Washington cuts in post-crash regulation: a small snip to the SLR to inflate the economy... or the next bubble? Thrilled banks, shivering taxpayers. Who pays the price?

Archive 2025

In a crypto environment marked by volatility, stablecoins are emerging as the preferred safe haven for venture capital investors. Despite geopolitical tensions and market fluctuations, these digital currencies pegged to traditional currencies are garnering increasing attention. Why does this particular segment generate so much enthusiasm among the most discerning financiers?

While Bitcoin gets cluttered with JPEGs, an economist waves the mop. Filters, insults, monetary ideals: the community is tearing itself apart. What if the real spam was us?

Bitcoin has once again shaken up the market. By surpassing the $105,000 mark, the iconic crypto has returned to levels it hasn't seen since January. This surge, accompanied by a rise in the major altcoins, reignites speculation: is it just a technical rebound or the start of a new bullish cycle? In a rapidly changing geopolitical context, as investors regain their appetite for risk, signals are multiplying... but their interpretation remains uncertain.

Beijing is picking Uncle Sam's pockets, offloading its Treasury bonds, and whispering to the global economy: "I love you... me neither."

Under pressure in a feverish crypto market, Bitcoin is approaching a key technical signal: the Golden Cross. This chart pattern, where the 50-day moving average crosses above the 200-day moving average, is often seen as a precursor to sustained bullish momentum. Still uncertain, this signal gains credibility each day, fueling traders' expectations. As the curves draw closer, the market holds its breath, ready to interpret this potential crossover as a major turning point in the current BTC cycle.

While regulation struggles to keep pace with crypto innovation, the introduction of futures contracts on XRP at CME Group reshuffles the deck. This initiative from the world’s largest derivatives market grants a new legitimacy to Ripple's asset, despite the lingering shadow of the lawsuit with the SEC. In a carefully calculated timing, this launch symbolizes a push towards the institutionalization of XRP amidst legal uncertainty and tensions between decentralized innovation and rigid regulatory frameworks.

Has a post by Javier Milei served as a lever for a concealed speculative operation? In Argentina, the judiciary is now interested in the potential gains that President Javier Milei and his sister could have derived from the artificial surge of the cryptocurrency $LIBRA. The investigation is taking a decisive turn with the lifting of their banking secrecy.

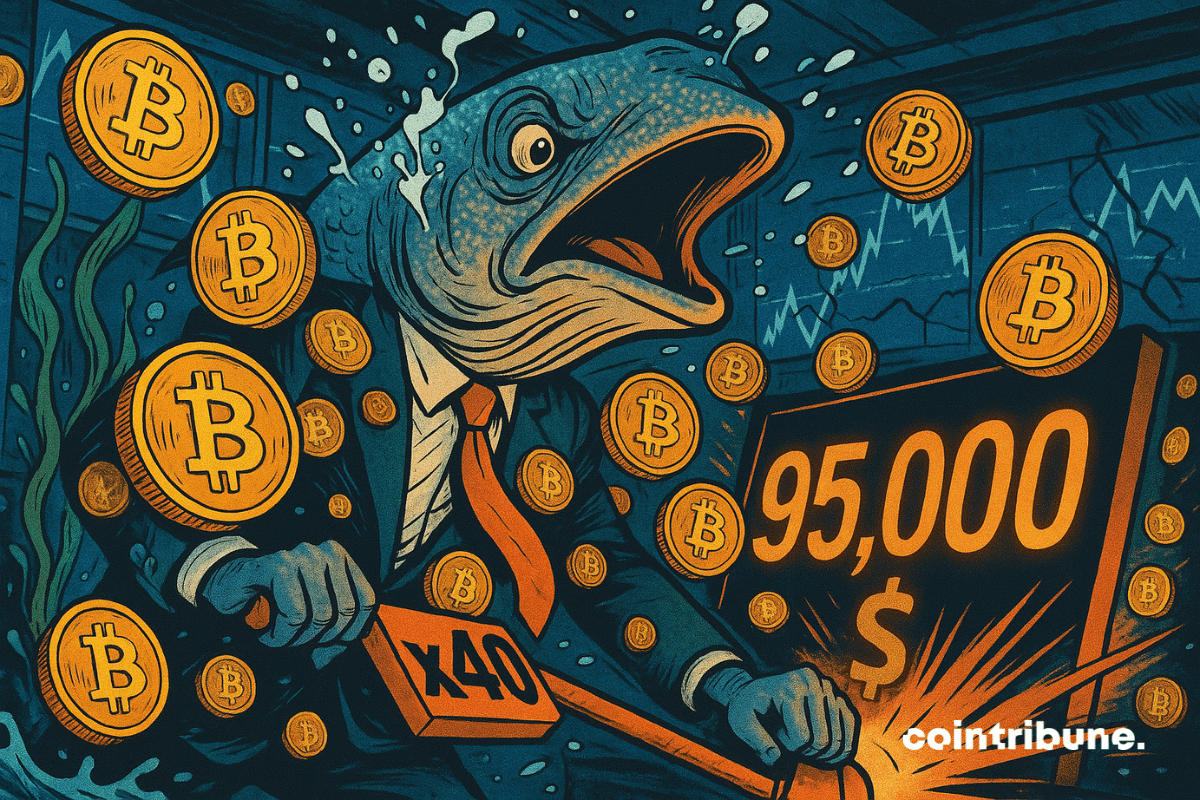

This weekend, the crypto community was shaken by an exceptional revelation: a leading trader on Hyperliquid took a long bitcoin position with 40x leverage, with a notional value of around 392 million dollars. This bold initiative, with a liquidation threshold around 95,000 dollars, raises important questions about the outlook for the crypto market.

Bribed agents, massive data leaks, exposed clients… The crypto exchange Coinbase in the middle of judicial turmoil. Details here!