Bitcoin: After the $60K Capitulation, Expert Predicts New Shock

While analysts agree on the end of bitcoin capitulation at 60,000 dollars, Michael Terpin, CEO of Transform Ventures, sounds the alarm. According to him, BTC could collapse to 40,000 dollars before a sustainable recovery. Between optimism and fear, what will happen to bitcoin in 2026?

In brief

- Michael Terpin believes that bitcoin could retest $40,000 or $50,000 before a sustained recovery, despite signs of capitulation at $60,000.

- Historical bitcoin halving cycles suggest a final “pain point” before a significant rise, as in 2012, 2016 and 2020.

- Current macroeconomic and technical risks are increasing uncertainty around bitcoin, urging investors to exercise caution.

Bitcoin Capitulation is Not Over Yet!

Recent analyses suggest that bitcoin has completed its capitulation phase around 60,000 dollars. However, Michael Terpin, at Consensus Hong Kong 2026, expressed a differing opinion. For him, the market remains fragile and one last “point of pain” could occur before a real recovery. In this regard, he mentions a possible relapse of BTC towards 40,000 dollars or 50,000 dollars.

This divergence of opinions creates uncertainty among investors, torn between hope for a rise and fear of a new correction. Predictions therefore range between 60,000 dollars as a floor and 40,000 dollars as a critical level to watch. Each scenario has distinct risks, making decision-making complex for market participants.

Why Bitcoin Has Probably Not Yet Hit Bottom?

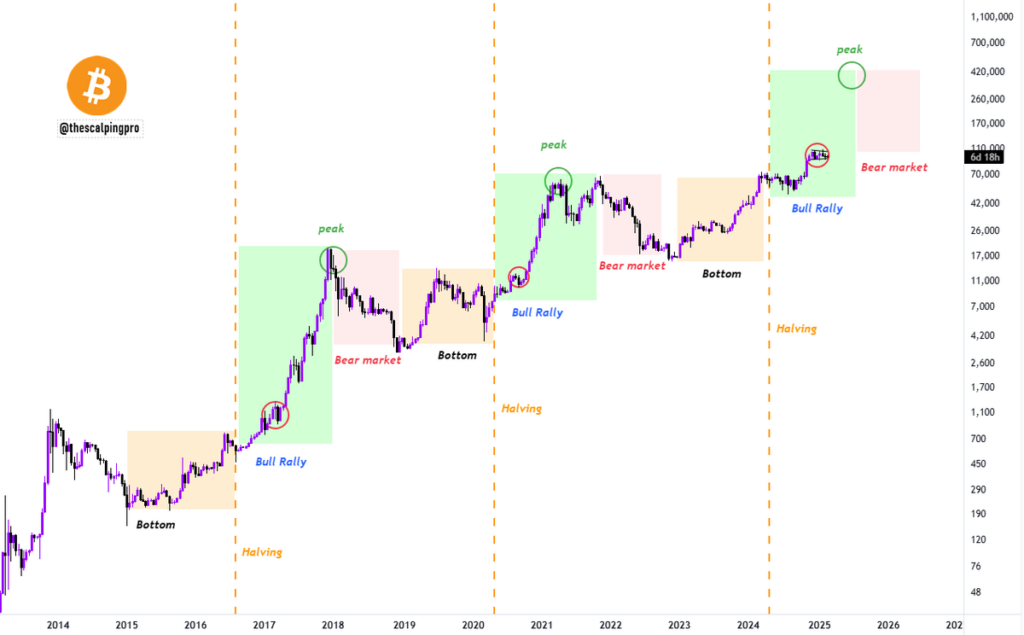

Bitcoin halving plays a key role in the dynamics of market cycles. Historically, this mechanism has preceded significant upward phases, such as in 2012, 2016, and 2020. Indeed, after each halving, BTC experiences a gradual increase in value, peaking about a year later.

Michael Terpin notes that the market peak generally occurs in the fourth quarter following the halving. Today, as the 2024 bitcoin halving is behind us, Terpin believes the market could retest 40,000 dollars or 50,000 dollars before a sustainable recovery. This analysis relies on historical patterns, where each cycle experienced one last shake before a sustained rise.

Falling Risks Multiply for BTC

Several risk factors currently weigh on bitcoin. On the macroeconomic front, high interest rates and persistent inflation continue to negatively influence risky assets, including cryptos. In addition, liquidations of $250 million in 24h, often triggered by sudden moves, could worsen a potential drop.

Despite growing institutional adoption and the arrival of bitcoin ETFs, these fundamentals may not be enough to avoid a correction. In this context, investors are encouraged to diversify their crypto portfolios and use tools like analysis to monitor crypto market developments in real-time.

The debate on bitcoin’s evolution remains open between optimists and cautious investors. While some believe capitulation is over, Michael Terpin and historical cycles urge vigilance. And you, do you think BTC has reached its lowest, or is a new drop expected?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.