Analysts Monitor Bitcoin for Potential Dip Below $100,000

Bitcoin has entered a quiet stretch, trading mostly between $110,000 and $112,000. Price action has slowed, with smaller moves and reduced momentum. Yet, within this calm, analysts agree that the cryptocurrency is undergoing a correction that could extend further, with some pointing to the risk of a dip under $100,000 before strength returns.

In brief

- Analysts, including Ted Pilliow, view the current pullback as a normal correction, with a dip below $100,000 possible before a recovery.

- Glassnode highlighted that a drop below $104,000 could push Bitcoin toward $93,000 to $95,000.

- Santiment observed that Bitcoin has fallen behind other assets, which may increase the likelihood of a rebound.

Bitcoin Could Drop Before Rebound

Market analyst Ted Pilliow compared the current retracement to previous phases in 2024 and early 2025 when Bitcoin dropped about 30% before stabilizing. He noted that the present correction may follow the same pattern and warned that a slide under $100,000 cannot be ruled out. Still, he emphasized that such a decline would be a normal adjustment in a continuing bull cycle and would likely be followed by another push toward record levels.

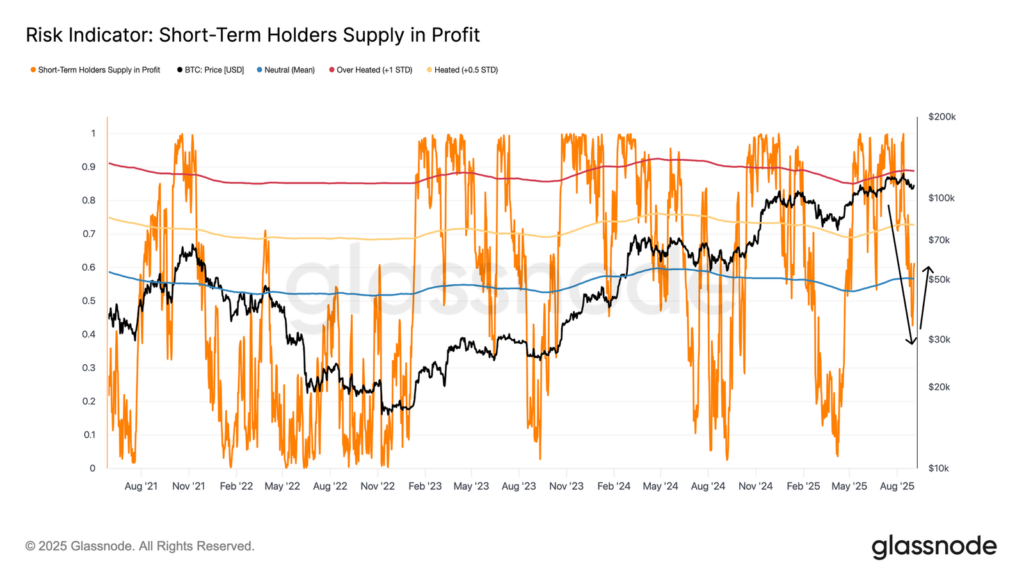

Glassnode’s weekly on-chain report revealed the key price zones to watch as Bitcoin consolidates. The platform noted that the cryptocurrency is trading within a broader range of $104,000 to $116,000. Within this context, short-term holders remain in a fragile position. Their profits have begun to recover from recent lows, but not enough to indicate a clear return of momentum.

Glassnode added that if Bitcoin climbs back into the $114,000 to $116,000 range, most short-term holders would return to profit, which could bolster overall market sentiment. Conversely, a drop below $104,000 could trigger a phase of exhaustion similar to those seen after previous all-time highs, potentially sending Bitcoin toward the $93,000 to $95,000 area.

Bitcoin’s Recent Decline Fits Typical Bull Market Patterns

Other market voices also described the pullback as typical of past bull cycles. CryptoQuant analyst Darkfost explained that from the most recent all-time high near $123,000, Bitcoin has eased by about 12%. This is modest compared to the largest drawdown of the current cycle since March 2024, which reached 28%, and still below the average corrections of 20% to 25% often recorded in previous rallies.

Darkfost pointed out that retracements of this kind are not a sign of weakness, but a mechanism that helps the market reset. They cool excessive speculation, ease leverage in derivatives, and create fresh opportunities for long-term investors to enter. In his view, the present move remains within the healthy range of a sustained uptrend.

Bitcoin’s Lagging Performance May Precede a Rebound

Adding another perspective, Santiment observed a growing divergence between Bitcoin and other assets. Since August 22, Bitcoin’s price has slipped about 5.9%, while the S&P 500 edged up 0.4% and gold advanced 5.5%. The performance of cryptocurrencies has largely mirrored equities since 2022, a trend driven by institutions adding exposure across both asset classes.

Santiment suggested that this gap may not last. When digital assets trail behind global markets for a period, they often move higher later to align with broader trends. The larger the separation becomes, the stronger the case for an eventual rebound.

Market Levels to Watch

Despite different emphases, analysts share the view that the current phase is a correction rather than the end of the bull market. The important levels are presented as follows:

- A drop below $104,000 could push Bitcoin toward $93,000 to $95,000, while remaining above that level reduces immediate downside risk.

- A rise into the $114,000 to $116,000 range would likely restore momentum and reinforce the bullish outlook.

- A dip under $100,000 remains a risk, though it is mostly regarded as a temporary stage in the cycle rather than a lasting downturn.

As of the latest reading, Bitcoin traded near $111,576, up about 1% in the past 24 hours. While the next direction has not yet been decided, the consensus among analysts is that corrections of this kind have been part of Bitcoin’s history. Whether through a temporary dip or a rebound from current levels, most expect the broader upward trend to remain in place.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Ifeoluwa specializes in Web3 writing and marketing, with over 5 years of experience creating insightful and strategic content. Beyond this, he trades crypto and is skilled at conducting technical, fundamental, and on-chain analyses.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.