Bitcoin Bet : Metaplanet And Semler Challenge Strategy

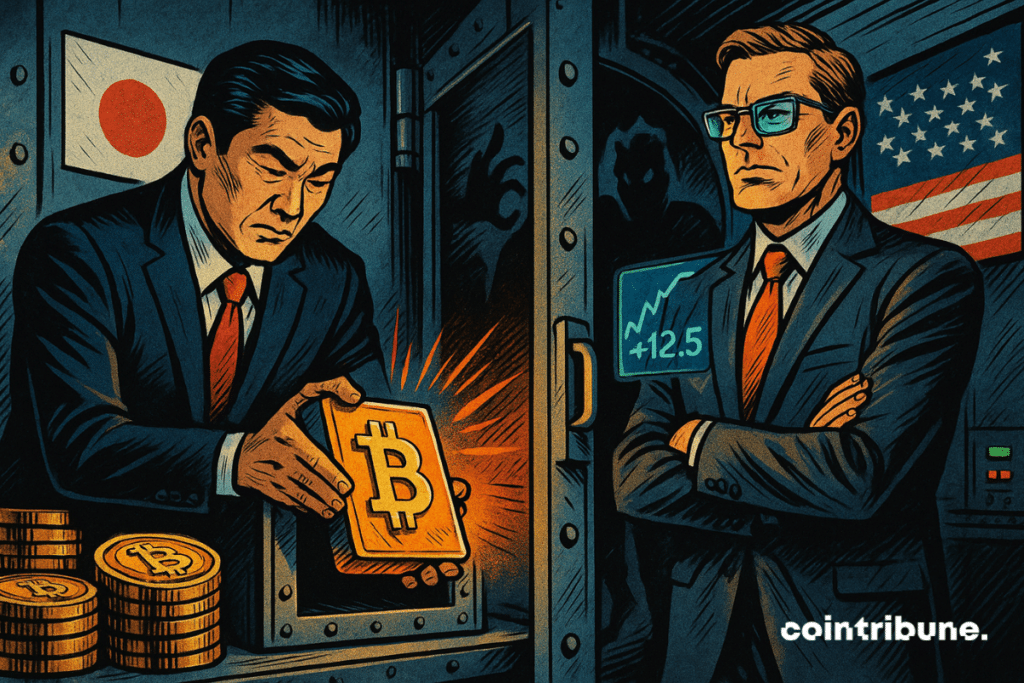

While Strategy, a pioneer in bitcoin balance sheets, temporarily suspends its purchases, two listed companies opt for the opposite path. Metaplanet and Semler Scientific are heavily betting on BTC, redefining the balance of power in the market. In a context of macroeconomic uncertainty and persistent volatility, these bold acquisitions raise the question: is this a simple speculative bet or a sustainable strategic repositioning?

In Brief

- Two listed companies, Metaplanet (Japan) and Semler Scientific (USA), significantly increased their Bitcoin treasuries on July 7, 2025.

- Metaplanet acquired 2,205 BTC for about $238.7 million, bringing its total to 15,555 BTC, valued at nearly $1.7 billion.

- Semler Scientific added 187 BTC for $20 million, reaching a total of 4,636 BTC in its accounts.

- These purchases come as Strategy (MicroStrategy) exceptionally suspends its weekly buys, breaking a streak that began in April.

A coordinated offensive despite uncertainties

While Strategy announced a colossal fundraising to buy more bitcoin on Monday, July 7, two listed companies announced substantial bitcoin acquisitions in a context where crypto remains near its all-time highs. These moves were publicly confirmed by the parties involved and shared by several key industry figures on social media.

Against the grain of a cautious market, Metaplanet and Semler Scientific continue their aggressive accumulation policies.

Here are the key points to remember :

- Metaplanet, a Japanese investment company, acquired 2,205 BTC for approximately $238.7 million, at an average price of $108,237 per bitcoin ;

- It now holds 15,555 BTC, valued at nearly $1.7 billion, with a total acquisition cost of around $1.54 billion ;

- It shows an internal performance called BTC Yield, reaching +416 % since the start of this year;

- Semler Scientific, a US medical sector company, bought 187 BTC for $20 million ;

- It currently holds 4,636 BTC, valued at over $500 million, and reports a BTC Yield of 29 % ;

- Both companies adopt unconventional financing solutions to support these purchases, following a logic introduced by Strategy, the pioneer of the BTC treasury model.

These moves are far from isolated. They fit into a landscape where listed companies are increasingly adopting bitcoin-linked performance indicators, such as BTC Yield, to assess their asset strategies.

This dynamic suggests that, for some companies, bitcoin is becoming much more than a simple speculative asset: it is now a lever for financial and stock market valuation in its own right, although results remain mixed depending on the actors.

An aggressive strategy in response to Strategy’s pause

This renewed enthusiasm is observed even as Strategy paused its weekly purchase program, breaking an uninterrupted streak since April 14. “Some weeks, it’s better to just hold your positions,” summarized Michael Saylor, its co-founder, Sunday evening on the social network X.

He thus anticipates the company maintaining the status quo for this new week. A pause all the more remarkable since Strategy now holds nearly $65 billion in BTC, after adding $7 billion during the second quarter alone.

This contrast between Strategy’s temporary restraint and the renewed aggressiveness of Metaplanet and Semler reflects divergent tactical visions. While Strategy seems to favor a wait-and-see approach in the face of bitcoin flirting with its all-time high ($108,061 currently, 3.4% off the ATH of $111,814), Metaplanet and Semler seem instead to want to capitalize on this consolidation phase to strengthen their positions.

Beyond the numbers, these moves signify a rise in influence of secondary actors seeking to compete with or emulate the pioneers of corporate bitcoin. The fact that over 852,000 BTC are now held by listed companies suggests a growing institutionalization of bitcoin as a long-term strategic asset.

This raises new questions about volatility management, the sustainability of credit purchase strategies, and these companies’ capacity to absorb market reversals.

These new operations by Metaplanet and Semler mark a turning point. They remind us that bitcoin accumulation by companies is no longer the preserve of a single player like Strategy. BTC is gradually becoming a strategic balance sheet asset, even an identity-defining one for some companies.

Although market performances diverge, with Metaplanet rising strongly and Semler declining, a broader trend emerges: the adoption of an asset management logic where bitcoin is no longer just a speculative bet but a safe haven and a structural component of balance sheets, as evidenced by the $2000 billion valuation of the asset. The question remains how long this model will hold up against the realities of financial markets, regulation, and an asset as unpredictable as bitcoin.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.