Binance Records 6 Billion Dollars In Unrealized Profits From Its 60,000 BTC

The dark hours of the markets sometimes lead us to examine the crypto-sphere from another angle. When gold rises and interest rates cause concern, some already foresee the collapse of digital assets. Yet, far from these pessimistic forecasts, Bitcoin holds strong. And so do its allies. Exchanges, these major strongholds, resist. Even better, Binance emerges revitalized, establishing itself as a crypto fortress that has not yet spoken its last word.

In Brief

- Binance holds 60,000 BTC of unrealized profits, equivalent to nearly 6 billion.

- More than 250 million users trust Binance, despite its status as a centralized exchange.

- Competitors like Crypto.com, Bitget, and Coinbase are gaining ground against the historic crypto exchange.

- The total spot and derivatives volume exploded in December, reaching a record 11,300 billion.

Binance: A Crypto Titan Raking in Billions

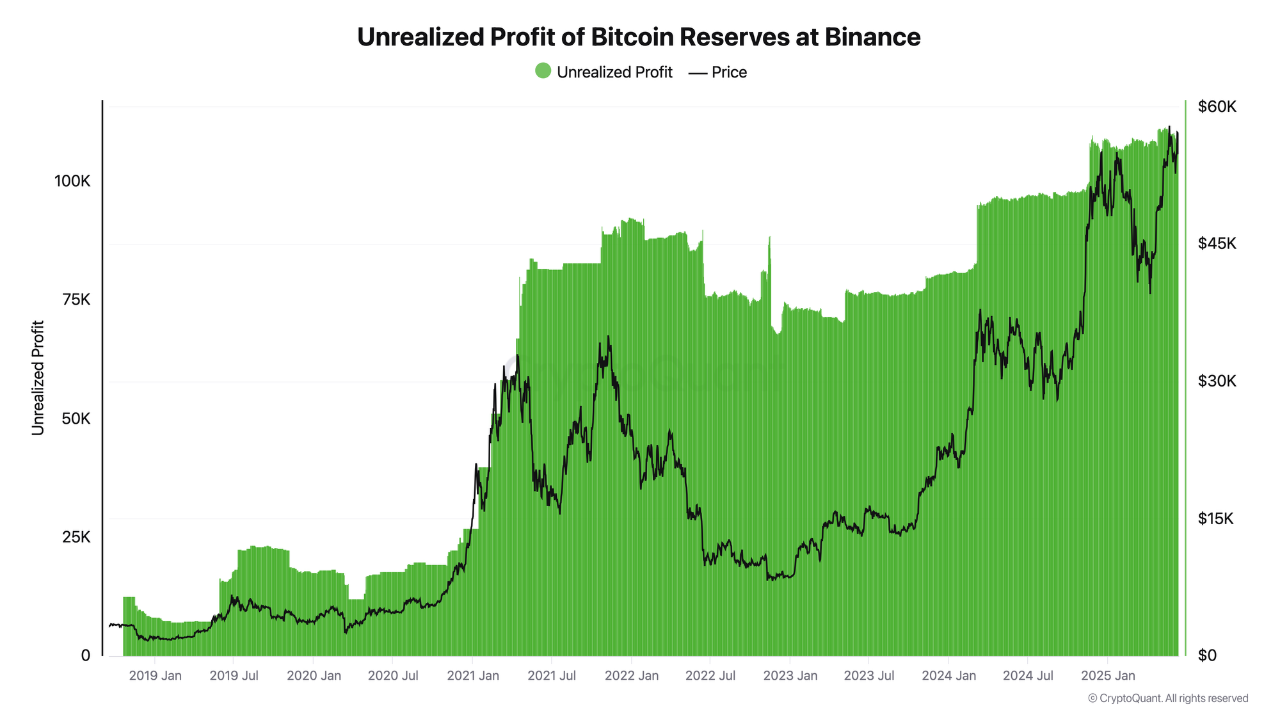

Binance, champion of innovation, displays an insolent financial health. Alone, the exchange holds more than 60,000 BTC of unrealized profits. This amounts to nearly 6 billion dollars, a historic record. The average acquisition price of these bitcoins is said to be $56,000, compared to $105,970 currently. This margin is impressive. And it reflects the platform’s strategic skill.

