Bitcoin Breaks Correlation With US Stock Market

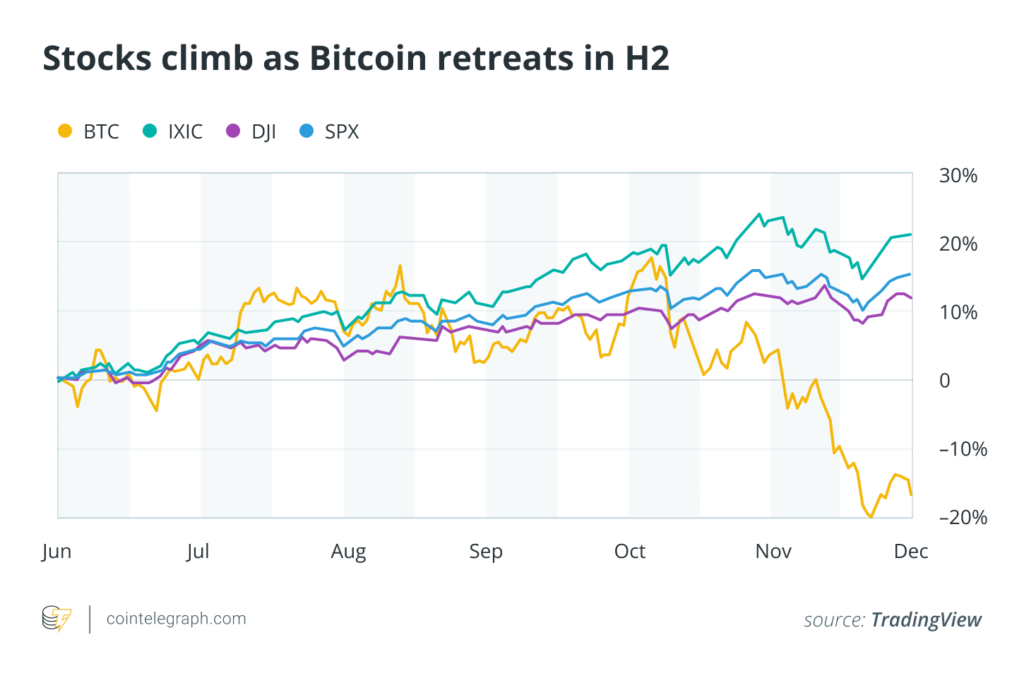

Bitcoin has increasingly decoupled from US stock markets in the second half of 2025. While major equity indexes continued to rise, Bitcoin entered a deep correction after its all-time high. Interest rate cuts, political uncertainty, and internal Bitcoin debates widened the gap. As a result, Bitcoin underperformed stocks despite strong fundamentals earlier in the year.

In brief

- Bitcoin increasingly decoupled from US stocks in the second half of 2025 as equity markets continued to rise.

- Major US stock indexes posted strong gains, while Bitcoin entered a correction after its October peak.

- Interest rate cuts, political uncertainty and large liquidation events widened the gap between crypto and stocks.

- The divergence highlights Bitcoin’s growing tendency to move independently from traditional markets.

Bitcoin and US Stocks Move in Different Directions

During the second half of 2025, Bitcoin and US equities followed very different paths. While stock markets benefited from falling interest rates and strong corporate earnings, Bitcoin struggled to maintain momentum after its October peak.

Over the past six months, Bitcoin dropped nearly 18%. At the same time, the Nasdaq Composite gained 21%, the S&P 500 rose 14.35%, and the Dow Jones Industrial Average climbed 12.11%. This growing gap highlights a clear decoupling between Bitcoin and traditional risk assets, according to Cointelegraph.

Bitcoin Gains Support From GENIUS Act in July 2025

July was a strong month for both stocks and crypto. Despite new tariff announcements, investor sentiment remained positive. Markets quickly shifted their focus back to earnings and economic growth. On July 9, Nvidia became the first company to reach a $4 trillion valuation. US stock indexes hit new record highs on the same day. Bitcoin also performed well, closing the month up 8.13%.

Crypto sentiment improved further after President Donald Trump signed the GENIUS Act into law. The legislation provided regulatory clarity, especially for stablecoins. Corporate Bitcoin adoption continued, with more companies adding BTC to their balance sheets. Interest in Ethereum and Solana also increased during this period.

Rate Cut Expectations Drive Volatility Across Crypto in August

In August, markets focused on expectations of interest rate cuts by the Federal Reserve. A weaker US dollar and rising trade tensions helped push Bitcoin to a new all-time high of around $124,000 on August 14.

Later in the month, attention shifted to the Jackson Hole symposium. Fed Chair Jerome Powell signaled that rate cuts were still possible. This helped push Ether to a new all-time high.

Bitcoin, however, failed to hold its gains. After a short rally, the price moved lower again. By the end of August, Bitcoin closed down 6.49%. Stocks, meanwhile, remained strong.

Bitcoin Beats “Red September” Again

September is usually a weak month for Bitcoin. In 2025, the trend broke once more. Bitcoin posted its third consecutive positive September, ending the month up 5.16%.

The move followed the Fed’s first rate cut of the year. The central bank lowered rates by 25 basis points, citing signs of a cooling labor market. Stocks continued their rally as investors priced in further easing.

Bitcoin faced internal pressure at the same time. A major debate emerged over a proposed network upgrade that would allow more data on the blockchain. The disagreement split the community and added uncertainty to the market.

Market Liquidations and Trade Tensions Hit Bitcoin in October

Bitcoin reached another all-time high on October 6. The month quickly turned negative. A massive liquidation event wiped out roughly $19 billion in leveraged positions.

Several factors played a role. These included a price glitch on Binance and heavy use of futures trading. The main trigger was a social media post by President Trump, who threatened 100% tariffs on Chinese imports.

Both stocks and crypto sold off initially. Stocks recovered soon after. Bitcoin did not. The asset ended October down 3.69%, breaking a five-year streak of positive Octobers. A second Fed rate cut later in the month failed to reverse the trend.

Bitcoin’s Worst Month of 2025

November is historically Bitcoin’s strongest month. In 2025, it became the worst. Bitcoin fell 17.67% and dropped below $100,000 by mid-month.

The divergence from equities was clear. Stock markets traded sideways as the US government shutdown ended. Concerns about an AI-driven bubble remained, but strong earnings from Nvidia helped stabilize stocks. Bitcoin continued to weaken despite calmer conditions in traditional markets.

Bitcoin and US Stocks Show Clear Divergence in 2025

Bitcoin is slightly up so far in December. Major stock indexes are also posting modest gains. Historically, December has been a solid month for Bitcoin. However, optimism is much lower this year. Several analysts have reduced their price targets. Standard Chartered cut its Bitcoin year-end forecast from $200,000 to $100,000. The bank also delayed its long-term $500,000 target from 2028 to 2030.

Overall, the widening gap between Bitcoin and US stocks highlights a clear divergence in market behavior throughout 2025. Even with growing institutional involvement, Bitcoin has increasingly moved on its own and reacted differently than stocks to monetary policy shifts, political uncertainty and broader macroeconomic developments.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Louis Blümlein has been analyzing the crypto market for several years. His focus is on trading strategies, market trends, and economic developments to identify and take advantage of market opportunities at an early stage.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.