Momentum around Coinbase is rising as the company enters a new phase of financial stability and public-sector experimentation. Latest data show revenue increasing while costs remain controlled. And as expected, this combination has created a sturdier foundation than in earlier market cycles.

Home » Archives for James Godstime » Page 7

James G.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

Bitcoin stumbled into the new month after a sharp weekend drop erased days of calm trading and reignited market-wide fear. Prices plunged without warning on Sunday, triggering heavy liquidations and closing out the asset’s weakest November in years. Traders now question whether the fall signals deeper trouble or a reset that clears the way for a rebound.

Self-custody and financial privacy have returned to the forefront of the U.S. crypto conversation after SEC Commissioner Hester Peirce reaffirmed them as core individual rights. Her remarks come amid regulatory uncertainty, rising ETF adoption, and renewed debate over Bitcoin’s founding principles.

Arthur Hayes is stirring debate across the crypto market with sharp criticism of Monad, a new layer-1 chain that launched with significant attention and industry backing. His remarks challenge the project’s early momentum and raise broader questions about high-valuation tokens supported by venture capital.

Ripple USD has entered a new phase of market growth as it surpasses the one-billion supply mark on Ethereum. RLUSD’s fast expansion has strengthened its position among major stablecoins, showing steady demand across trading platforms, wallets, and payment services. For an asset less than a year old, this milestone represents a notable achievement for the dollar-pegged stablecoin.

BitMine is drawing fresh attention as its aggressive buying spree in Ethereum continues. New on-chain activity suggests the company may be preparing another significant purchase, prompting traders to watch whether continued accumulation can steady sentiment in an uneven market. Interestingly, BitMine’s recent purchase activity comes amid broad macro pressures that remain a persistent drag on digital assets.

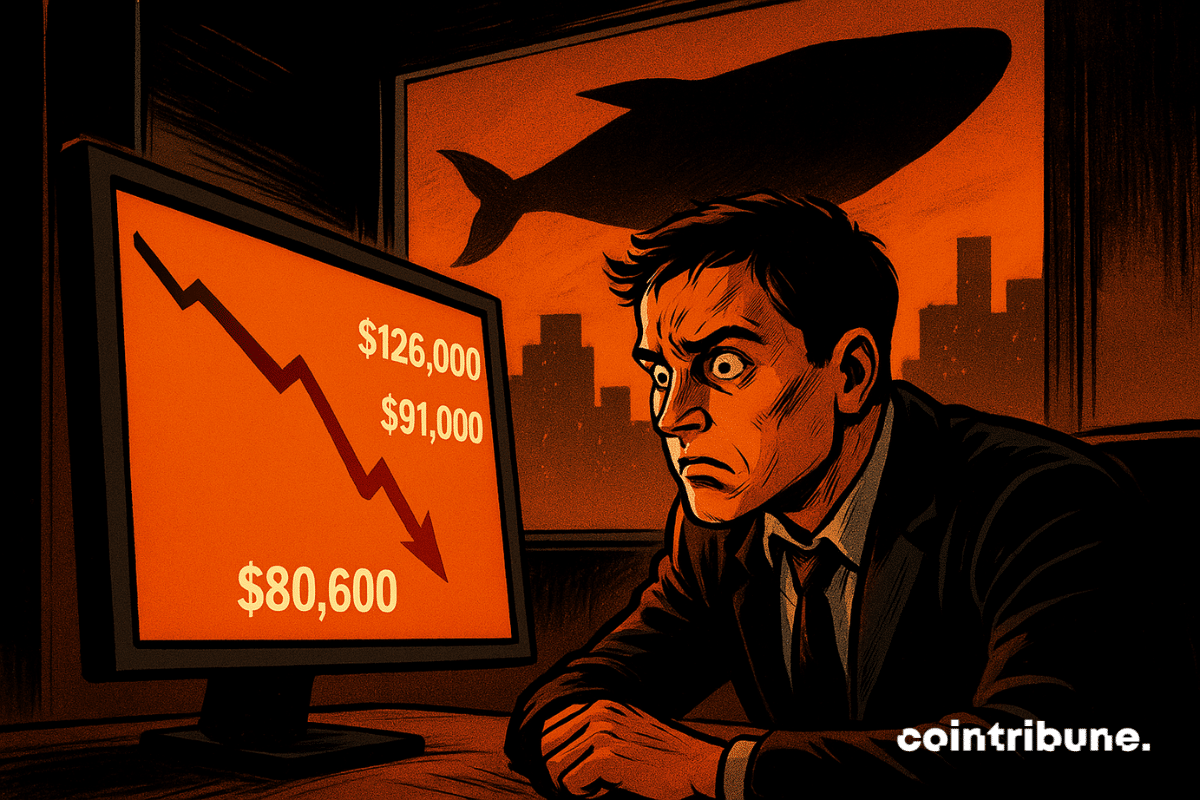

Fresh selling from large Bitcoin holders is putting renewed pressure on an already shaky market, as traders deal with one of the steepest pullbacks of the year. Price softness, rising exchange inflows, and cautious positioning across major trading venues all point to a market still trying to find its footing. Analysts at CryptoQuant say continued whale deposits could push Bitcoin lower if the pattern persists.

Growing confusion over Polygon’s token identity has prompted project leaders to reconsider a decision made just a year ago. Concerns from everyday users and long-time holders have reopened the discussion about whether the network should drop its current POL ticker and restore MATIC, the name many still recognize.

Fresh activity in Metaplanet’s financing plan suggests the company is accelerating efforts to increase its Bitcoin exposure amid ongoing market volatility. A newly executed $130 million loan backed by its BTC reserves signals a continued commitment to a balance-sheet strategy built around borrowing and long-term equity funding.

Strong market interest returned to TON, with the token climbing to $1.60 after an 8.33% daily rise. Growing activity across Telegram-linked applications, steady technical signals, and a packed month of ecosystem releases added fresh confidence to traders. Even while the broader market continues to struggle, TON stands out as one of the sharpest moves among major networks.

Crypto markets are showing signs of strain as several key measures of capital flow turn negative. Recent data points to a broad cooling of demand across Bitcoin ETFs, stablecoins, and corporate treasury activity. And as expected, this trend has raised concerns that the rally’s core drivers have stalled.

Market conditions continue to tighten around Bitcoin as traders confront nearly $2 billion in leveraged long positions that could be liquidated if prices fall to $80,000. Recent swings reveal how fragile derivative exposure has become, with borrowed positions at risk of automatic liquidation during sharp price moves.

Strong inflows returned to major crypto ETFs at the end of the week after several days of uncertainty across digital asset markets. Bitcoin, Ether, and Solana products all posted gains on Friday, hinting at early stabilization following sharp swings and heavy withdrawals earlier in the week. Sentiment remains cautious, but renewed allocations to key products suggest that some investors are selectively re-entering the market.

Market pressure has surged across the crypto sector. Even so, analysts say the recent wave of Bitcoin ETF outflows reflects short-term trading adjustments rather than a meaningful pullback by institutional participants. Recent redemptions, combined with forced selling in spot markets, have put added stress on prices, but experts maintain that broader demand for Bitcoin remains intact.

Sharp volatility hit the crypto market on Friday after Bitcoin briefly plunged on Hyperliquid. The sudden drop triggered millions in liquidations and sharply raised investor anxiety. Prices bounced back quickly, but market data indicate that conditions remain fragile and pessimism is deepening among traders.