But that’s not all. Binance claims 250 million users by the end of 2024, 275 million as of early June, with more than $100,000 billion in cumulative transaction volume. Despite increasingly fierce competition, it maintains a spot market share of 25.4%. These numbers speak for themselves. They show that Binance remains a colossus in the crypto sector, resilient in the face of headwinds.

Despite a drop in performance in certain segments, the exchange continues to attract investors. Its margins, scale, and robustness make it a central player, difficult to dislodge.

Users Loyal to Their Digital Vault

While many crypto holders opt for cold wallets, Binance still attracts. Its hybrid model, between hot wallet and cold wallet, appeals. Customers see it as a good compromise between security, flexibility, and profitability.

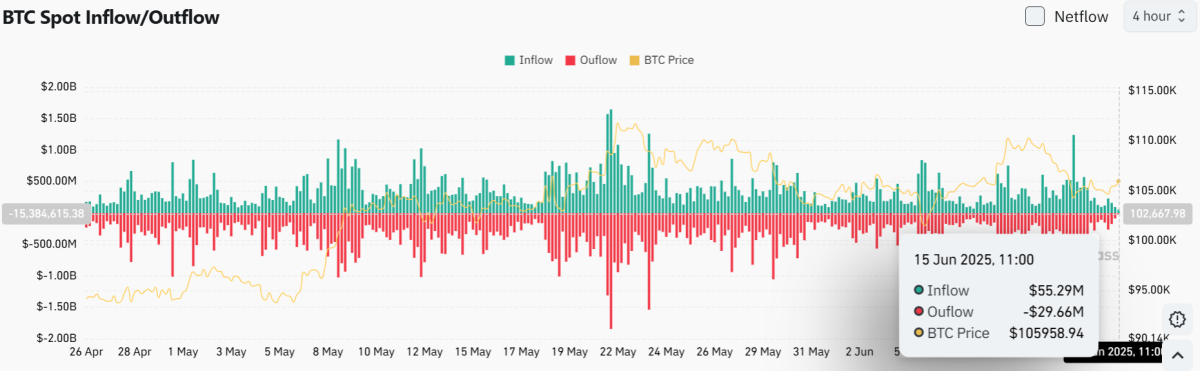

In May-June 2025, despite a trend of withdrawals from exchanges, a flow of $55 million was recorded in a single day. This reflects a recovery of confidence in the platform. Binance is not just an exchange: it is a modern-day vault.

Its product strategy plays a big role. Staking, reduced fees, VIP access, and high liquidity: everything is designed to retain the user. Investors, whether novices or experienced, appreciate the ease of access and the diversity of services.

Even in a world that promotes decentralization, Binance, issuer of the BNB crypto, retains strong appeal. Its complete ecosystem reassures. It shows that a centralized exchange can still meet the demands of a demanding market.

The Battle for Market Share Shakes the Giants of Crypto

Binance’s reign is put to the test. While it still dominates, competition sharpens its strategies. In 2024, Crypto.com gained 6.26% market share, reaching 8.66%. Bitget and WhiteBIT also made progress.

Here are the key figures to remember:

- Binance: -7.49% market share in one year;

- OKX: -3.22% over the same period;

- Bitget: +97.6% spot volume in December;

- MEXC Global: 4.42% market share at year-end;

- Total spot and derivatives volume in December: $11,300 billion, a record.

Coinbase International, meanwhile, exploded with +376% growth in derivatives, reaching 5.50% of the market. The rise of these challengers shows that Binance is no longer alone. Each competitive advance chips away at its kingdom. Commercial strategies evolve, promotions intensify, and the environment becomes more and more competitive.

Binance has come a long way. In 2023, the U.S. SEC, led by Gary Gensler, sued it. These attacks cost billions and led to the ousting of its founder CZ. The shock was severe. But the tide has turned: the complaint was officially withdrawn. A relief for the crypto company. This episode reminds us that even giants can falter, but they also know how to get back up.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.