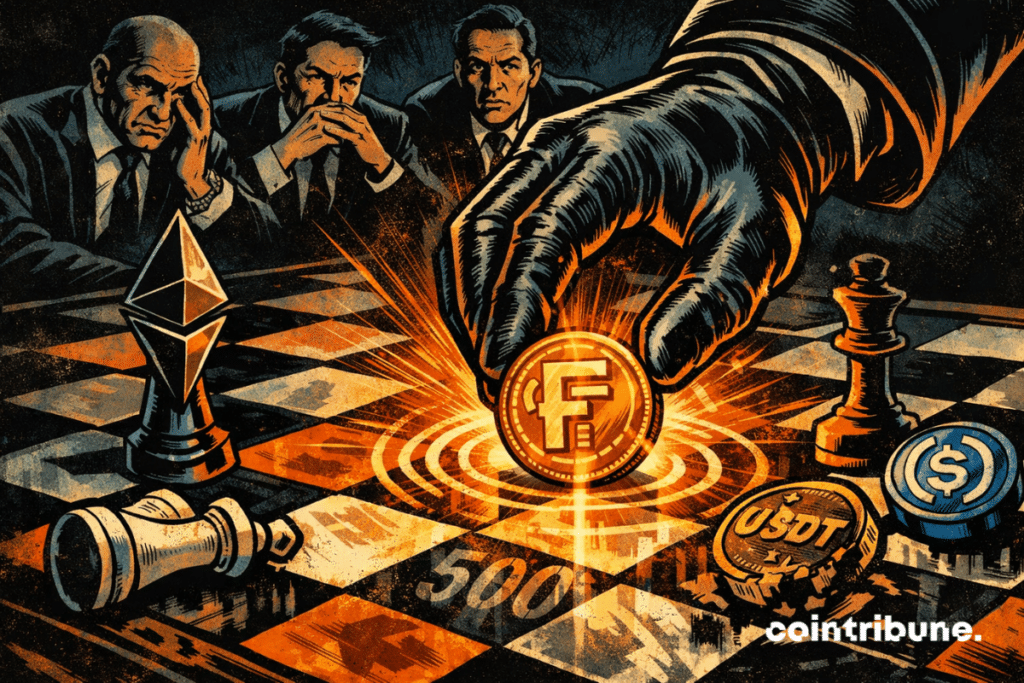

Banks Could Lose $500B After Fidelity's Official Token Launch on Ethereum

Fidelity launches a digital dollar on Ethereum. This compliant, freezable token controlled by a fiduciary bank could cause banks to lose 500 billion dollars by 2028. A monetary shock during the crypto transformation!

In Brief

- Fidelity launches a digital dollar on Ethereum, capable of freezing funds and heavily regulated.

- This stablecoin threatens up to 500 billion dollars of bank deposits by 2028, according to Standard Chartered.

A digital dollar on Ethereum controlled by Fidelity

The Fidelity Digital Dollar (FIDD) arrives on the Ethereum blockchain. Created by a regulated banking subsidiary, this stablecoin is intended for Fidelity clients via its brokerage, wealth management, and exchange channels.

The token remains transferable on-chain. Fidelity, however, retains full control. It can therefore freeze wallet funds, monitor transactions, and restrict access.

This heavily regulated architecture makes Ethereum a regulated playground. FIDD holds a reserve composed of cash and US Treasury bonds, with daily publication of net asset value. The idea? To offer a solid, compliant stablecoin suited for institutional markets.

Ethereum becomes the battlefield for bank stablecoins

Behind this launch lies a colossal stake: the deposits war. According to Standard Chartered, US banks could lose up to $500 billion by 2028 to stablecoins. As an open infrastructure, Ethereum thus becomes a strategic battlefield.

FIDD does not seek to compete with Circle or Tether, but to establish itself as a on-chain settlement tool for Fidelity clients. Choosing Ethereum rather than a private blockchain also highlights an ambition for interoperability with the DeFi.

This model rests on five levers:

- distribution;

- compliance;

- redemption rails;

- portability;

- treasury strategy.

Regulation becomes a competitive advantage here. Fidelity bets on a future where trust, traceability, and integrated monitoring will prevail over anonymity or raw speed.

In any case, FIDD could well become a central token in the future financial landscape. If other institutions follow, Ethereum could crystallize the shift from fiat currencies to supervised digital assets. The question remains whether the public will accept such a level of control!

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

My name is Ariela, and I am 31 years old. I have been working in the field of web writing for 7 years now. I only discovered trading and cryptocurrency a few years ago, but it is a universe that greatly interests me. The topics covered on the platform allow me to learn more. A singer in my spare time, I also cultivate a great passion for music and reading (and animals!)

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.