#Altcoin – Pay attention for generational wealth.

— Mags (@thescalpingpro) July 17, 2025

If you look at the total altcoin market cap excluding Ethereum, you'll notice a similar pattern in every cycle.

Price breaks out after consolidation and slowly grinds upward.

The real up only begins toward the end when the… pic.twitter.com/vdNPahNmfg

A

A

Altcoins Surge Amid Record Stablecoin Inflows

Sat 19 Jul 2025 ▪

4

min read ▪ by

Getting informed

▪

Summarize this article with:

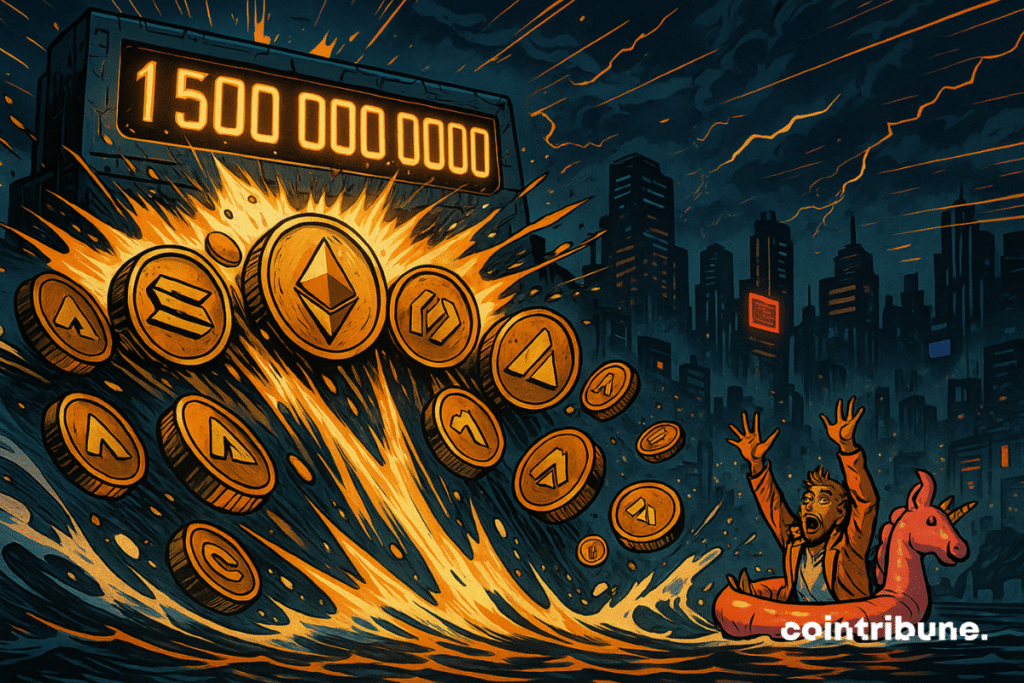

The milestone has just been crossed: altcoins once again weigh in at 1.5 trillion dollars. While bitcoin is faltering under its resistances, part of the flows seems to be migrating to secondary cryptos, reviving the scenario of an altseason. This rotation, often a precursor to intense speculation phases, occurs against the backdrop of a major technical breakout. And in analysis circles, the countdown seems to have started.

In brief

- The altcoin market crosses the symbolic mark of 1.5 trillion $ capitalization, a major technical threshold.

- This level has not been reached since January and could announce a large-scale altseason.

- Platforms like Binance and HTX record more than 1.7 billion $ inflows in stablecoins, a sign of liquidity returning.

- According to some analysts, the total capitalization of altcoins could climb up to 5 trillion $ during this cycle.

The 1.5 trillion threshold crossed: a technical turning point for the altcoin market

The total market capitalization of cryptos, excluding bitcoin, reached 1.5 trillion dollars this Friday, driven by encouraging signals revealed by the Altseason Index. It is the first time in five months that this index, known as TOTAL2, has crossed this key threshold.

This level corresponds to a long-term resistance, last tested in January. If TOTAL2 closes the month above 1.51 trillion dollars, it would be the highest monthly close ever recorded for the altcoin index. This eventuality would strengthen the hypothesis of a major technical shift in favor of altcoins, which could then target the previous peak at 1.72 trillion dollars.

Such a surge is fueled by an inflow dynamics, notably via stablecoins, which shed light on a reconfiguration of institutional and retail portfolios. Several data illustrate this movement :

- 1.7 billion dollars of stablecoins have been transferred this week to exchanges, an unprecedented volume in several months ;

- Binance recorded 895 million dollars, and HTX 819 million dollars in net stablecoin inflows ;

- An additional 2 billion dollars have been deposited in stablecoins on major derivatives platforms, mainly in USDT ;

- Meanwhile, BTC deposits by whales have dropped by 2.25 billion dollars, reducing selling pressure on bitcoin and potentially freeing capital for altcoins.

This reallocation of capital suggests a renewed interest in riskier assets, supported by a favorable technical context and a market environment where accumulation signals are multiplying.

A cycle in its early stages : between consolidation and vertical potential

While the spotlight is on TOTAL2, another indicator deserves attention: TOTAL3, which measures the total market capitalization excluding Bitcoin and Ethereum. It is currently valued at about 1 trillion dollars, far from its highs, but several analysts believe we are on the brink of a major cycle.

Crypto analyst Mags reminds us that altcoin cycles generally unfold in several phases. “The most explosive gains occur in the last phase, a vertical surge often concentrated in only a few monthly candles,” he explains.

This phenomenon, already observed during previous cycles, tends to surprise investors who arrive late.

The Altseason Index confirms this diagnosis of an early cycle. Over a 30-day period, the index crossed the 75 mark, signaling the beginning of capital rotation towards altcoins. However, over 60 days, it remains relatively low, which shows that few altcoins have yet truly outperformed bitcoin in a sustainable manner. This imbalance suggests that the market is far from having exhausted its potential. Accumulation signs remain present, but the main wave has not yet been triggered.

In this context, several implications emerge. If the trend confirms, altcoins could enter a phase of exponential growth in the coming months, with performances concentrated over a very short time. However, this configuration requires rigorous execution and particular attention to timing. The market remains unpredictable, and bouts of euphoria can both fuel rallies and precipitate brutal corrections.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.