Despite the drop in Ethereum, whales are maintaining their positions. In this article, find an analysis of the key data to know.

Archive June 2025

Solana is gaining traction as ETF speculation intensifies. Rising CME activity, institutional filings, and growing public interest suggest the asset may be nearing a pivotal moment.

Ever struggled to understand how to securely manage your cryptocurrency? A crypto wallet doesn’t store digital assets like a bank account but safeguards private keys—cryptographic tools proving ownership of blockchain-based funds. This article unpacks how crypto wallets work, explores their security frameworks, and compares custodial versus non-custodial solutions, while addressing critical concerns like protecting assets from theft and ensuring seamless transactions across networks like Bitcoin and Ethereum. Discover how these tools bridge the gap between complex cryptography and user-friendly access to decentralized finance (DeFi), empowering both beginners and advanced users to navigate the evolving Web3 landscape with confidence.

Financial markets are going through a fascinating period, where the boundaries between traditional finance and cryptocurrencies are increasingly blurred. BNB, the native token of the Binance ecosystem, is taking a bold new step by becoming the cornerstone of an institutional initiative listed on Nasdaq, fueled by an impressive raise of 100 million dollars.

Trying to time the crypto market is a nightmare for most investors. FOMO, sharp corrections, contradictory signals… Volatility brings both opportunity and anxiety. Fortunately, there’s a calmer approach already embraced by 59% of crypto holders: Dollar-Cost Averaging (DCA). What if you could enjoy it stress-free, without having to attend classes every day? Kraken offers a simple, automated, and ultra-flexible solution to help you build a crypto position over time, without obsessing over market dips.

Donald Trump's surprise announcement of a ceasefire between Iran and Israel has caused a real earthquake in the energy markets. Oil prices plunged by more than 5%, while global stock markets soared. Is this geopolitical calm sustainable?

Japan is wielding its fiscal sword: crypto ETFs on the horizon, lower taxes... and investor samurais soon converted to Bitcoin? In Tokyo, traditional finance shakes under its kimono.

Despite a decline in profits, companies in the CAC 40 are increasingly attentive to their shareholders. In 2024, they maintain record payouts, contrary to traditional economic signals. In an environment marked by sluggish growth, rising inflation, and unstable markets, this strategy raises questions. Is it a sign of strength or a risky bet? While shareholder profitability remains a priority, the gap between distributed profits and actual performance raises doubts about the sustainability of this model.

Against the backdrop of years of regulatory ambiguity, Washington seems to want to take control of the crypto ecosystem. On June 18, Federal Reserve Chairman Jerome Powell surprised many by clearly supporting two landmark bills on stablecoins and the crypto market. In a changing political climate in the United States, this stance marks a potential turning point for the industry, which has long awaited a solid and predictable legal framework.

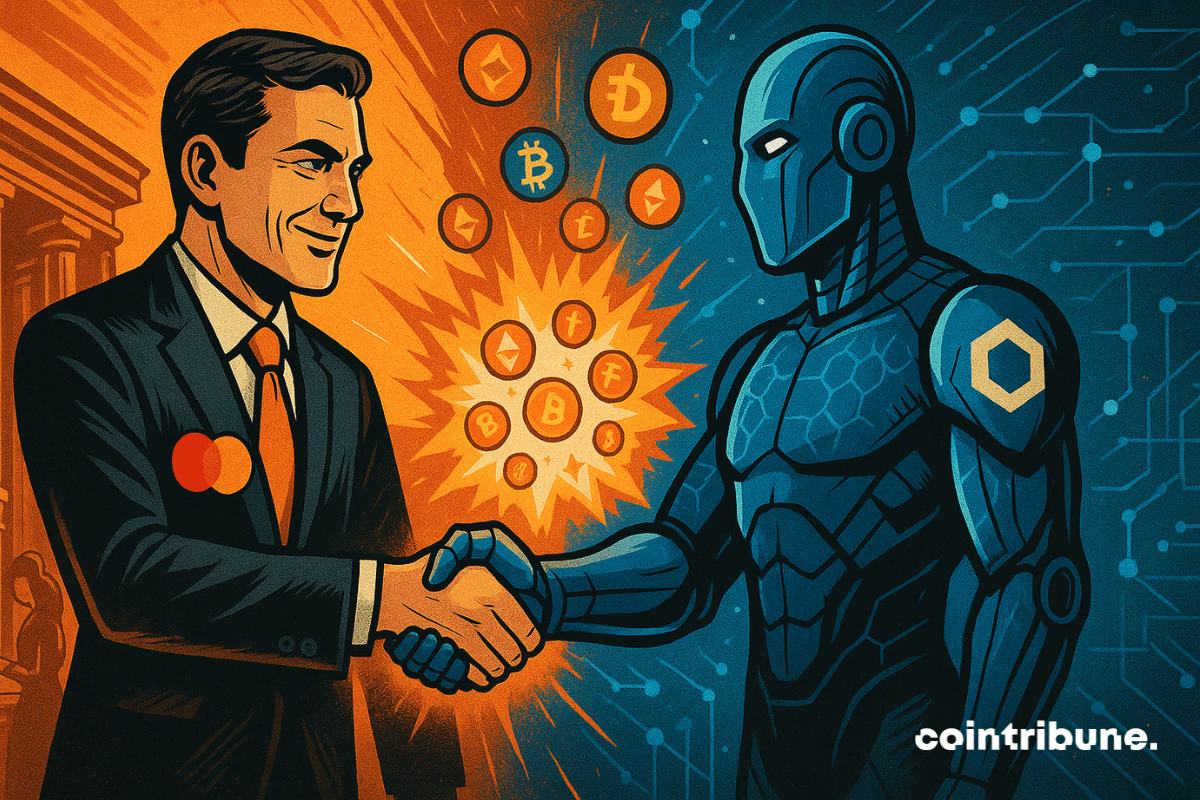

As the lines between traditional finance and blockchain become increasingly blurred, Mastercard and Chainlink are crossing a decisive threshold. In a partnership announced this Tuesday, they unveil a fiat-to-crypto conversion solution directly on-chain, designed for Mastercard cardholders. This initiative, far from being anecdotal, redefines access to cryptocurrencies and lays the groundwork for a new era of hybrid payments between traditional finance and Web3.