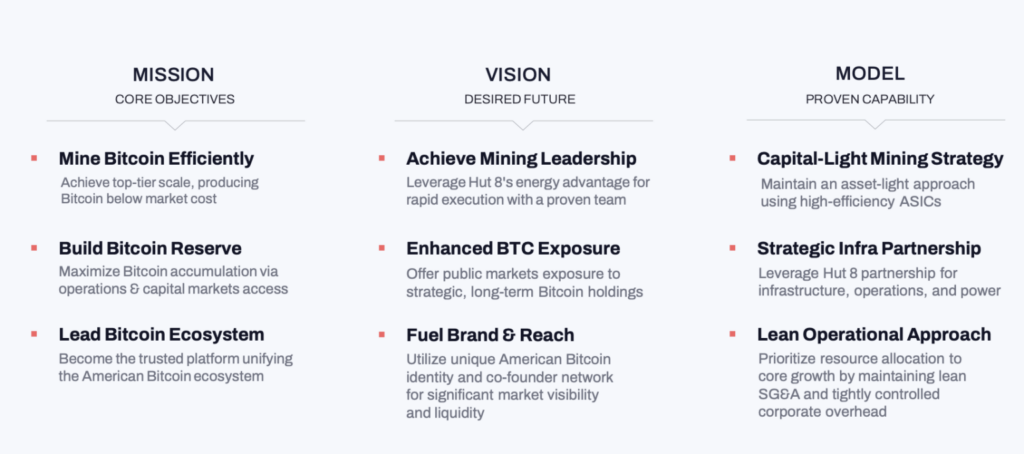

In the presentation, ABTC outlined its mission to “mine efficiently, build reserves, and lead the ecosystem.” The company plans to expand its mining capacity while keeping an asset-light model by leveraging Hut 8’s operations, energy infrastructure, and deployment expertise.

As contained in the report, ABTC’s estimated cost per BTC mined was $50,000 as of Q2 2025. In just two months, the firm doubled its hashrate to 24.2 exahashes per second (EH/s) and targets 50 EH/s, with fleet efficiency expected to improve to below 15 joules per terahash (J/TH).

Eric Trump, who serves as ABTC’s Chief Strategy Officer, said the company’s goal is to establish the United States as the world’s leading center for Bitcoin. The leadership team—drawing talent from the Trump Organization, Hut 8, and US Bitcoin Corp.—brings what the company calls “a proven capability to scale rapidly and efficiently.”

At the treasury level, ABTC plans to grow its Bitcoin reserves through a mix of mining and direct market purchases. The initiative will be funded through a $2.1 billion at-the-market (ATM) share offering on Nasdaq.

According to the company, this hybrid approach integrates mining profitability with strategic BTC accumulation. This balanced model positions ABTC to capture the market-to-net-asset-value (mNAV) premiums typically seen among leading public Bitcoin treasuries.

ABTC Bets on U.S. Bitcoin Future, Eyes Institutional Expansion

Eric Trump shared the investor deck on X, highlighting ABTC’s commitment to both the United States and Bitcoin. He said the company was founded to strengthen America’s position in the global BTC market. ABTC aims to leverage its brand reach and capital-market access to unify what it views as a fragmented U.S. Bitcoin ecosystem.

Plain and simple: We love America and we love the asset known as Bitcoin. That’s why we launched ABTC.

Eric Trump

The report also highlighted America’s strength in the global Bitcoin market, noting that U.S. companies hold the majority of publicly reported BTC reserves. ABTC believes this foundation presents a unique opportunity to integrate traditional capital markets with digital assets.

Following its September merger with Nasdaq-listed Gryphon Digital Mining, ABTC’s stock saw sharp volatility, triggering five trading halts before closing at $7.36 per share. With institutional adoption still limited, ABTC sees an opportunity to position itself at the heart of the U.S. Bitcoin economy—driving national growth and advancing digital-asset innovation.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.