BPCE, a heavyweight in the French banking sector, launches its crypto trading service this week through its mobile applications. A revolution: buying Bitcoin will become as easy as checking your balance.

Archive 2025

Bitcoin has just crossed $91,000, but the euphoria is not spreading to all market segments. Mining company stocks fell 1.8% over the week, while trading volumes dropped 25%. This decline reflects less a simple technical pause than a deeper malaise in a sector weakened by rising production costs.

Solana’s lending sector is dealing with one of its most visible internal disputes of the year, raising concerns about how public conflicts may affect trust in the ecosystem. A tense exchange between Kamino Finance and Jupiter Lend has now pulled in Solana Foundation president Lily Liu, who urged both projects to direct their energy toward growing Solana’s overall lending market.

Ether has entered an important phase as exchange balances drop to their lowest level in nearly ten years. Supply continues moving into staking and long-term holding, leaving fewer tokens available for trading. Market structure is tightening even as investor sentiment remains cautious. Recent network events and steady institutional demand are also adding to this overall market trend.

Ethereum’s network shows record stablecoin activity, $6T in Q4 settlements, low fees, and steady prices above $3,000.

Ethereum has just reached a historic milestone: 6 million ETH burned, equivalent to $18 billion up in smoke. Yet, against all odds, its supply keeps increasing. How to explain this paradox that defies the logic of the crypto ecosystem?

Accused of closing crypto accounts linked to Trump, JPMorgan denies and denounces unfair rules. All the details here!

These companies thought they were riding the bitcoin wave, but they are drowning in their own debts. The crypto king is nosediving, and the kings of leverage are getting slapped.

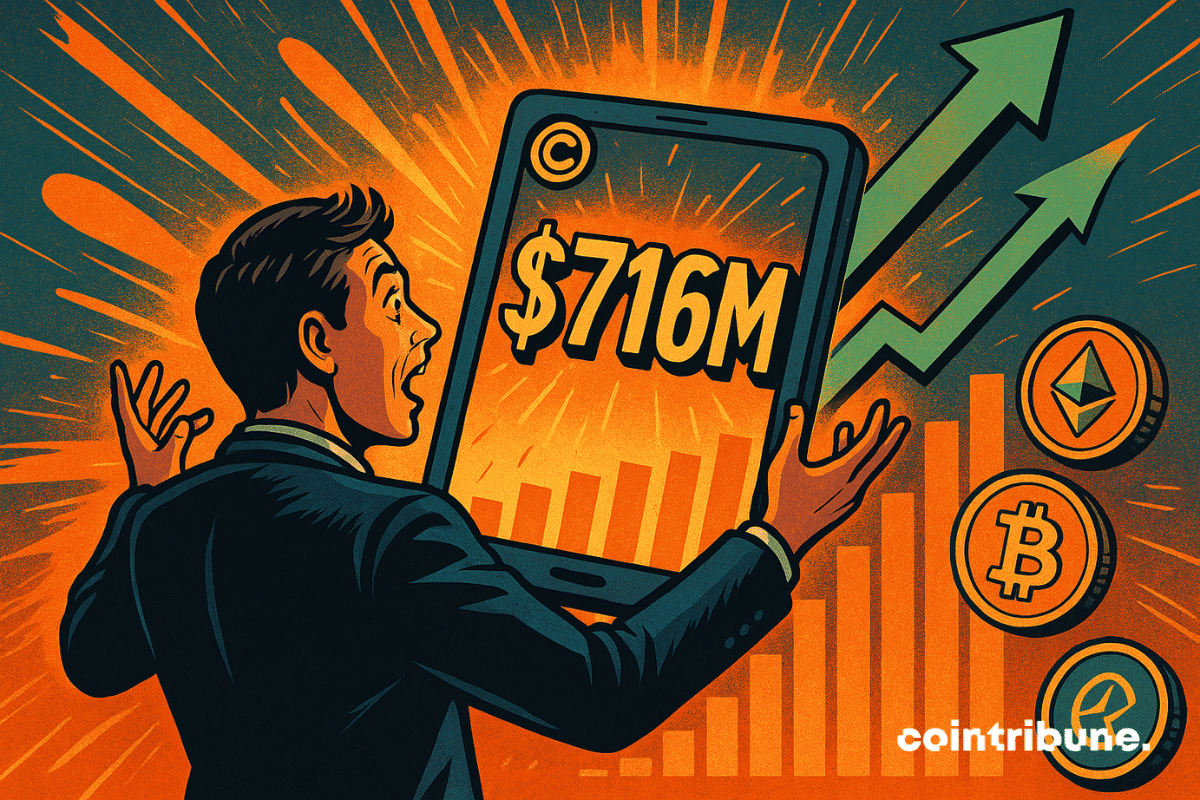

CoinShares reports $716 million in weekly inflows into its digital asset ETPs, marking the second consecutive week of positive flows. This growth brings assets under management to $180 billion, up 7.9% from their November low. Data show increased investor participation, with significant contributions from the United States, Germany, and Canada.

While bitcoin hovers around $91,000 after its October peak, Strategy surprises the markets with a massive purchase of over 10,000 BTC. This billion-dollar bet, amid a prolonged downturn, reignites debates on the viability of the "Bitcoin treasury" model. The move fascinates as much as it worries: should it be seen as a strategic conviction or a major financial risk for an already pressured company?